Royalty Financing – An important Segment of Asset-Backed Finance

June 22, 2023

Companies seeking cash have experienced significant headwinds since mid-2022 as IPOs dropped 78% year-on-year and macroeconomic headwinds and high inflation made for a much stiffer cost of debt. Several companies, especially in pharma and biotech, veered towards value investments with royalty financing emerging as a viable alternative.

Royalty financing, also known as revenue-based financing or revenue sharing, is a funding arrangement where a company receives capital from an investor in exchange for a percentage of its future revenues. Unlike traditional debt financing, where the borrower repays a fixed principal amount plus interest, royalty financing involves the payment of a predetermined percentage of revenue until a certain total payment amount is reached.

The concept of royalty financing began1 with Bart Goodwin and Ed Mello2 when they saw a gap in the market for this type of investment opportunity. Their company, Cypress Growth Capital, decided to take a percentage of the borrower’s monthly revenue instead of the traditional equity stake. The concept gained popularity initially amongst oil and gas, pharmaceuticals, film, and even mining. However, companies like Cypress Growth Capital, Barkerville, Osisko, and Grenville Strategic Royalty Corporation have expanded their investment model into new industries.

According to a research report3 by Verified Market Research, Revenue-Based Financing Market size was valued at USD 2298.9 Million in 2022 and is projected to reach USD 153.95 Billion by 2030.

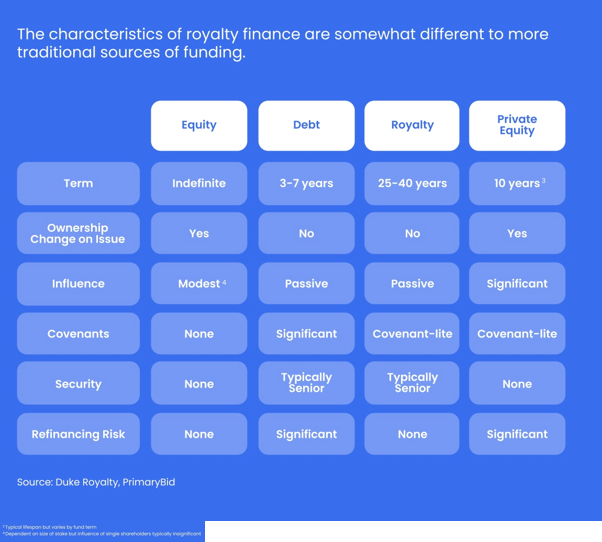

Some key differences between royalty financing and traditional sources of funds:

As per industry research4, The key differences between royalty financing and other sources such as equity, debt and private equity are illustrated as under:

Some examples of Royalty Financing:

- Music Royalties: In the music industry, artists or songwriters may enter into royalty financing agreements with investors who provide upfront capital in exchange for a percentage of future royalty payments from their music sales, streaming, or licensing.

- Franchise Financing: Franchisees seeking funds to start or expand their franchise business may opt for royalty financing. The franchisor may provide the necessary capital in exchange for a portion of the franchisee’s future revenues.

- Software Royalties: Software developers or technology companies may enter into royalty financing arrangements where investors provide funding in exchange for a share of future revenues generated from the software’s licensing, subscription fees, or usage fees.

- Film or Entertainment Financing: Independent filmmakers or production companies may utilize royalty financing to secure funding for their projects. Investors may receive a percentage of the film’s box office revenues, streaming revenue, or other related income.

- Product Sales Royalties: Startups or small businesses with innovative products may opt for royalty financing instead of traditional debt. Investors provide capital in exchange for a percentage of the company’s future product sales.

It’s worth noting that the terms of royalty financing can vary significantly based on the specific agreement between the parties involved. The percentage of revenue, total payment amount, and other terms will depend on factors such as the industry, the company’s growth prospects, and the perceived risk and return profile of the investment.

A good way to understand Royalty financing is as under:

Suppose a small business borrows US $ 250,000 on an undertaking to pay Three percent on annual sales for next 10 years. Assuming an average sale of One million dollars over the next 10 year period, the financier would make US $ 30,000 per year, totalling to US $ 300,000, which is a return of 20%. However, if the firm increases its revenue by an average of 10% over the period, then the financier’s return would go up to US $ 3,30,000, a return of 32%.

Normally, the terms of Royalty Financing are finalised at the beginning of the transaction and the financier will be loath to change the tenure midway, unless accompanied by some stiff clauses.

Conclusion

Since the returns are capped, there is a high degree of visibility of cash flows as far as the investee is concerned. Also since there are no personal guarantees or any upfront payments, it is a useful route for the small business owner who otherwise may have to give sureties in terms of assets to get the loan. For the financier, it is a high-risk approach but one that assures him of steady cash flows from the very first year, unless there is a moratorium period included in the contract.

Since it is a founder-friendly funding, recent trends5 in royalty finance also include companies in the pharma sector, including bio-tech since bulk of the focus in these sectors is on innovation which is based on a stable management. Since the royalty financier does not get involved in the business at all, this is proving to be an attractive funding alternative as compared to the VC/PE or debt.