Rising inflation and supply crunch: Will 2020s be the decade of commodities?

March 31, 2022

The 2010s were a forgettable period for commodities. While most asset classes, led by stocks and bonds, enjoyed quite a stellar run amid ultra-accommodative monetary policies pursued by central banks, commodities, by and large, found the going pretty tough in an environment of benign inflation and muted inflation expectations.

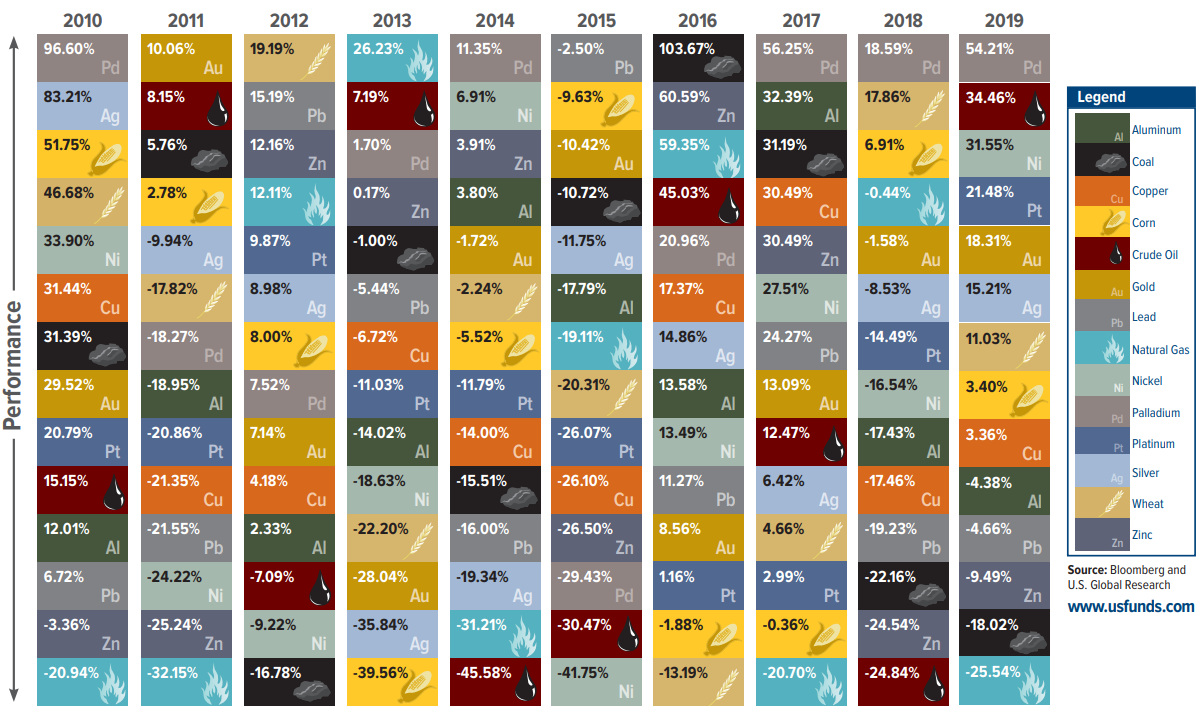

During the 10 years ended 2020, the S&P Goldman Sachs Commodity Index (GSCI), a leading commodities benchmark, delivered negative1 returns in seven years. A deep dive into the commodities complex, as per the following chart2, shows that most raw materials struggled to generate positive returns in several calendar years during the past decade.

The reasons for this underperformance were multifold. But three factors stood out, namely inflation not rising as expected despite financial repression, a broadly sanguine trajectory of global economic growth with no major downturns since the 2008 Global Financial Crisis (GFC)-induced worldwide recession, and a largely stable geopolitical environment.

However, that scheme of things could finally have changed in 2021, in the aftermath of the COVID pandemic. GSCI returned3 37.1% last year, substantially outpacing all major equity benchmarks.

The Refinitiv CoreCommodity CRB Index, a composite gauge of prices for 22 major commodities including crude oil, metals and grains, surged4 46% in 2021, marking its highest annual jump since 1995. With demand rebounding strongly amid an economic recovery, and supply getting hit by geopolitical events, labor shortages, etc., prices of nine leading commodities rose by over 50% last year.

In fact, 2021 was the best year for commodities, as an asset class, since 2000. A major reason behind this renaissance was the pent-up demand roaring back post reopening of economies amid normalization of the public health situation. Another big factor driving the commodities comeback last year was the squeeze in supply, which struggled to match demand after years of under-investment in new production.

Inflation is back

Commodities have historically done well in periods of high inflation. And if the past 12 months are anything to go by, inflation has stormed back5 across much of the developed world, and is persisting at levels unseen for over a generation. A principle anchor of low inflation during the 2010s, namely accommodative central bank policies via quantitative easing and zero-bound rates, is on a retreat now, setting the stage for a potentially structural growth cycle in commodities.

For the year to date, S&P GSCI is already up a whopping 37.25%6, in contrast to a major correction in several equities and bond indices over the same period, and nearing its highest level since 2008.

Geopolitical turmoil

Another tailwind for commodities is the rise in geopolitical tensions following Russia’s invasion of Ukraine in late February. The second- and third-order impact of this event have already triggered huge spikes in prices of several raw materials including agricultural commodities, oil and natural gas, with supply chains being disrupted massively.

Under investments; tight supply

With both Russia and Ukraine being notable contributors to the production and trading of various commodities, the ongoing war is, and would, over the foreseeable future, adversely affect the supply of oil, gas, coal, metals such as nickel, aluminum, palladium, and platinum, as well as corn and wheat7.

Going into post-pandemic 2022, the world was already grappling with extremely lean inventories across the commodities spectrum, and this geopolitical event has only exacerbated the supply crisis.

Greenflation

While pandemic-induced inventory shortages and supply chain disruptions have accentuated the supply crunch, more long-term, structural drivers are also under way.

In recent years, there has been a growing chorus in politics, policy making and civil society in advanced countries for transitioning to “green” energy, so much so that investments in new oil fields, mines, etc. have gone down sharply.

In fact, 2021 marked the completion of a decade of under investments8 in commodities production, with energy companies writing off more towards depreciation than spending on new supply, for the first time since 1988.

Ironically, the clamor for building a “greener economy”, via decarbonization, has stoked demand for non-renewable energy resources such as copper and aluminum. A case in point being electric cars, which need over three times as much copper as their gas counterparts. The ongoing energy transformation toward a greener future will likely fuel robust and sustained demand for many key metals.

And, all of these factors are fueling the commodities rebound. For instance, West Texas Intermediate (WTI), the U.S. crude oil benchmark, crossed9 the $130-a-barrel level, a 13-year peak, earlier this month, while aluminum and wheat futures also hit multiyear highs.

The ramifications of these exceptional price swings could be structural, rather than cyclical, on medium- to long-term supply, with demand destruction being a real possibility for some commodities.

Conclusion

Historically, commodities have followed a boom-and-bust cycle. The last major turn in the cycle happened in 2001, and now we seem to be in the early innings of another.

While short-term supply disruptions may peter out gradually, the structural drivers of supply crunch, namely “greenflation” and under investments, would take years to reverse, thereby likely providing a solid platform for commodities to thrive.

More so, as the world starts bracing itself for a return to normalization in terms of monetary policy, the ramifications for valuations of equities, bonds and other asset classes could be significant, in turn helping commodities’ positioning as an effective portfolio hedge.