Private credit – A safe bet in troubled times

November 29, 2022

The ongoing challenges to the global economy has already shifted the risk expectations of investors. The Cliffwater Direct Lending index comprising direct-origin middle-market loans returned 0.5% in the second quarter, weighed down as it was by unrealized losses of 1.5%. However, this isn’t all bad news, given that private credits with floating rates may stand to benefit from higher short-term interest rates. The downside though is that these investments could lose value if companies run into fresh financial troubles.

A report by Fidelity International describes1 private equity as a possible defensive option for 2023 as global economies brace for recession. Their structural features and relative strength would help investors navigate high volatility in other asset classes through the floating rate structures that generate higher incomes in what promises to be a rising rate environment. However, the fact remains that high inflation and a squeeze on money supply would test the skills of private equity managers over the next twelve months.

The numbers tell a story

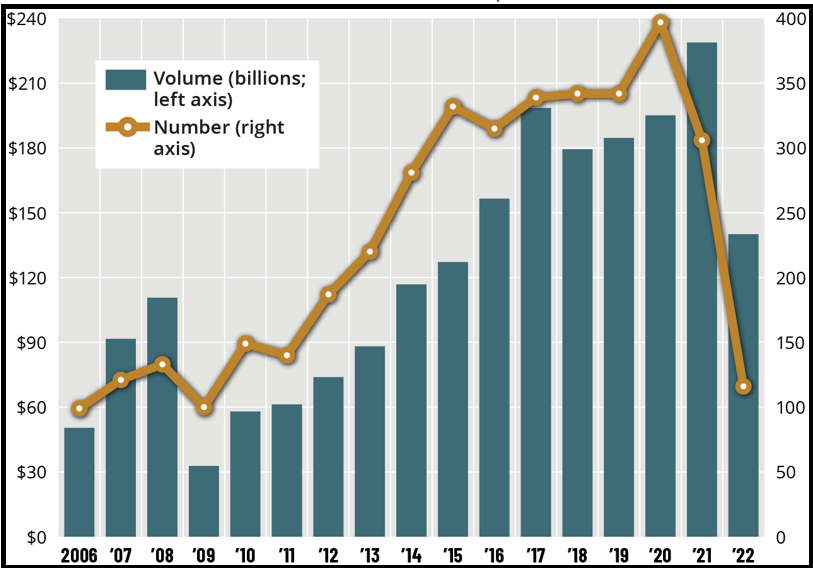

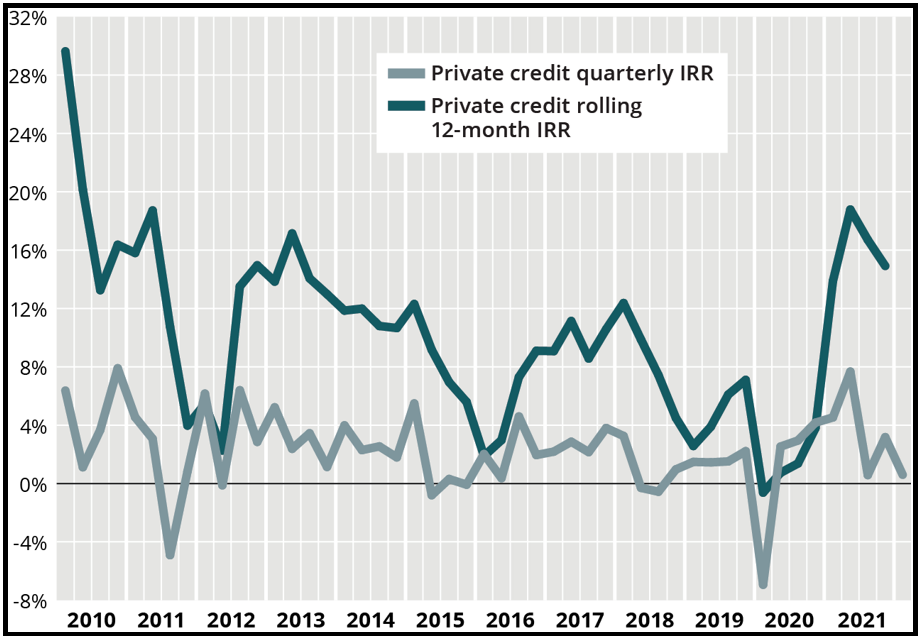

Through the first week of November, 116 private credit funds closed at $140.1 billion as against 306 funds raising a record $228.8 billion during the whole of 2021. Direct lending was the most popular, accounting for 46.5% in 2021 compared to just 1% in 2006. Through January-June this year, total assets under management fell 3.1% to $1.3 trillion, of which private credit funds held close to $425 billion, as against $451 billion at the end of last year. Internal rates of return dropped to 0.6% in the first quarter, as per data collected by PitchBook, as against 3.2% in the fourth quarter of 2021. The decline was palpable as The Morningstar LSTA US Leveraged Loan index lost 0.1% in the first quarter, its first negative return since Q1 of 2020. Over the first ten months of 2022, the number stood at 2.3%.

However, in spite of these numbers, the fact remains that private credit continues to account for a larger piece of the institutional markets’ asset allocation, albeit at marginally lower returns.

Flexible financing: Aid or Impediment?

Andrew Davies and John Empson, partners and joint heads of private credit at CVC are confident2 of a continued inflow, as institutional investors get more comfortable with the fact that established firms would utilize their expertise and the data in their possession to execute a broader set of investment opportunities. They hold the view that, in the post-Covid era, underwritings found it challenging to support M&A with flexible financing options, a trend that has since accelerated to include mezzanine financing and bridge loans, over and above direct lending.

For example, direct lending can potentially be long-dated and tightly covenanted in the lenders favor, even as the high tenure secured loans continue to benefit from the protection that their positioning at the top of the capital structure offers. Moreover, the asset class itself is positioned defensively, leading into the current market volatility. While default rates across the sector could spike in 2023, they could be limited as compared to public assets, with the pricing weakness likely to be less severe than it was during the last global economic crisis.

Comparatively, mezzanine financing is in a tougher spot as PE firms have chased returns and unitranche lenders in recent times. Many companies offering mezzanine finance have already dropped warrants from their agreements or lowered their return goals. The strategy of combining senior and subordinated debt into a package with a blended rate has moved into the lower middle market, says Joe Burkhart of Saratoga Investment Corp., who believes that such rates make the deal more lucrative. Another challenge to mezzanine debt comes in the wake of PE sponsors deploying a larger share of their capital in the low volume market, making them write large equity checks to close the gap between senior debt and equity. Having said so, the mid and upper-mid market still remains relevant for private credit managers in spite of the broader options available in the large cap universe that has seen robust growth in recent months.

Diversifying to a broader investment portfolio

Given the global volatility across liquid public markets, traditional financing has been limited in its ability to execute. In this scenario, it would make sense for private equity to deploy funds into this broader opportunity. All this points to a trend where capital has flowed into the private markets because institutional investors became comfortable with the established companies that can use their expertise and their networks and data to ensure diligence and execute investments across a broader spectrum. Juxtaposed with the relationships that private equity providers have built over the long term with financial sponsors, management and advisory teams, the opportunity appears compelling in the short term.