The Long And Short of Equity Long/Short – Yesterday, Today and Tomorrow

October 31, 2022

The markets have always been hard to predict, and, easy to rationalize in hindsight. Analyzing short term equity markets is like the Matrix movie – dimensions within dimensions within dimensions. And not surprisingly, equity markets have been increasingly obscure in the short term and yet with abundant clarity when seen over extended periods of time. Investing has become harder with so many conflicting mainstream views, not to mention the tangential, contrarian and fringe opinions.

Everyone at the family dinners, across age and education tiers, voiced passionate opinions on the markets, bringing their own tips and rationale, and so many of the debates started with “I read/heard somewhere that”. In a different time, all this would have appeared harmless banter but with the highest ever levels of democratization of investment in the markets through apps like Robinhood, reddit fueled meme stocks, rise of the day traders, and, free money zero-risk pandemic handouts, the markets were no longer immune.

Despite these somewhat chaotic cross currents, long-standing investing conventions stood the test of time. Choosing industry winners, track record of cash flows and profitability, clear path to growth, skilled management still made up for quality investments in individual markets. In the paper below lets look at some of the key mover-shaker factors in more recent history and the direction that’s visible to most professional investors for 2023.

The 2021 Ride

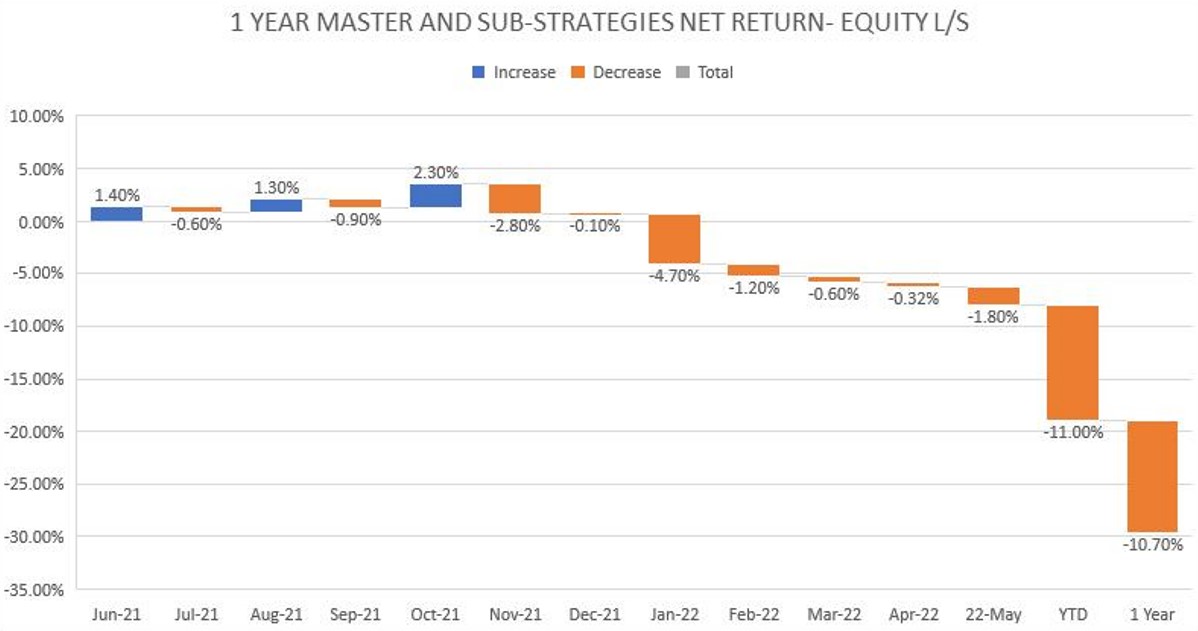

2021 was a wild ride for equity markets in general that ended overall positive for some and disastrous for many.

In the US, DJIA was up close to 20% while S&P500 was up approx. 25%. Clearly the large caps were doing well. Unfortunately, most of the stock rally focused on few stocks where the sentiment was to maximize short term gains. According to Goldman Sachs research, just 5 stocks accounted for 51% of S&P500’s return from April to Dec 2021.

Emerging markets took a bit of beating as money drained out of them, China suffered massive collapses in their real estate and tech sectors, and the European and US markets were flushed with fresh infusions, stemming from overwhelming stimulus.

2021 exposed for the first time many unique attributes such as how the markets were driven by widest-ever retail investor equity participation rates. In the past, the markets would have reacted poorly to many individual events like extremely high broad-based inflation, new super contagious and super deadly variants of the virus, supply chain doomsday scenarios, complete shutdown of sectors like travel and hospitality, commodities plunging and then skyrocketing within 12 months, short squeeze in the meme stock frenzy. Yet even a collective occurrence of all of them together within 12 months did not scare away investors. To the contrary, the high confidence levels, and easy access to speculative bets, made the S&P500 hit all-time highs, 70 times during the year. Huge number of companies went from private to public via SPAC, M&A or direct listings, taking advantage of the euphoria and high liquidity.

The Turbulent 2022

2022 macro-economics was in sharp contrast to 2021 in so many ways. The central bankers collectively and suddenly felt deeply offended by the high inflation, much of which could be attributed to their own lax policy over the years. The rapid increase in interest rates, the war and its impact, the movement of economic-tectonic plates of China, the desire for green investments, the growing belief that US is too heavy weight in stocks for its own good, all characterized 2022 developments. Another interesting trend was how quickly the cycles and narrative shifted each time. The dirty R word (recession) did not command any airtime in the first half of the year and then became the bedrock of investor communications in the 3rd and ongoing 4th quarter. Needless to say the 2022 story is that investors are exposed to far higher volatility and uncertainty than ever.

2023 – Greenshoots of Hope

As at the end of 2022, the global stocks are expected to trade well below their peaks. The Bulls make the case that many of the dampeners of 2022 will cease to exist in 2023, such as an end to the Ukraine conflict, tapering off of interest rate increases by central banks, stability in dollar rates, discount in markets like UK making equities attractive again, post-covid China humming again, and equally importantly that investors will go back to weighing technical analysis and stock quality over all the speculative, sentiment led investment trends. IMF on the other hand predicts global growth slowing to 2.7%, increasing risk of deglobalization, and, recession hitting most economies hard, causing overwhelming worries for CEOs and investors.