Private Equity Secondaries – A New Frontrunner?

June 29, 2024

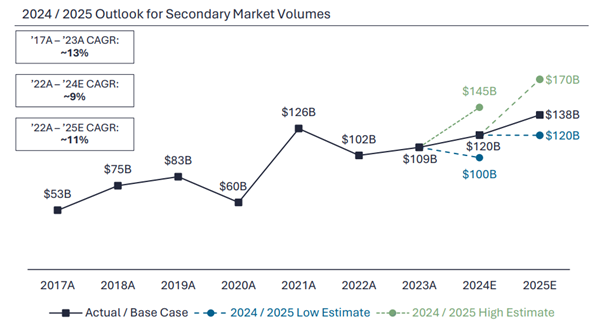

As we enter the second half of 2024, we can safely say that the demand for secondaries has been robust, fulfilling the predictions from last year. In 2023, with M&A activities at precarious levels and the IPO market virtually shut, the GPs holding quality assets couldn’t use the traditional exit routes, particularly amidst soaring interest rates, global economic concerns, high market volatility, and low valuations. This resulted in GP-led secondaries coming into their own. Their cash-out options became attractive for the LPs, many of whom were battling the denominator effect and seeking liquidity solutions.

Source: Lazard Secondary Market Review 2023

The resilience of 2023, with overall transaction volumes increasing, has proved once again that secondaries are a highly relevant part of the private capital markets even during a period of macroeconomic turbulence. LP-led activity was the primary driver for the higher transactions in the second half of 2023, while the first half of 2024 has witnessed a surge in GP-led activity in the secondaries market, according to William Blair .

Source: Secondaries in 2024: Optimism, New Buyers, and Improving Deal Activity

GP-Led Resurgence in 2024

GP-led activity seems to have gained momentum in the first half of 2024, following a pattern where enhanced LP-led activity typically precedes similar trends for GP-leds.

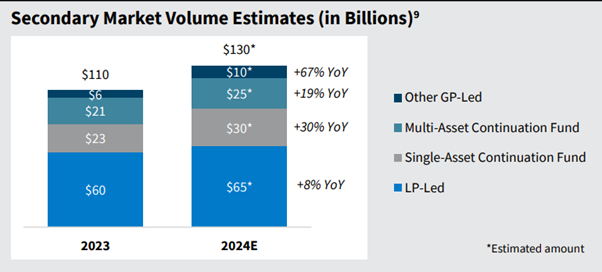

The primary factor behind the growth of GP-leds in recent years has been the rise of single-asset continuation funds since around 2019, and this trend shows no signs of abating. Insiders predict that single-asset continuation funds will experience stronger growth (30%) compared to multi-asset continuation funds (19%) and the broader LP-led space (8%) this year. This is partly because single-asset deals are common and easier for investors new to secondaries to understand.

The resilience of the secondaries market over the past two years can be attributed in part to GP-led secondaries’ ability to address various platform-fund and asset-level objectives. These objectives include resolving liquidity issues while retaining important assets that GPs are well-acquainted with, in addition to price considerations.

The anticipated improvements in M&A and IPO activities might appear to compete with secondaries. However, the resurgence of these traditional exits is likely to benefit GP-led secondaries. A healthy exit environment and strong valuation comparables should facilitate constructive underwriting and robust pricing for high-quality companies.

Moreover, GPs are expected to continue seeking to provide liquidity in a competitive fundraising environment, leading to sustained and robust supply and demand for GP-led solutions. Experts also anticipate a higher deal-closing success rate in the GP-led market, as the recovery in M&A and IPO markets should enhance the actionability of GP-led transactions.

LP-led momentum continues, but concerns remain

When it comes to LP-led secondaries, the momentum has persisted, with pricing favorable enough for sellers with genuine strategic motives to proceed with transactions. While this represents an improvement from earlier in the year, it remains incremental and insufficient to entice opportunistic sellers into the market.

However, this began to shift in the spring, marking a rapid and encouraging improvement for the secondaries market. A year ago, pricing was unfavorable, and bid-ask spreads were so wide that only highly motivated or distressed sellers were engaging in deals. If the current trends persist, secondary activity levels could approach the peaks seen in 2021.

Despite these improvements, negotiations in the first half of 2024 have been challenging. Deferred purchase prices have been a common tactic to bridge pricing gaps, where sellers agree to be paid over time – such as half upfront and half after 12 months – in exchange for a higher total price from buyers. However, this method has been less effective compared to previous years. Buyers, anticipating limited immediate liquidity post-transaction, are only marginally increasing their offers, often not enough to finalize deals. Other common methods to find a middle ground, like third-party financing, have been less attractive due to high interest rates, and more complex approaches like preferred equity and collateralized fund obligations have limited appeal.

Predicting when we might return to a period of strong pricing that attracts opportunistic sellers remains difficult and heavily dependent on macroeconomic factors.

Secondaries’ resilience in the face of macro concerns

Macro concerns, particularly inflation and interest rate trends, are prominent in the minds of market participants. These metrics are trending less favorably for liquidity than anticipated. However, there is good reason to believe that the remarkable resilience of secondaries will continue. Although secondary activity levels declined by 18% in 2023 compared to 2021 , the broader M&A and IPO markets saw sharper declines of 36% and 81% respectively . Both M&A and IPO activity were lower in 2023 compared to 2022, while secondary activity saw a 5% increase .

Looking ahead to the rest of 2024, dry powder is at an all-time high. However, secondaries are still integrating into the mainstream investor universe, leading to a supply-demand imbalance where opportunities to invest exceed the number of investors ready to deploy capital. Some market insiders have criticized claims of market health based on dry-powder totals without considering the potential lag in near-term deployment. This has led to concerns about creating unrealistic seller expectations. A PitchBook analysis found that only 72 funds participated in secondary fundraising last year, down from 119 in 2022, with four funds representing over 60% of the 2023 total. This concentration was driven by macro factors and a flight to quality, which also contributed to significantly lower secondary fundraising totals in the first quarter of 2024.