REITs VS Real Estate Funds – What’s the Difference?

July 21, 2024

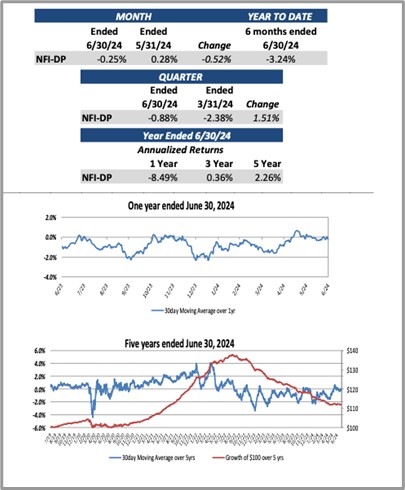

For the first time since the post-pandemic financial crisis, property markets across the world appeared favorably poised. For starters, investors suffered losses on some top-rated, which analysts saw as a sign that the real estate markets were closer to the end of the shakeout. The National Council of Real Estate Fiduciaries index , which lost 12% from its peak in 2022 after the Fed rate hikes, appeared steady for a while before moving back into negative territory in June (the latest month for which data is available). However, with the rate cuts appearing imminent over the next few months analysts are holding the view that happier days are around the corner.

Source: National Council of Real Estate Fiduciaries, June 2024 Press Release

All of these factors once again prompt the question of what a better bet from an investor’s point of view would be. Before getting into specifics, we must keep in mind that the industry has been in a wait-and-watch mode for two years due to the short-term cyclical forces, a few of which now appear set to stretch longer. Per a PwC report , the message coming through is that the driver of investor and occupier behavior in the future would shift from traditional property sectors and focus increasingly on the 3Ds – demographics, digital and decarbonization.

Both REITs and real estate funds (REF) offer the retail investors an easier and safer means of participating in what is considered as one of the oldest investment opportunities the world has seen. Unlike direct purchase and sale of property, these instruments are more liquid and offer a wider array of options. A key difference between the two investment types is that while the REF is a one that invests in publicly traded real estate companies and REITs, while the latter directly invests in projects and pays out dividends annually, the REFs operate like any other fund and seeks appreciation through the securities. Both offer investors a way to access the real estate without needing to own, operate, or finance properties. While REITs provide a steady source of income via dividends, REFs create value via appreciation, thus making them attractive to long-term investors.

REITs as a Means of a Steady Income

Investors seeking a steady income from the real estate sector are the targets for REITs, which are similar in structure to a mutual fund insofar as investors pool in capital to buy shares of commercial real estate or similar projects and earn an income commensurate with the shares they hold. Since REITs are required to pay out a minimum of 90% of their taxable income in the form of dividends each year, there is a certain assurance about getting some money in the bank each year. From a point of view of options, REITs typically offer three, viz., equity REITs, mortgage REITs, and Hybrid REITs.

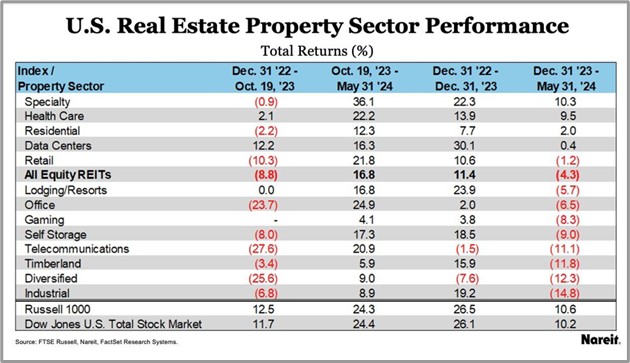

Source: reit.com

● Equity-led trusts usually own and operate income-generating real estate assets in the form of projects related to housing, hospitality, shopping arcades, and offices. According to NAREIT data, public equity REITs comprise a majority of the US market, owning $2.5 trillion worth of assets that include over 575,000 structures in 50 states.

● Mortgage-led trusts are one step removed in some ways and lend money to real estate owners and operators either directly via mortgages and loans or indirectly by acquiring mortgage-backed securities. Individuals can acquire shares of these trusts listed on stock exchanges. Per the latest data, they help finance a million US homes while also investing in commercial mortgages to finance income-generating real estate.

