Rise of the Dollar: The Haven Trade in a Volatile, Inflationary World

May 31, 2022

Wagering on currencies became a placid affair for many stakeholders in the foreign exchange (FX) market following the 2008-09 global financial crisis (GFC), as the flood of liquidity driven by historically low interest rates and quantitative easing pretty much killed volatility in this asset class.

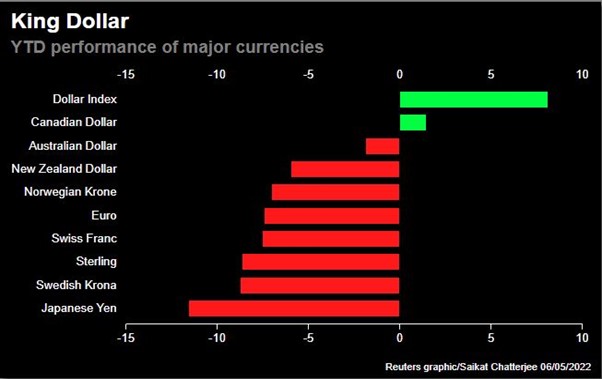

But all of that has changed over the past year, as the U.S. dollar surged dramatically against other leading currencies, amid a rise in inflation worldwide, surge in benchmark interest rates, mounting concerns over a global economic slowdown, and geopolitical tensions sparked by Russia’s invasion of Ukraine.

The WSJ Dollar Index, which tracks the greenback against a basket of other developed-world currencies including the euro, yen and pound, soared by over 12.5%1 during the 12 months ended May 17, with the euro and British pound plunging almost 14% and 12% against the dollar, respectively, during the same period. In fact, the dollar hit its highest level in two decades in late April, as the dollar index rose by up to 0.9% to just under 104 as of April 28, its strongest level since 20022.

USD annual performance3 (Source: Reuters)

Major swings in the dollar on a daily basis and significant declines in equities since the turn of the year have, in turn, led to a spike in volatility across FX markets. A JPMorgan Chase index measuring fluctuations in currencies linked to the Group of Seven (G-7) nations has jumped by as much as 80%1 this year, upending the normally tranquil currency landscape.

So, what explains the continuing appreciation of the dollar? Broadly, four factors are at play here, combining to produce this major turn in global financial markets.

The haven trade

First, the “flight to safety” dynamic remains a major driver of capital inflows into dollar-denominated assetsin a volatile, uncertain global environment characterized by the ongoing war in Ukraine, supply chain disruptions post COVID, concerns over worldwide GDP growth prospects, etc. A dollar financing stress gauge maintained by Barclays hit its highest level since 2015 recently, with the U.K. bank citing an analysis3 of previous peak-to-trough ranges to suggest that the dollar index could surge another 2% to 3%.

High U.S. inflation not a deterrent

What’s truly remarkable in the current dollar strengthening cycle is the fact that it is happening despite U.S. inflation remaining persistently high, nearing 40-year peaks. Traditionally, higher consumer prices in America implied a weak greenback. For example, during the 1970s, inflation-ravaged U.S. saw its currency plummet almost 40%4 against West Germany’s mark between January 1974 and 1980. Well, that’s not the case this time. The dollar has shrugged off high inflation back home to keep appreciating against several leading currencies.

Global economic weakness

The third big factor underpinning the rise of the dollar is the growing concern in several quarters over a substantial deterioration in the economic outlook for the eurozone, China, Japan and elsewhere. For instance, Beijing’s “zero covid” policy of enforcing strict lockdowns domestically has impacted industrial production across the region. Meanwhile, the Russia-Ukraine war has driven up commodities and energy prices across the board, thus hurting many European countries badly who rely on Moscow’s supplies of natural gas and other items.

The specter of a potential “stagflation” in the eurozone, triggered by energy-supply shortages, slowing economic growth, and rising inflation, is accentuating the dollar-euro trade in the former’s favor, as investors bet the U.S. economy will fare relatively better than the multi-nation bloc.

Divergent monetary policies

Finally, we have the unfolding sequence of events in the central banking arena, where the U.S. Federal Reserve and its counterparts in Europe, U.K. and Japan are increasingly acting on their own, abandoning a long-standing approach of executing policies in a coordinated manner. Amid the widening gulf in monetary policies between the Fed and the European Central Bank, Bank of England, Bank of Japan and other peers, many investors are betting that the pace of interest rate hikes in the U.S. will be much faster than that elsewhere.

With the Fed vowing to rein in high inflation in the U.S., and regain its credibility in keeping consumer prices under control, the dollar is enjoying a renaissance, attracting disproportionately high flows in FX markets. In contrast, the ECB has publicly acknowledged that it will lag behind the Fed5 in raising rates, while the BoJ recently reaffirmed its commitment6 to keeping benchmark Japanese bond yields close to zero.

Conclusion

Events of the past 12 months have reinforced the dollar’s status as a haven amid geopolitical uncertainty, and its pre-eminent role as the world’s reserve currency. As equities, bonds and other asset classes reprice themselves dramatically in line with rapidly evolving monetary policies, it remains to be seen whether the dollar will manage to hold onto its recent gains, or if we will witness a course correction.