Private equity secondaries – a beacon of hope

March 10, 2023

The demand for secondaries has been robust for some time, though off late, it could be attributed to the reduced exit options. With M&A activities at precarious levels and the IPO market virtually shut, the GPs holding quality assets couldn’t use these traditional routes to exit. Especially amidst the multiple macroeconomic and geopolitical challenges where interest rates rose to unseen levels and global economic concerns resulted in high market volatility and low valuations. Not surprising then that GP-led secondaries came into their own. Their cash out options became an attractive option for the LPs, many of whom were battling the denominator effect and seeking liquidity solutions.

Two straight years of robust volumes

A report by Lazard1 said the secondary market delivered a second consecutive year of estimated volumes in excess of $100 billion in 2022, proving again that it was a highly relevant part of the private capital markets even during a period of macroeconomic turbulence. The survey pointed out that GP-led transactions comprised about 43% of the secondary market in 2022, with continuation funds contributing three-fourth of the volume, making it a preferred means of liquidity alongside IPOs and M&A routes. Average transaction size touched $82 million in 20222 , up from $74 million a year ago while the average number of transactions completed by secondary buyers also increased, thus indicating a broadening and deepening of the market. At the same time, LP-led volumes stood at $60 billion during the year with more than 500 completed transactions driven by the desire to accelerate liquidity and the denominator effect that was prevalent amongst LPs.

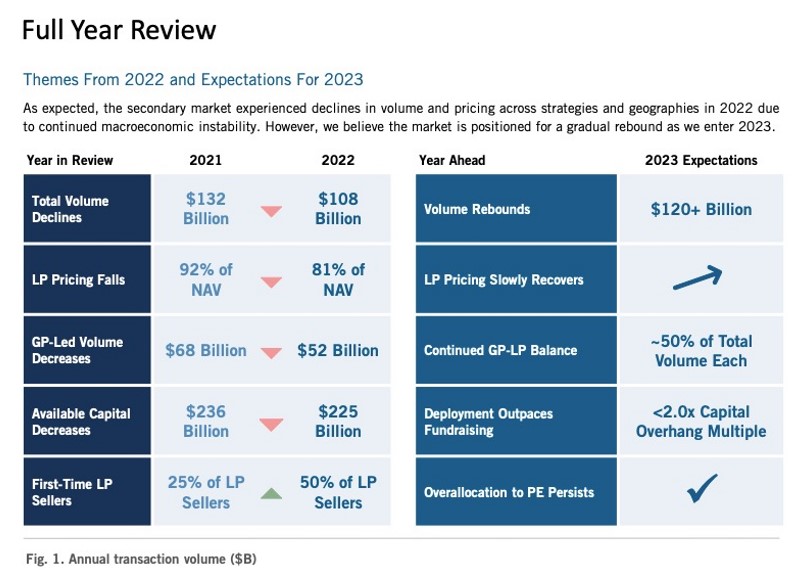

(Source: Jefferies Global Secondary Markets Review 2023)

Single-asset continuations funds rule the roost

The Global Secondary Market Review by Jefferies3 indicated that total volumes touched $52 billion in 2022. The volumes of GP-led transactions contracted by 24% year-on-year with the challenging valuations combined with the lag between public and private markets resulting in most of them being at a discount. Lazard’s review indicated that single-asset continuation funds accounted for about 40% of the total GP-led volumes as against 52%4 in 2021, while multi-asset deals stood at 34% of the volume during 2022, compared to 31% a year ago. However, in spite of the turbulence, GP-led volumes recorded the second highest during the year, with transactions accounting for nearly half of the entire secondaries. The decline could be attributed to the bid/ask spreads on LP sales and secondary firms increasing selectivity on GP-led deals following a year of substantial deployment in 2021.

Smaller transactions and shelved deals

Of course, the annual numbers weren’t as good as a year ago. Secondary volume stood at $108 billion3, representing an 18% decline from 2021’s record of $132 billion. We saw smaller transactions and shelved deals, ostensibly caused by the widening bid-ask spread and increased selectivity among buyers as the valuation disconnect between private and public companies continued. This resulted in a quiet second half with $51 billion as against $57 billion in the first six months of 2022. However, with the bid-ask spreads expected to narrow, a rebound appears on the cards in 2023 as demand for strategies makes a return with venture and real estate getting back in favour towards the end of last year. In fact, the year also represented the first period of market volatility that the GP-led secondaries had to encounter. Annual volumes contracted 24% comparing favourably to global leveraged loans and IPO volumes that declined 65% and 70% respectively.

The big reversal and its positive aftermath

As mentioned earlier, the secondaries pricing reversed its course during the year, declining 1,100 basis points to 81% of NAV3 across all strategies. Double-digit falls in pricing were a result of inflated private company valuations, expected delays in portfolio company exits and higher underwriting hurdles over fears of an impending recession. All of this also contributed to increased buyer selectivity. The Jefferies report also noted that interest rate hikes and tighter lender underwriting standards shaved away the buyer’s use of leverage, changing how aggressively they could bid while also aiming for target returns. Secondary pricing as a percentage of NAV ended 2022 at a 10-year low, but still remains strong historically in dollar terms when juxtaposed with NAV write-ups over the past five years.

(Source: Lazard Secondary Market Review 2022)

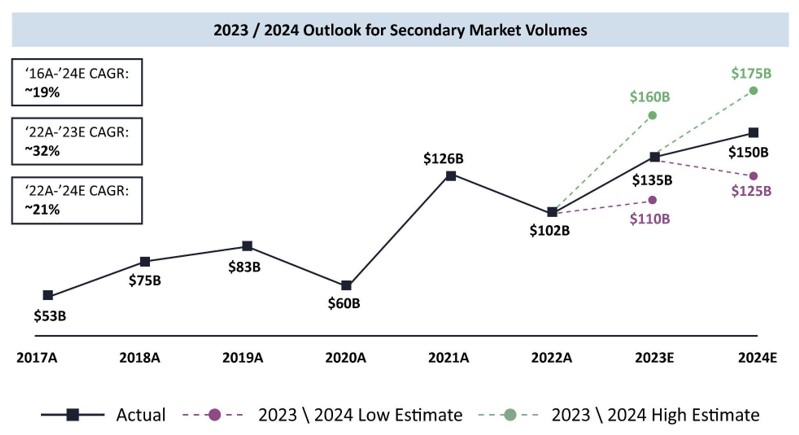

Poised for a turnaround in 2023 and 2024

Given this scenario, the next twelve months could see a rebound in market volumes for GP transactions, given that they are expected to utilize the secondary market to hold on to their prized assets. This could cause increased variability in transaction types (such as tender offers) across strategies like credit and growth. Private valuations are also expected to be reset when year-end audit season starts off, causing the pricing for LP portfolios to recover. Volumes could then start moving back up as the bid-ask spreads narrow down. However, market analysts expect buyers may continue to remain selective in the near term.

Over the course of the next two years, entry of new buy-side participants with additional fund raises are also expected. In the second half of 2022, buyers who were investing in both GP and LP-led transactions shifted marginally towards the latter as they sought more portfolio diversification. It remains to be seen whether this trend continues through the first half of 2023 or would the shift towards GP-led transactions make a welcome return? Only time will tell.