Private Credit To The Rescue – Rebuilding From the Rubble

February 25, 2025

In an era of economic uncertainty, rising interest rates, and volatile public markets, investors are increasingly turning to alternative asset classes to diversify their portfolios and generate stable returns. Among these alternatives, private credit has emerged as a standout investment vehicle, offering attractive risk-adjusted returns, lower volatility, and a hedge against market downturns. With its growing popularity, private credit is no longer just a niche asset class but a critical component of institutional and individual investment strategies. In this blog, we’ll explore why private credit is a compelling investment option, backed by data and insights.

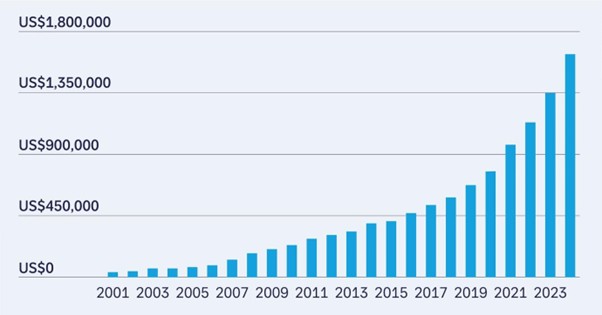

The private credit market has grown significantly over the past decade, with global assets under management (AUM) reaching $1.4 trillion in 2023, up from $500 billion in 2015, according to Preqin. This growth has been driven by tighter banking regulations, reduced lending by traditional banks, and increased demand for flexible financing solutions from businesses.

Source: Preqin via Flow1

Why Private Credit is a Good Investment Vehicle

- Attractive Risk-Adjusted Returns

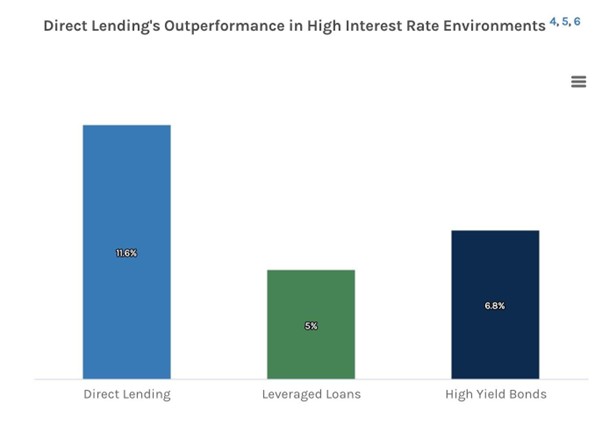

Private credit has consistently delivered higher yields compared to traditional fixed-income investments. In particular, direct lending has outperformed in high and rising rate environments. When measured over seven different periods of high interest rates between the first quarter of 2008 and the third quarter of 2023, direct lending yielded average returns of 11.6%, compared with 5% for leveraged loans and 6.8% for high-yield bonds.

Source: Morgan Stanley2

Moreover, private credit loans are often secured by collateral, providing an added layer of protection. For example, senior secured loans, which make up a significant portion of private credit portfolios, have recovery rates of 70-80% in the event of default, according to Moody’s. This makes private credit a relatively low-risk investment compared to unsecured bonds or equities.

- Lower Volatility and Market Correlation

One of the most appealing aspects of private credit is its low correlation with public markets. Unlike stocks and bonds, which are subject to daily price fluctuations, private credit investments are not marked-to-market, reducing volatility. This makes private credit an excellent diversifier for portfolios heavily exposed to equities or traditional fixed income. During the 2008 financial crisis and the 2020 COVID-19 market crash, private credit funds demonstrated resilience, with default rates remaining below 5%, according to the Alternative Credit Council. This stability is particularly valuable in times of economic uncertainty when public markets often experience sharp declines. - Floating Interest Rates Provide Inflation Protection

