The Global Commodities Market: Shifts from 2023 to 2024 and Predictions

August 28, 2024

The global commodities market is a dynamic landscape, influenced by a confluence of economic, geopolitical, and environmental factors. As we transition from 2023 to 2024, key commodities such as copper, silver, and gold are under significant scrutiny, with multiple forces shaping their demand and prices. Excluding oil, this article delves into the shifts witnessed in 2023 and what lies ahead, given the backdrop of the U.S. elections, the ongoing war in Ukraine, China’s economic trajectory, and other global economic factors.

The 2023 Landscape: Key Trends in Copper, Silver, and Gold

In 2023, the commodities market faced a mixed environment:

• Copper: Copper, a critical metal in green energy and technology applications, witnessed fluctuations due to both supply chain issues and demand volatility. Supply was constrained by disruptions in top-producing regions like Chile and Peru. On the demand side, uncertainties in China’s economic recovery after COVID-19 lockdowns, combined with global inflation pressures, weighed on copper prices. However, the ongoing global energy transition kept a solid floor under copper demand, driven by investments in renewable energy and electric vehicles (EVs).

• Silver: Silver saw heightened demand, especially in its dual role as both a precious metal and an industrial one. The push toward solar energy and 5G technology bolstered industrial demand. However, investor sentiment remained cautious due to global inflation, keeping prices somewhat stable.

• Gold: Gold’s performance remained relatively strong as it continues to be a safe-haven asset. The lingering effects of inflation, recession fears, and geopolitical instability (like the war in Ukraine) kept gold prices resilient. Central banks also increased their gold reserves as part of risk management strategies amid currency volatility. Gold prices have rallied to record highs this year, propelled by U.S. interest rate cut expectations, as well as the bullion’s appeal as a safe-haven asset. Gold futures recently hit another all-time high of $2,549.9 per ounce. Despite volatility in the year so far, the global commodities market remains elevated and is expected to remain so.