● Hybrid trusts are simply a combination of both of the above with most of them usually getting weighted towards one type rather than the other. Such entities could own properties as their primary business while having an investment management division that provides capital to other builders and property owners.

In a nutshell, most REIT revenues arise from real estate property rentals and interest earned on mortgage loans. This makes such investments prone to the risk of demand slumps for office space while a propensity to put off home purchases works well. Recent trends around the demand for data centers have fueled investment options into REITs. However, the market for warehouses, timberland, and retail centers has hit a none-too-optimistic note, especially in Europe where REITs have taken a beating in recent times. However, a recent report by Franklin Templeton suggests that this investment option could see better days in 2024, especially in the second half.

Real estate funds and long-term goals

Like any other mutual funds, real estate funds are managed either actively or passively – the latter typically tracking the performance against a benchmark index. For example, some REFs track their growth against the MSCI US Investable Market Real Estate Index. In addition to publicly traded stocks, these funds also directly invest in real estate projects and even in REITs. These funds gain value through appreciation and do not usually provide short-term income to investors of the kind that REITs can. However, they do offer a much broader asset selection and diversification opportunity than individual REITs. As with the other investment options, even the REFs are of three major types which are discussed below:

● Real estate exchange-traded funds own the shares of real estate corporations and REITs. Like other ETFs, these trade like stocks on major exchanges.

● Real estate mutual funds can be open- or closed-end and either actively or passively managed.

● Private real estate investment funds are professionally managed funds that invest directly in real estate properties. These are available only to accredited, high-net-worth investors and typically require a large minimum investment.

In summary, a real estate fund functions as an ETF and trades on stock exchanges. These are made up of shares of REITs and other real estate companies. They could also act as a mutual fund privately managed by a fund manager, who picks real estate stocks, REITs and ETFs, and other securities. These funds make money via different paths that could include rental income, property appreciation, and capital gains upon the sale of the securities. Fund managers distribute the income after collecting their management fees, as with other funds.

Factors That Investors Should Keep In Mind

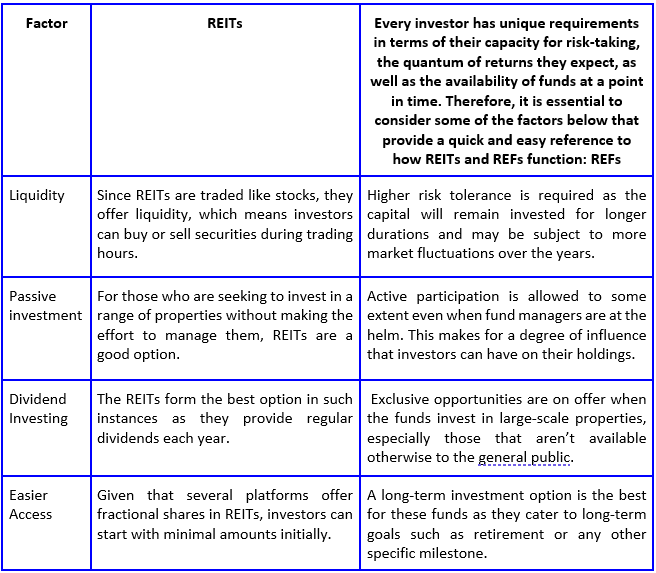

Every investor has unique requirements in terms of their capacity for risk-taking, the quantum of returns they expect, as well as the availability of funds at a point in time. Therefore, it is essential to consider some of the factors below that provide a quick and easy reference to how REITs and REFs function:

In addition, there are also some challenges that investors should know while investing in either of the two real estate opportunity classes. For example, with REITs investors have limited control as they have no say over property selections of the trust. Similarly, they are open to severe market volatility around interest rate changes and macroeconomic factors. On the other hand, real estate funds offer less liquidity and could attract penalties for early withdrawals. There could be a higher requirement for initial investment and the REFs come with management costs that impact one’s returns.

Based on the current market outlook, both REITs and real estate funds have not been on top of the investor radar largely due to the macroeconomic reasons led by high interest rates. However, with the US Fed looking increasingly likely to make a rate cut soon and Europe already doing so in recent times, both REITs and REFs could be back in business. Investors need to identify which of these would fix their investment portfolio based on the factors that we have discussed above.