Secondary Prime: Why VCs are Flocking to Secondary Markets to Meet LP Demands

July 26, 2023

2021 was a landmark year for the global VC market. KPMG’s Venture Pulse Q4’21 report1 found that the quarter saw near-record highs for total venture capital investment, corporate venture capital investment, exits, and global fundraising. Global venture capital investment in Q4’21 totaled $171.4 billion, up 65% from Q4’20 and just short of the all-time high of $180.2 billion set in Q3’21.

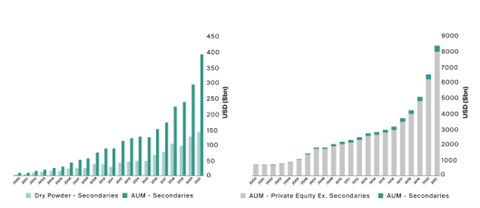

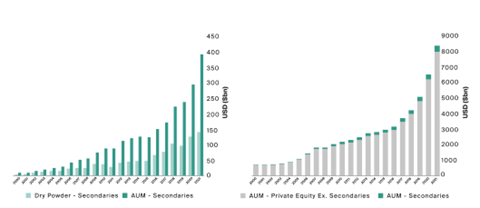

Image via CAIS Group2; Data from Prequin.

According to Prequin data, the secondaries market grew at a faster clip than the larger private equity market in 2021. In fact, the secondaries funds AUM quadrupled over the preceding 10 years and grew at a CAGR of 20.2% after 2000, outperforming the overall annual growth rate of private equity AUM at 12.9% over the same period,

2022 marked a sharp decline in the market, which has only just begun to stabilize3. The bullish optimism of the 2020-2021 cycle is yet to return despite the buzz created by generative AI and the relative resurgence of big tech stocks, and investors have been more circumspect about dealmaking given the current recessionary climate and high cost of debt.

Furthermore – startup valuations are dropping, although in most cases, they are still higher than pre-2021 levels. According to Pitchbook4, US VC-backed companies raised $39.8 billion in Q2’23, a 48% decrease year-on-year. The median pre-money valuation for venture-growth stage companies fell 62% year-on-year to roughly $126 million, the sharpest decline of any stage. Therefore, startup exits and IPOs are still elusive, meaning VCs have less capital available for new investments.

In this environment, the secondary market is becoming increasingly important. LPs are looking for ways to exit their investment early, and this demand for liquidity has driven VCs to secondaries. Secondaries provide LPs with a way to exit their investments without having to wait for a company to go public or be acquired.

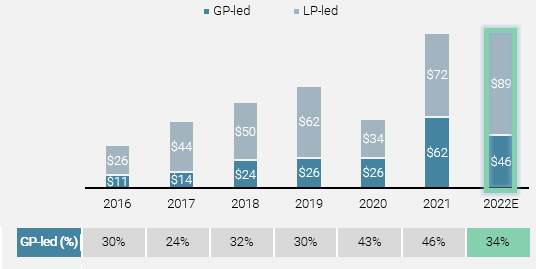

Image via Unigestion5

Growing Opportunities

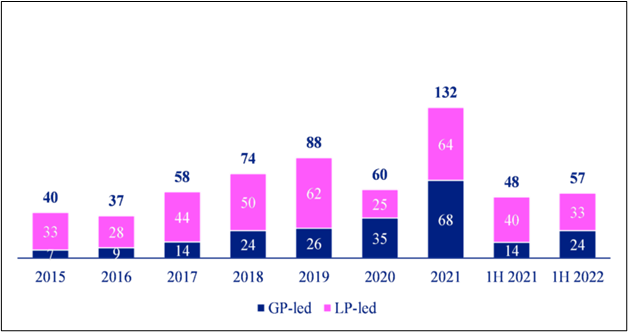

The secondary market for venture capital is still in its early stages but is growing rapidly. According to the Jefferies Global Secondary Market Report6, 2022 was the second-biggest year on record for secondaries, as they logged volumes of $108 billion; furthermore, for the first time since 2019, LP portfolios represented a larger share of this volume than GP-led transactions. According to Industry Ventures7 deal volume in secondaries is poised to surpass $130 billion in 2023. The growth of the secondary market is being driven by a number of factors, including:

- The increasing size of VC funds: As VC funds have become larger, so has the amount of capital that LPs are looking to exit.

- The extended time horizons for startup exits: It is taking longer for startups to go public or be acquired, which means that LPs are looking for other ways to exit their investments.

- The rise of new investment strategies: Some investors are using secondary markets to gain exposure to venture capital without having to commit to long-term investment.

