The BOJ Pivot: Why Ending Zero Rates in Tokyo Will Shock Global Fixed Income

December 5, 2025

For over two to three decades, the Bank of Japan (BOJ) has maintained an extraordinary policy of ultra-low, and often negative, interest rates. Struggling with persistent deflation and low growth, the BOJ had adopted an ultra-loose monetary policy, keeping interest rates near zero. This position created the cornerstone of the world’s most profitable and most rampant arbitrage trade: the Japanese Yen (JPY) Carry Trade. It has been the financial world’s indispensable, low-cost liquidity spigot.

JPY is built on an elementary principle – borrow at low (near-zero) rates, convert them into another safe haven currency (usually the US Dollar), invest in assets which have higher returns, and pocket the difference. The high-yielding assets could be US bonds, treasuries, stocks, or, for that matter, even cryptos.

So… What Is the Problem?

As long as the JPY remained weak and the interest rates were hovering near zero, or thereabouts, it was all kosher. However, if the Yen suddenly strengthens, then all those positions will unravel very quickly. To understand the magnitude of the problem, we first need to understand the size of the carry trade business.

While estimates vary from $4 trillion to close to $20 trillion1, including the government-run pension fund GPIF, the Bank of Japan (BOJ), and state-owned banks2, one thing is clear: unwinding the carry trade will not just have a financial impact. Still, it will have structural repercussions that will reverberate across global economies.

The Trigger

Faced with higher-than-normal inflation and economic stagflation, the BOJ’s imminent move to normalize rates, effectively ending this era of monetary singularity, is not just a footnote for Japan’s economy. It is a shockwave poised to disrupt global fixed-income markets, trigger a massive wave of capital repatriation, and reset risk premiums from New York to Frankfurt. The magnitude of this shift is difficult to overstate, positioning the “BOJ Pivot” as the single greatest macro risk event of the current era.

The Mechanics of the JPY Carry Trade

The JPY Carry Trade is built on a deceptively simple premise: borrow cheap, lend expensive. It is a sophisticated, leveraged bet on two factors: the persistence of a wide interest rate differential and the stability of the Japanese Yen.

Source: Disruption Banking3

- The Funding Leg (Borrowing): Investors, including hedge funds, institutional banks, and corporations, borrow massive amounts of Yen at near-zero interest rates. For years, the Yen offered a funding cost close to 0%, making it the cheapest source of global capital.

- The Investment Leg (Lending): The borrowed Yen is immediately converted into a higher-yielding currency, typically the US Dollar (USD), Euro (EUR), or certain high-rate Emerging Market (EM) currencies, and invested in their respective bonds or deposits. This generates the “carry”, the predictable, daily profit derived from the interest rate differential.

For years, the sheer size, leverage, and stability of the spread made this a favourite trade, pumping hundreds of billions, and potentially trillions, of Yen into the global financial system. This cheap liquidity, subsidized asset purchases across every class, from US government debt to corporate bonds, led to asset bubbles and suppressed market volatility everywhere.

The Shock: Unwinding Decades of Arbitrage

A single BOJ rate hike-or even a credible commitment to a rate trajectory above zero, like the one that BOJ governor Kazuo Ueda made about the Dec ’25 meeting-shatters the economic logic of this trade. If the BOJ raises its short-term rate, the interest differential narrows, killing the trade’s profitability. Crucially, it creates a massive, non-linear risk: Yen appreciation.

In such a scenario, investors race to unwind their highly leveraged short-Yen positions, and they must buy back Yen, triggering a self-reinforcing cycle of deleveraging with three key effects:

- Capital Repatriation: Global capital flows reverse. Funds must sell their foreign assets (US Treasuries, German Bunds) to generate the USD or EUR needed to purchase Yen and repay their Japanese loans.

- Global Bond Sell-Off: This mass selling pressure targets the most liquid markets first. It pushes down bond prices and raises yields across developed economies, causing a dramatic spike in volatility in US and European fixed-income markets.

- Currency Dislocation: The Yen rapidly appreciates against the USD and EUR, punishing any investors who unwound too slowly and creating broad FX market dislocation, particularly in emerging markets where the carry trade was leveraged most aggressively.

This sets up a self-reinforcing loop:

Impact on Developed Markets (DM)

The immediate and most visible effect will be felt in the world’s safest, most liquid markets: US Treasuries and German Bunds. The BOJ’s decades-long policy not only enabled the carry trade but also indirectly anchored global long-term yields. Japanese institutional investors, managing enormous savings pools, became the single largest foreign holder of US Treasuries, often relying on JPY stability and the low cost of hedging. In a scenario where domestic Japanese rates rise, these institutions are incentivized to sell lower-yielding foreign bonds and reinvest domestically.