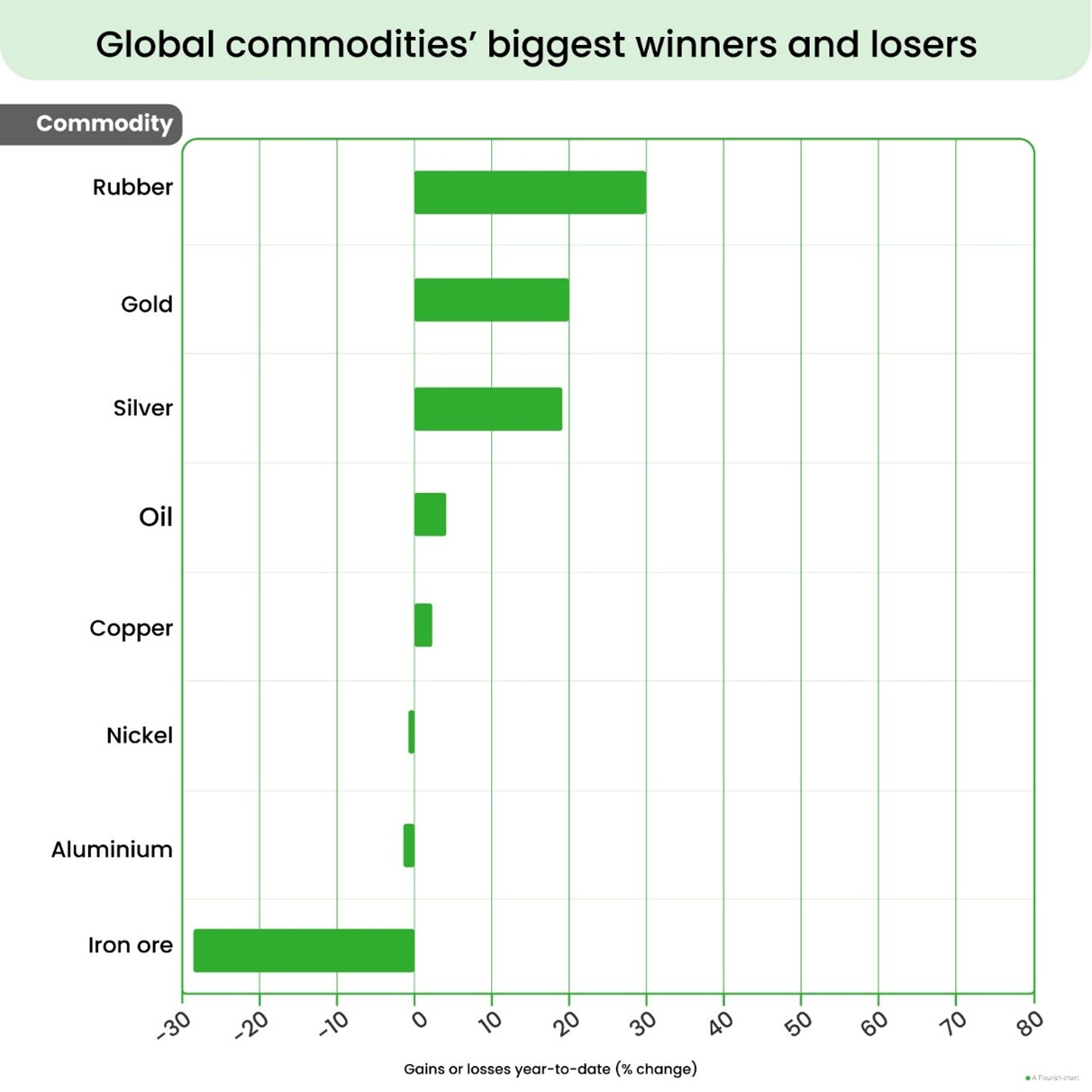

Gains or losses year to date, % change. Data from CNBC

Key Factors Driving 2024 Predictions

Moving into 2024, the global commodities market will likely be shaped by several critical factors:

• The U.S. Elections: The 2024 U.S. presidential election could bring significant policy shifts, influencing markets broadly. Should the outcome favor candidates advocating for aggressive green energy investments, it could lead to increased demand for metals like copper and silver, which are essential in green technologies. Conversely, uncertainty or market volatility during the election period might see investors flocking to gold as a safe haven, pushing its prices higher.

• The Ukraine Conflict and Geopolitics: The war in Ukraine continues to disrupt global trade and supply chains, particularly in Europe. Any escalation or de-escalation could have ripple effects on metal markets. For instance, copper could face tighter supply chains if geopolitical tensions worsen. Silver and gold, with their traditional roles as safe-haven assets, could benefit if global tensions rise.

• China’s Economic Trajectory: China remains a key player in the commodities market, being the world’s largest consumer of copper and a significant user of silver and gold. In 2023, China’s economic recovery from strict COVID-19 policies was slower than anticipated, creating demand uncertainty. As 2024 unfolds, whether China manages a stronger rebound or continues facing economic challenges will play a crucial role. A robust Chinese recovery could drive up copper and silver prices, while persistent economic woes might see these metals underperform.

• Global Inflation and Interest Rates: Inflationary pressures and central bank responses will continue to impact commodities. Higher interest rates tend to strengthen the dollar, making commodities more expensive for holders of other currencies. However, if inflation fears resurge or economic growth falters, gold could see a significant boost.

Commodity-Specific Outlook for 2024

After several years of pronounced volatility, commodity prices are expected to largely stabilize in 2024. This anticipated stability might seem unexpected, given the numerous geopolitical challenges currently affecting the global economy. These challenges include adverse weather conditions, intensifying conflicts in the Middle East, and soaring freight costs due to disrupted shipping lanes through the Suez and Panama canals. However, this apparent calm in commodity prices masks what is likely to be an active year, with markets continuing to experience short-term volatility before longer-term trends, particularly those associated with the green transition, become more prominent.

