The Multi-asset Defence against Inflation

February 28, 2023

Markets had a fairly good January. The dovish cues from easing inflation continue to improve investors’ risk appetites, driving a surge in equities and decline in long-term bond yields—the 10-year US treasury yield declined to 3.5%, as of January 31, 20231, from a peak of 4.2% in October 2022. While the -1% forecast on the year-on-year earnings growth in the first half of 20232 resonates with the consensus view of a postponed recession, the dovish cues have led bottom-up analysts and investors to buy into the idea of “immaculate disinflation.” This uncertainty, evolving macro backdrop, and emphasis on balance sheet strength underscore the potential of a multi-asset approach in being a good defense against horsemen of the investors’ apocalypse.

Do not put all your eggs in one basket!

By diversifying into multiple uncorrelated asset classes, investors compound their portfolios over the long-term, even in the face of headwinds. A multi-asset approach helps investors to spread wealth across diverse asset classes, and thereby increases their potential of earning risk-adjusted, stable, and better returns. This diversified approach also helps investors to identify alpha opportunities, capitalize on both cyclical and anti-cyclical return drivers, and regularly rebalance the portfolio to avoid bias. These features make multi-asset allocation3 an appropriate investment strategy in this climate. While headline yields from single assets such as equity and fixed income appear attractive from the income perspective, investors should focus on the compensation for credit risks, given the stickiness of inflation. These single assets may not provide additional boost from capital growth, especially in the case of fixed income assets. Hence, a multi-asset can help investors to blend attractive income4 from these assets with the opportunities available across asset classes. An insight into the current estimates on the main asset classes—equities, bonds, commodities, and credit—can help investors to take the right stance (long, neutral, or short) and engineer a portfolio providing consistent exposure to returns with stability.

Taking a strategic stance

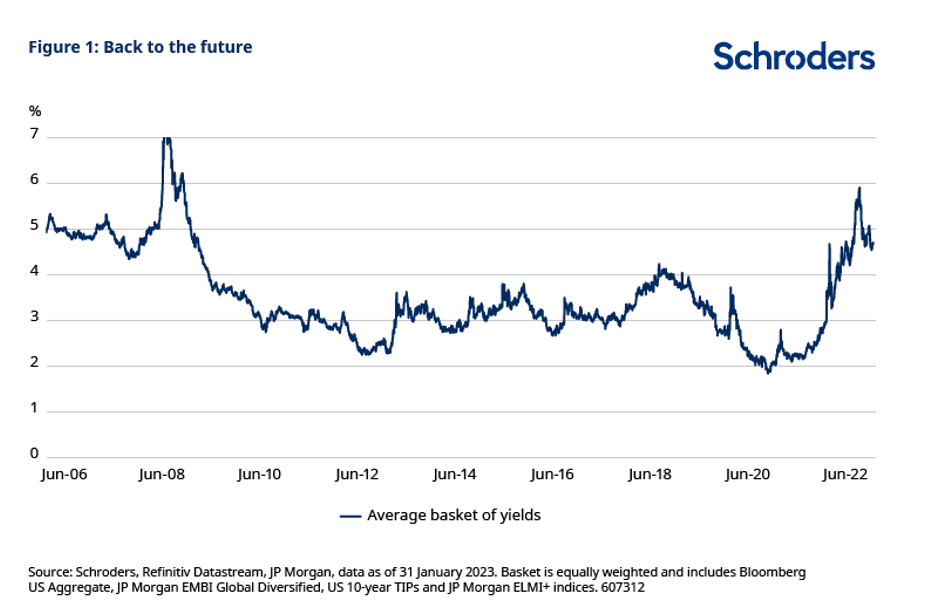

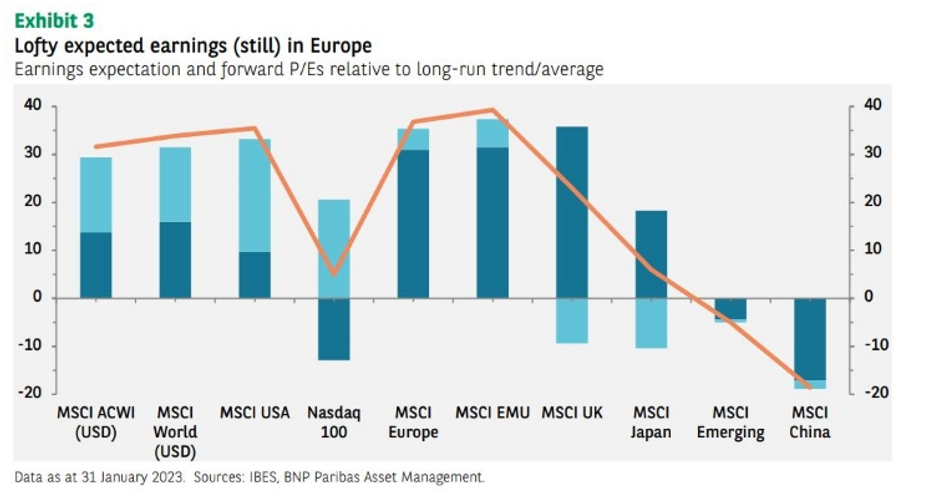

As per analysts’ estimates5, the peak in inflation and policy-rate expectations make long-term sovereign bonds and emerging-market (EM) equities attractive sources of income. They are doing better than developed markets; with waning USD strength, the real yield for local EM debt also appears promising. Although investing in ex-US did not appeal to investors in the past, the rally in foreign stocks clarifies that US shares are set to play second fiddle to European equities6. Overall, the estimates show a market-neutral stance on multi-asset portfolios, especially on equities. Some have taken a short position on European equities and long on the US and EM stocks, and some others have taken a long/positive position on European equities while under weighing the US large caps. This position on European equities can be attributed to attractive valuations, strong corporate balance sheet, and spillover from China’s reopening. The “China factor”7 is also expected to profit commodity exporting countries. Since supply chain lags are driving companies to increase commodity prices, some have taken a neutral stance on commodities, and some others are hopeful because of a fall in this spike since early 2022. High yield bonds have been providing better inflation protection, and hence investors should consider including bonds in their multi-asset portfolio. Estimates show that European high yield bonds are offering better yield (wider high-yield spreads) and credit quality than their US counterparts. The implications are positive for European investment-grade credit8, given the significant tightening in spreads (from 228bp to 141bp). Analysts also suggest adding high-quality DM credit owing to their attractive all-in yields in the short end of the curve. Given these positions, investors must focus on alternative scenarios when designing a multi-asset portfolio. Based on analysts’ estimates9, if interest rates remain at the current level, then investors must focus on building a high income and inflation protection portfolio, comprising low duration government and corporate bonds and equities. Conversely, if the economy returns to the secular stagnation steady state, then investors can consider long duration investment grade and high yield corporate bonds and dividend stocks with a stable cash flow. In the real world the outcomes may not be binary across the aforementioned scenarios. Hence, investors must balance attractive yields across asset classes while favoring assets offering positive returns in a challenging scenario.

Do not break your eggs!

Multi-asset investors must strategically balance risk and returns based on their risk appetites, investment tenure, and financial targets. They must balance inflation resilience, if prices rise, with growth potential as market fundamentals become stronger. By identifying diverse return sources as per conservative, balanced, and growth risk appetites and by investing in DM and EM stocks and bonds to markets including commodities, volatility, alternative risk premia, and cash, investors can protect their eggs even when the ride gets bumpy.