From 60/40 to 40/30/30: A New Investment Approach

February 20, 2023

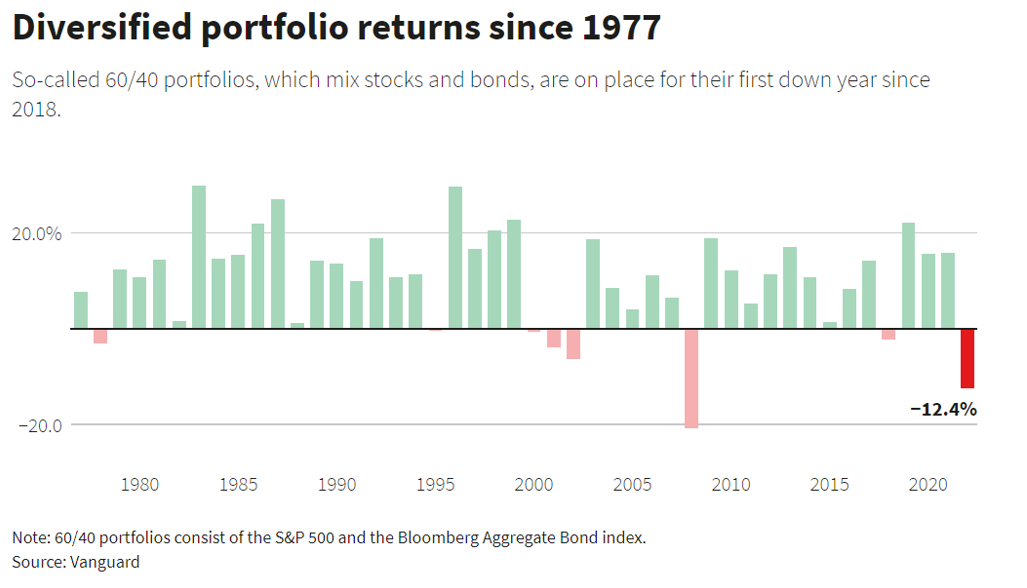

After a mauling in 2022, when balanced portfolios recorded the worst returns since 2008, the prospects for the traditional 60/40 portfolio appear bleak. Instead, experts such as KKR are of the opinion that a 40/30/30 portfolio – 40% publicly-traded stocks, 30% bonds, and 30% private assets – is more suitable.

A KKR report titled “Regime Change: Enhancing the ‘Traditional’ Portfolio”1, released last May, compared a 60/40 portfolio with a 40/30/30 allocation in three scenarios – low inflation, high inflation, and all periods – and found that the latter performed particularly well in a high-inflation environment. It also suggested that geopolitical tensions, commodity shock, and radical monetary and fiscal policy approaches arising from the COVID-19 pandemic could play a major part in changing the global macroeconomic situation.

The Story So Far

A 60/40 portfolio, which typically allocates 60% of assets into stocks and 40% into bonds, expects one asset class to offset the other with stocks going up during high economic growth and bonds rising during volatile times. This formula has been successful as stocks rose and interest rates fell.

“Without question, the 2010s were a golden decade for the ‘60/40′ investor,” the report states. “In particular, the stars were perfectly aligned for the ‘60/40′ allocation to perform strongly after the Great Financial Crisis of 2008. Stocks rose and rates fell; thus bond prices rose and the stock-bond correlation was muted. However, we believe each of these premises will be at risk in the next decade and are now beginning to turn.”

In recent months, both inflation and interest rates have risen, causing both stocks and bonds to fall, leading to decreasing returns. Stocks are extremely volatile at present, and a number of market valuation metrics show the stock market to be overvalued. Experts are warning2 investors about a stock market bubble akin to the dot com bubble or the one prior to the Great Depression.

“The structural relationship between stocks and bonds, particularly during volatile and inflationary times, is changing,” KKR’s report states. “We believe that not only are forward returns likely to be lower, but also that bonds can no longer serve as shock absorbers or diversifiers when paired with equities.”

The Future is 40/30/30

KKR’s report recommends a 40/30/30 allocation for equities, bonds, and alternatives respectively, to allow for diversification and a higher degree of inflation protection. Even within the alternatives, the report pitches in for a 10% allocation to private credit owing to improved lending terms, higher absolute yields, and access to higher quality counterparties and eventually to better risk-adjusted returns.

Including illiquid alternative assets such as hedge funds, real estate, and private equity is a trick out of the institutional investment playbook that retail investors are picking up. The ‘illiquidity premium’ (higher yield to make up for the increased risk from tying up capital illiquid assets) could be an additional incentive for investors to pad their portfolios with alternative investments.

There is also the element of uncertainty: the Russian war on Ukraine shows no sign of ending anytime soon, the energy crisis in Europe and the UK is threatening to expand into a full-blown cost-of-living crisis despite the EU’s robust response to the Russian oil embargo threat, and unless the Fed’s tightening ends by May, bond yields will continue to be volatile. Ditching the 60/40 formula in favour of a 40/30/30 portfolio seems like a better approach in a market that will likely be volatile for some time, if not indefinitely.

In terms of the geographic spread, the US continues to be the mainstay for the 60/40 investors, with Europe still trying to deal with the ongoing repercussions of the Ukraine crisis, high inflation, and depressed consumer spending. At a granular level, there could be a few bright spots within the EU such as Pharma, Tech, and Energy. However, at a macro level, the sentiment could be somewhat subdued. Consequently, bond yields will remain robust in the EU region, while equities will continue to struggle, owing to lower consumer spending and industrial growth.

“In an environment where you have both growth risk and inflation risks, like stagflation, 60/40 portfolios are vulnerable and to some extent incomplete. You want to diversify more broadly to asset classes that can do better in that environment.” said3 Christian Mueller-Glissman, Head of Asset Management Research and MD, Goldman Sachs.