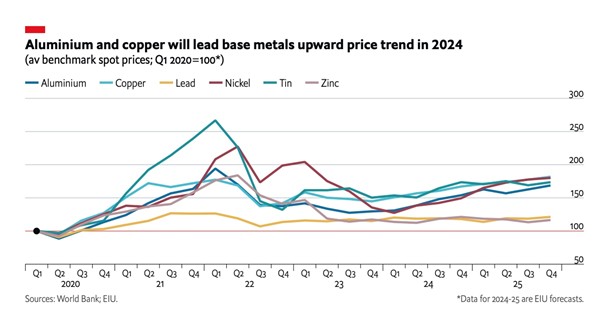

Green Transition to Influence Base Metals Prices by Late 2024

We anticipate a 3% average increase in our base metals price index in 2024, following a significant drop of over 11% in 2023, driven by growing demand for critical minerals associated with the green transition. Even metals like nickel, which will see substantial year-on-year declines in 2024, are expected to experience price increases from their end-2023 levels. Despite a robust supply response from producers, leading to an oversupplied market in 2024, low reserve levels will make nickel vulnerable to supply-chain disruptions. London Metal Exchange (LME) warehouse stockpiles are low by historical standards, and the availability of class 1 nickel will be constrained as end-users avoid Russian supply.

Russia will also play a significant role in the aluminum market, with prices projected to rise by nearly 20% over the year. Here, too, LME stockpiles remain low and do not accurately reflect the availability of metal for consumers, as many end-users are avoiding aluminum sourced from Russia, which now constitutes around 80% of LME warehouse supply. Although the market deficit (where demand exceeds production) in 2024 will be smaller than in 2021 and 2022, stockpiles will continue to decrease, with excess stocks being redirected to Asia due to the sluggish economic recovery in Europe.

While investment in decarbonization will continue to support prices for nickel and copper—key components in the green transition—tight monetary policy in developed countries will weigh on consumer spending and housing demand in 2024, especially in the first half of the year. Weak construction activity in China will also limit a significant rebound in copper prices. However, risks to copper price forecasts are more likely to be on the upside, given the potential for mine supply disruptions, particularly in South America. Although copper and nickel prices are expected to rise sharply from 2025 onwards, concerns about potential shortages driven by increased demand for electric vehicle batteries could push prices higher sooner than currently anticipated.

• Copper: Copper is expected to see strong demand, particularly if green energy investments accelerate. However, supply risks and China’s uncertain recovery could lead to volatility. Prices may edge higher if the global green transition remains a key priority, driven by ESG commitments and infrastructure spending in major economies.

• Silver: Silver’s outlook remains tied to industrial growth, particularly in the solar energy sector and electronics. If green initiatives and technological upgrades gather pace in 2024, silver could see a demand surge. Nonetheless, any slowdown in these sectors could temper price gains, keeping the metal’s performance balanced between industrial demand and its role as a safe asset.

• Gold: Gold is poised for a favorable year, especially if macroeconomic instability persists. Factors like recession risks, geopolitical unrest, or currency fluctuations could drive a flight to safety, benefiting gold prices. Central banks are likely to continue diversifying reserves with gold, further supporting demand.

Source: LinkedIn

Risks and Opportunities in 2024

• Supply Chain Resilience: Whether supply chains, particularly in mining, can stabilize or face further disruptions will be critical. Environmental policies and regulations will also influence supply, especially as mining becomes increasingly scrutinized.

• Technological Innovations and Substitutions: Advances in material science could alter the demand for certain metals. For instance, any breakthroughs in battery technology might impact copper demand. Similarly, the rise of alternative materials in electronics or energy storage could affect silver consumption.

• Market Sentiment and Speculation: Investor behavior, driven by sentiment on global growth, could cause price swings. If markets sense instability or impending economic downturns, speculative activity in gold and silver could intensify.

Conclusion

The global commodities market in 2024 will be shaped by the interplay of geopolitical tensions, economic policies, and market sentiment. As the world transitions through another year of post-pandemic recovery, the demand for key metals like copper, silver, and gold will remain robust, albeit with some volatility. The U.S. elections, China’s recovery, and the direction of the Ukraine conflict are among the pivotal factors to watch. Investors and stakeholders should prepare for a year where flexibility and responsiveness to global shifts will be essential in navigating the commodities market successfully.