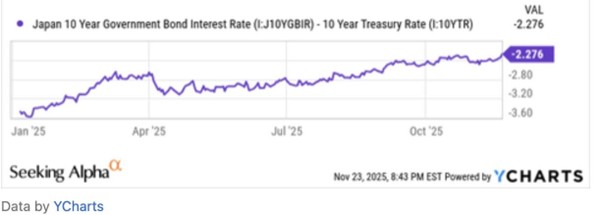

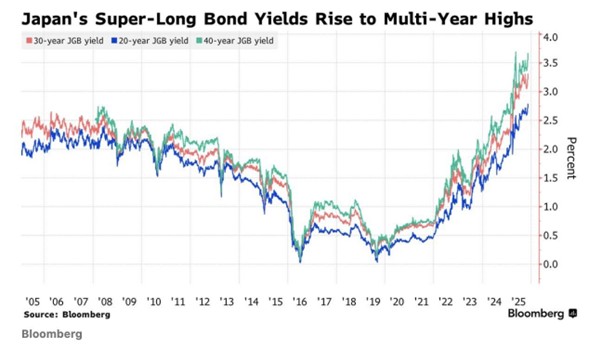

The combination of unwinding carry trades and institutional repatriation will overwhelm natural buying demand, sending a shock through DM bond markets. This selling pressure would drive up borrowing costs (yields) for governments and corporations, potentially clashing with any planned monetary easing by the Federal Reserve, which, according to recent forecasts, is preparing for rate cuts at the December ’25 FOMC meeting. As it is, the mere articulation of the rate hike by the BOJ governor has had an impact on the Japanese bond market.

Source: Seeking Alpha4

The BOJ pivot introduces a profound, external source of market tightening, adding complexity and unpredictability to global interest rate movements.

Emerging Markets Face The Domino Effect

The risk cascade will be particularly severe in Emerging Markets (EM). Currencies like the Brazilian Real, Mexican Peso, and various high-yielding Eastern European currencies offered even higher carry spreads, attracting the most leveraged forms of the trade.

When the Yen abruptly strengthens, the entire investment thesis collapses. The massive foreign exchange loss on the short Yen position instantly wipes out the small, accumulated profits from the interest rate differential. Funds are forced into a chaotic rush for the exit, selling off EM bonds and currencies indiscriminately. This creates a liquidity crunch, driving EM sovereign debt yields sharply higher and weakening local currencies. This powerful and destabilizing domino effect can quickly threaten fiscal stability across the developing world.

The Macro Opportunity: Positioning for Volatility

But wait – it’s not all doom and gloom. On the positive side, the high-dispersion, high-volatility environment created by the BOJ Pivot is the ideal hunting ground for discretionary macro hedge funds. While many investors will be caught off guard by the speed of the unwind, macro managers are positioning for outperformance through precise, high-conviction bets:

- Long JPY and JPY Volatility: Direct bets on Yen appreciation and increased volatility through futures and options on the currency.

- Short Developed Market Duration: Shorting US Treasury futures or European bond futures, anticipating the price decline (yield increase) caused by the massive repatriation sell-off.

- Relative Value Stress Trades: Shorting EM currencies and bonds that are known to be heavily financed by JPY (e.g., highly indebted nations in Asia or Eastern Europe) against relatively stable DM assets, capitalizing on the divergence in market stress.

The “BOJ Pivot” is, therefore, the single greatest macro risk event of 2026, but risk and opportunity are two sides of the same coin. For macro funds positioned on the right side of this massive, global fixed-income shock, the unwind of the JPY Carry Trade will be the trade of the decade.

A BOJ rate hike is not just a domestic policy adjustment. It is a systemic global event that alters funding costs, liquidity dynamics, and cross-border capital flows. The death of the yen carry trade and the resulting repatriation of capital will create a volatility shock that cascades through U.S. Treasuries, European bonds, and credit markets.

Sources:

1. https://www.reuters.com/markets/global-markets-selloff-analysis-pix-2024-08-08/

3. https://www.disruptionbanking.com/2025/11/07/how-dangerous-is-the-yen-carry-trade/

4. https://seekingalpha.com/article/4847117-the-yen-carry-trade-is-unwinding