Rising Inflation and Supply Crunches: Will the 2020s be the Decade of Commodities?

January 15, 2024

The 2010s were a forgettable period for commodities. While most asset classes, led by stocks and bonds, enjoyed quite a stellar run amid ultra-accommodative monetary policies pursued by central banks, commodities, by and large, found the going pretty tough in an environment of benign inflation and muted inflation expectations.

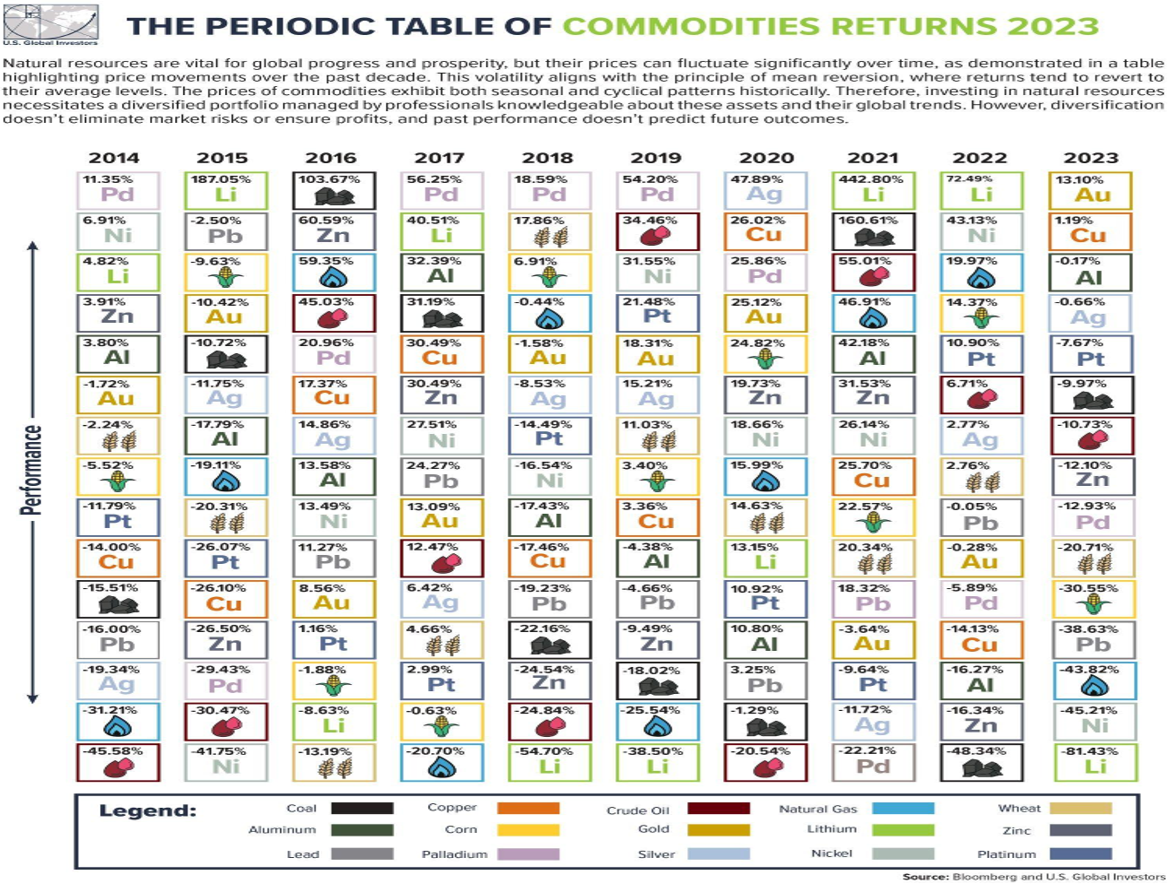

During the 10 years ended 2020, the S&P Goldman Sachs Commodity Index (GSCI), a leading commodities benchmark, delivered negative returns in seven years. A deep dive into the commodities complex, as per the following chart, shows that most raw materials struggled to generate positive returns in several calendar years during the past decade.

Image via US Global Investors1

The reasons for this underperformance were multifold. But three factors stood out, namely inflation not rising as expected despite financial repression, a broadly sanguine trajectory of global economic growth with no major downturns since the 2008 Global Financial Crisis (GFC)-induced worldwide recession, and a largely stable geopolitical environment.

It seemed that that scheme of things had finally changed in 2021, which was the best year for commodities, as an asset class, since 2000. A major reason behind this renaissance was the pent-up demand roaring back post-reopening of economies amid the normalization of the public health situation. Another big factor driving the commodities comeback last year was the squeeze in supply, which struggled to match demand after years of under-investment in new production.

2023: Underperformance with a ray of hope

However, that surge seems to have been short-lived, as, aside from oil and uranium, the commodities sector performed disappointingly in 2023. Oil prices rose due to concerns regarding potential production cuts by OPEC and escalating conflicts in the Middle East. Uranium prices saw an increase driven by the accelerated development of nuclear programs globally, coupled with geopolitical instability in historically uranium-rich regions like Niger.

This negative performance can be attributed to various macroeconomic factors. Firstly, there were investor expectations surrounding China’s economic recovery post-Covid. However, these expectations were largely unmet. Consequently, there was a decrease in demand for metals and other commodities. Secondly, commodities have traditionally served as a hedge against inflation, tending to appreciate during periods of rising prices. However, recent months have seen declines in key consumer price indexes, such as the widely monitored US CPI, indicating a trend towards disinflation as noted by many observers.

Despite these challenges, we believe there is significant value in the commodity sector, especially considering long-term structural trends. In particular, we find companies involved in the extraction and processing of metals, commonly referred to as miners, to be particularly appealing. These companies could emerge as key players in the ongoing green revolution that encompasses all sectors of society.

The growing demand for raw materials is evident, driven by technologies like wind, solar, electric vehicles, and even the nuclear sector. For instance, an electric vehicle requires substantially more copper to operate compared to a traditional vehicle, while the construction of offshore wind plants demands a significant amount of minerals like rare earths, far exceeding the requirements of conventional gas-fired plants. This positions miners strategically to play a crucial role in the energy transition and potentially benefit from the resulting supply-demand imbalance.

Looking ahead to 2024: Uncertainty on the horizon

Predicting the future performance of the commodities market is always challenging due to the complex interplay of various factors. However, several key trends will likely shape the market in 2024:

- The trajectory of the war in Ukraine: The ongoing conflict remains a significant wildcard, and its resolution or escalation will significantly impact energy and agricultural commodity prices.

- The pace of global economic growth: Slowing economic growth could dampen demand for commodities, leading to price corrections.

- Central bank policies: As central banks worldwide continue raising interest rates to combat inflation, the cost of financing commodity purchases could increase, potentially impacting demand.

A Decade of Opportunity and Challenge

While it is difficult to definitively declare the 2020s as the “decade of commodities,” the current landscape certainly presents significant opportunities for producers and investors in the sector. However, it is crucial to acknowledge the inherent volatility of the market and the multitude of factors that can influence price fluctuations.

With careful analysis and a nuanced understanding of the economic and geopolitical landscape, participants in the commodities market can navigate the complexities of the coming year and potentially capitalize on the opportunities it presents.