Many private credit loans feature floating interest rates, which adjust based on benchmark rates like LIBOR or SOFR. This feature provides a natural hedge against rising interest rates and inflation. In 2022 and 2023, as central banks around the world raised rates to combat inflation, private credit funds benefited from higher interest income, while fixed-rate bonds suffered significant price declines. - Strong Demand from Borrowers

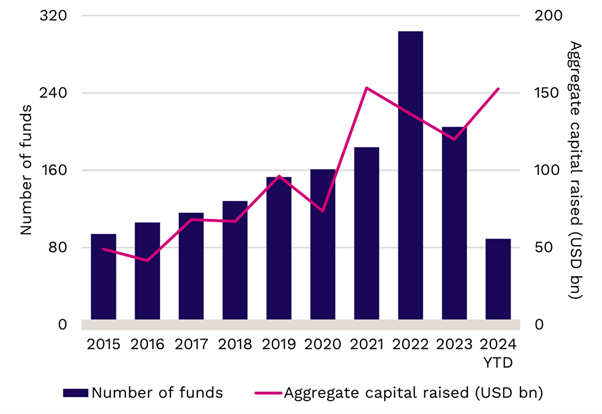

The demand for private credit is fueled by the growing financing needs of SMEs and mid-market companies, which often struggle to secure loans from traditional banks. According to the Federal Reserve, banks have tightened lending standards for small businesses since the 2008 financial crisis, creating a $1 trillion funding gap in the U.S. alone. Private credit funds have stepped in to fill this void, offering customized financing solutions with flexible terms. This strong demand ensures a steady pipeline of investment opportunities for private credit lenders. According to Preqin, Direct lending was the hottest strategy in 2024, securing 77.4% ($152.7bn) of total capital raised.

Source: Prequin3

- Institutional Adoption and Market Growth

Private credit has gained significant traction among institutional investors, including pension funds, endowments, and insurance companies. According to a 2023 report by Preqin, 80% of institutional investors plan to increase their allocations to private credit over the next five years. This institutional adoption has driven the growth of the asset class and improved its credibility. According to Zach Lewy4, Founder, CEO, CIO of Arrow Global, “Five years ago, private credit was one bucket and most of it was direct lending. Now it’s clearly evolving and diversifying. There’s direct lending, real estate lending, construction lending, litigation finance, capex finance, and infrastructure debt, to name a few. Private credit is significantly broader now, and I do believe it’s going to be a huge asset class”.

The market is also becoming more accessible to individual investors through private credit funds, interval funds, and business development companies (BDCs). These vehicles provide retail investors with exposure to private credit without the need for large capital commitments or direct lending expertise.

Risks to Consider

While private credit offers numerous benefits, it is not without risks. Key risks include:

- Illiquidity: Private credit investments are typically locked up for several years, making them unsuitable for investors who need immediate access to their capital.

- Credit Risk: Despite lower default rates compared to high-yield bonds, private credit loans are still subject to borrower defaults, particularly in economic downturns.

- Complexity: Private credit requires specialized expertise to underwrite and manage loans, which may be a barrier for some investors.

To mitigate these risks, investors should work with experienced fund managers and diversify their private credit allocations across sectors, geographies, and loan types.

The private credit market is poised for continued growth as businesses increasingly seek alternative financing solutions and investors look for stable, high-yielding assets. According to McKinsey, private credit AUM is expected to reach $2.3 trillion by 2027, driven by strong demand from borrowers and investors alike.

Technological advancements, such as blockchain and AI-driven credit analysis, are also expected to enhance the efficiency and transparency of private credit markets, making them more accessible to a broader range of investors.

Private credit has proven itself as a resilient and attractive investment vehicle, offering high yields, low volatility, and diversification benefits. With its ability to generate consistent returns in various market conditions, private credit is an essential component of a well-rounded investment portfolio. While risks exist, they can be managed through careful due diligence and diversification.

As the global economy continues to evolve, private credit is likely to play an increasingly important role in financing businesses and delivering value to investors. Whether you’re an institutional investor or an individual looking to diversify your portfolio, private credit deserves serious consideration as a strategic investment option.