Tech Stocks in 2023: A Recovery and A Reckoning

July 31, 2023

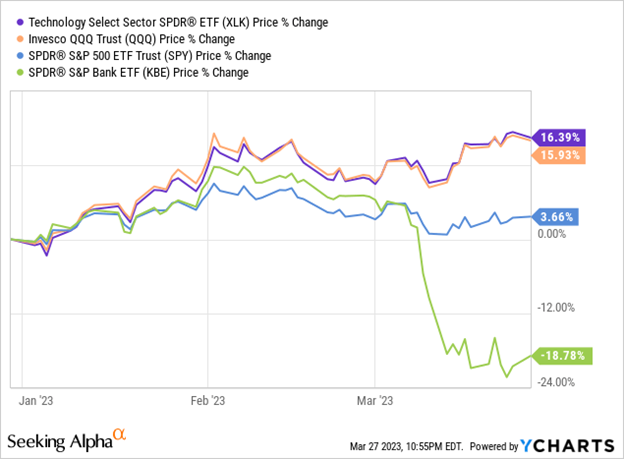

After a major slowdown in 2022, US tech stocks rebounded in Q1 2023. In fact, tech stocks have outperformed the larger market by focusing on cost discipline post sharp sector-wide valuation resets.

Image via Seeking Alpha

Julian Lin of Seeking Alpha writes1: “In a year in which the S&P 500 (SPY) is up only marginally and the S&P Bank index (KBE) is down nearly 20%, the Technology Select Sector ETF (NYSEARCA:XLK) is up 16.4% and the Invesco QQQ ETF (NASDAQ:QQQ) is up 16%.”

Rallying Amidst Uncertainty

The uncertain macroeconomic climate and the slew of interest rate hikes by the Fed adversely impacted top-line growth in the sector, and may have contributed to the valuation reset at the beginning of 2023.

Image via Seeking Alpha

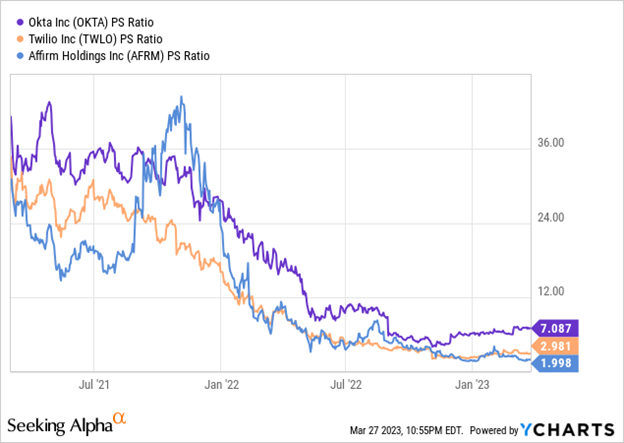

However, by prioritizing margins and adopting a cost-discipline approach, revenue growth rates have held steady in the tech sector. Tech stocks have thus been surging of late, fueled by a firm commitment to fundamentals as well as the buzz around generative AI.

For example, Okta Inc has performed strongly in the stock market this year despite being its stock price falling to 70% of its peak as recently as January. Many tech companies have demonstrated a similar commitment to margins and their shareholders, which is leading Wall Street to look favorably on the sector despite a torrid 2022.

There are also a number of signs of inflation declining to some extent; data from the Bureau of Labor Statistics shows that in June 2023, consumer prices increased at the slowest rate since July 2021. “The Consumer Price Index (CPI) rose 0.2% over last month and 3% over the prior year in June, a slight acceleration from May’s 0.1% month-over-month increase but a slowdown compared to the month’s 4% annual gain,” reports2 Yahoo Finance.

“There has been significant progress made on the inflation front, and today’s report confirmed that while most of the country is dealing with hotter temperatures outside, inflation is finally cooling,” says3 George Mateyo, chief investment officer at Key Private Bank. “The Fed will embrace this report as validation that their policies are having the desired effect – inflation has fallen while growth has not yet stalled.”

Experts expect one more quarter-point interest rate hike by the Fed, after which they expect a period of flat interest rates as the market adjusts to and normalizes the new business environment.

Soaring Stocks: A Cause for Concern?

The soaring tech stocks might give some pause, particularly so soon after the lows of 2022. Geopolitical uncertainty, banking sector stability, signs of global economic slowdown, investor expectations for corporate earnings – any one of these factors could cause a change of fortune for the tech sector.

In fact, earlier this month, both US Treasury bonds and tech stocks fell in price. As the sector awaits the Fed’s expected quarter-point interest rate hike, the yield on the 10-year Treasury bond touched 4.09% on July 7, according to the CME’s FedWatch survey of futures activity4.

Economic forecaster BCA Research wrote in their June 2023 report that: “”We remain tactically overweight equities but are preparing to transition to equal weight once the S&P 500 reaches 4500… Although the index may well peak above our target, we do not expect the rally will last beyond the summer.” Furthermore, they expect an economic recession in the first half of 2024.

However, the Nasdaq Composite finished the quarter strong, with a 12.8% increase. In the first half of 2023, it has gained 31.7%. Megacap tech stock has increased 46% in 2023, 165% higher since its 2020 low of around 132.

Conclusion

Galloping stock prices, the expected interest rate hikes, and the general geopolitical and global economic uncertainty are indeed a cause for concern; sharp rises in stock prices are often followed by sharp declines. Furthermore, analysts such as Mike Wilson, chief U.S. equity strategist at Morgan Stanley are pessimistic about the forecast for tech stocks in 2023. Wilson expects that the S&P500 will fall to 3900 by the end of the year, driven by a possible 16% drop in corporate earnings. Fed chief Jerome Powell has also indicated that more monetary tightening policies are on the way.

However, not all is doom and gloom. The soaring stock prices are rooted in firm economic fundamentals and driven by tech innovations such as generative AI, machine learning, AI-applied data analytics, climate tech etc. Interest in these sectors is likely to continue unabated for the foreseeable future, given the rising climate concerns and the push for digital-first solutions.

Veteran economist Ed Yardeni feels5 that the US is amidst a “rolling expansion” as opposed to the “rolling recession” he described last year. This could result in a broadening of the stock market recovery, with other sectors apart from megacap tech stocks witnessing gains. He expects that investors will give more attention to companies that are leveraging new-age tech solutions to boost productivity.