During the latter half of 2022, there was a sharp decline in the public markets, resulting in the denominator effect and LPs being over-allocated to private equity. LPs began looking for ways to free up capital tied up in long-term private equity investments. With IPOs reducing, LPs turned to secondary markets as a liquidity alternative. LP-led investments represented over 60% of VC investment in the secondary market in 2022.8

At this moment, the secondary market is very much a buyers’ market. A large number of VCs are looking to sell portfolio stakes, but buyers are focusing on the best assets, while lower-value sellers are unable to sell their stakes despite large discounts. While sellers were initially reluctant to accept large discounts, leading to a slight slowdown in secondary market transactions in the second half of 2022, Anthony Shontz, partner at Partners Group expects9 sellers to grow more receptive to lower prices, accepting 15% to 20% discounts as “just the price of liquidity.” He expects transaction volumes to rise from the second half of 2023.

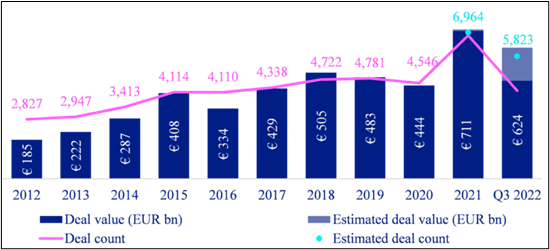

Image via LPEA10

PE dealmaking in the European market has followed a similar pattern, with 2021 showing a sharp upswing in PE deals and deal values and 2022 numbers displaying a market correction that still represent a gain on 2020 figures.11 This resilience is remarkable given the geopolitical tensions, energy crisis, and tighter economic policies across Europe; the fall in valuations measured by EV/EBITDA multiples has not been as steep as secondary buyers expected in the face of public market volatility.

The Luxembourg Private Equity and Venture Capital Association (LPEA) and Hamilton Lane both expect LP-led secondaries VC activity to continue in 2023, particularly once the bid-ask pricing gap stabilizes. According to a survey by Private Equity International12, 56% of the respondent LPs said that they planned to back secondaries funds in 2023. Furthermore, once venture fund valuations stabilize from the sky-high 2021 levels or those assets regain value, secondary market discounts will also reduce.

Impact of Secondary Market Growth

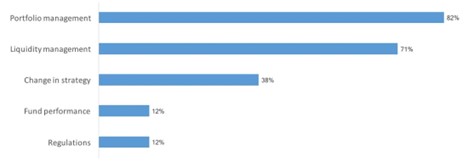

The growth of the secondary market has a number of implications for the VC industry. First, it provides LPs with more liquidity options and is therefore a valuable tool for LPs who need to get their money out of a venture capital fund before the end of the lockup period. This is making it easier for LPs to exit their investments and free up capital for new ones. LPs may choose to sell their interests on the secondary market for many reasons, the most widespread being portfolio management and liquidity management.13

Second, the secondary market is providing VC firms with a new source of capital. This can help VC firms to raise larger funds and invest in more startups. Thus, the secondary market can be a way for venture capital funds to recycle their capital for new investment opportunities.

Survey on motivations of private equity LP sellers. Image via Medium14

Third, the secondary market is increasing the transparency of the VC industry. This is making it easier for investors to understand the value of their investments and make informed decisions about when to exit.

“The secondary market is growing significantly now,” Devon Kirk, co-head of Portage told Pitchbook15. “We see a lot of seed investors looking for liquidity alongside a primary round.”

Secondary Market Volume, in Bn USD. Image via LPEA16

LP-led secondary investments are been proportionately larger than GP-led investments so far, although the gap is narrowing as GPs seek greater liquidity and attempt to diversify17. Moreover, strategic buyers, such as corporate venture capital firms and hedge funds, are also increasingly active in the secondary market. This is because they see venture-backed companies as a way to gain access to new technologies and markets. The secondary market can be a way for these strategic buyers to acquire stakes in venture-backed companies without having to go through the IPO process.

Conclusion

The meteoric rise of secondaries signifies a transformative shift within the VC industry. This growth is a positive development, as it provides LPs with more liquidity options, VC firms with a new source of capital, and investors with greater transparency. This helps investors better understand the value of their investments and make informed decisions about when to exit. Strategic buyers are also increasingly active in the secondary market, as they see venture-backed companies as a way to gain access to new technologies and markets more easily amidst a sluggish IPO environment. The next five years will be crucial for the development of the secondaries market, and also for VC and private equity. The secondary market is a dynamic and growing market, and it is likely to play an increasingly important role in the VC industry in the years to come.