The Return of the Macro Trade: Why Hedge Funds Are Rebalancing Toward Global Themes

October 28, 2025

For much of the past decade, global macro investing was considered a relic of the 1980s and 1990s: an era when titans like George Soros, Julian Robertson, and Paul Tudor Jones made fortunes betting on currencies, interest rates, and sovereign bonds. Then came a long stretch of central bank dominance, synchronized monetary policy, and ultra-low volatility. The macro trade seemed dead.

Today, it’s back — and with a vengeance.

After a period of relative dormancy, macro hedge funds are making a compelling comeback in 2025. Increasing global uncertainty has pushed hedge funds to rebalance their portfolios toward macroeconomic themes driven by deglobalization, rate divergence, and geopolitical volatility.

Across the world, hedge funds are realizing that macro themes – big, structural trends across economies, geopolitics, and policy – are again the dominant forces shaping returns. As deglobalization reshapes trade flows, rate divergence fragments monetary regimes, and geopolitics-driven volatility redefines supply chains, global macro funds are once again finding fertile ground.

Source: Aurum.com1

The End of Global Homogeneity

The 2010s were a time of extraordinary macro homogeneity. Globalization was the driving force behind subdued inflation, and the Fed was the pied piper, with nearly every major central bank following the Federal Reserve’s lead. In such a world, there was little dispersion – the lifeblood of macro strategies.

Fast forward to 2025, and the world suddenly looks very different – US dominance is fading fast, and every other major economy is looking inward and discarding a homogenous regime to one where self-protection is the watchword. The world economy is now a patchwork of competing regimes:

- The U.S. economy remains resilient, supported by fiscal expansion and reindustrialization spending.

- Europe struggles with stagflationary dynamics amid the costs of the energy transition.

- Japan maintains ultra-loose policy even as inflation sticks.

- China manages a structural slowdown with selective stimulus.

- Other emerging markets (EMs) are, to varying degrees, trying to grow with both domestic and global markets in mind.

This fragmentation has resurrected opportunities for relative-value macro trades – long one currency, short another; receive rates in one market, pay in another, actively exploit these divergences, positioning across FX rates and commodities.

Is Rate Divergence The New Alpha Engine?

For macro managers, the end of rate synchronization is the most critical development of this cycle. From 2015 to 2021, global central banks moved in near lockstep -zero or negative rates everywhere. That made it hard to express differentiated macro views.

In a post-COVID world, different economies have been affected to different degrees. With the result, with inflation dynamics diverging and fiscal policy constraints widening, interest rate paths have decoupled. While the Federal Reserve is balancing a soft landing with persistent price pressures, the European Central Bank remains cautious, and emerging markets, meanwhile, are easing early after front-loading hikes in 2022–23.

Consequently, Macro hedge funds are rediscovering the old art of rate spreads – betting on how yield differentials between economies will evolve. These strategies hinge on probabilistic models of monetary regime shifts, often using Bayesian updates and stochastic rate path simulations to estimate the likelihood of central bank pivots.

In effect, macro managers are now trading the divergence of policy paths, not just their levels – a far more complex, data-driven game.

Deglobalization and the Return of Economic Nationalism

Once dismissed as political rhetoric, the term deglobalization is an investable theme. The reordering of global supply chains, from semiconductors to critical minerals, is creating structural dispersion across markets. This retreat from globalization—or its evolution into regionalized nearshoring and friend-shoring-is creating powerful, persistent, and profitable macro trends:

Macro funds are positioning along multiple fronts:

- Commodity Geography: Long energy producers (U.S., Middle East) vs. short energy importers (Europe, Japan).

- Industrial Policy Beneficiaries:S. and India have become magnets for capital reallocation – reflected in stronger currencies and equity inflows.

- Fragmented Trade Blocs: The rise of dual trading systems (U.S.-led vs. China-centric) is altering capital flows and FX stability.

This is a return to national economics — where geopolitical alignment now matters as much as economic fundamentals. Macro investors are mapping trade networks, supply vulnerabilities, and fiscal priorities to identify asymmetries.

For instance, commodity-linked currencies (AUD, CAD, NOK) are increasingly sensitive not just to prices but to trade alliances. Funds that once modeled oil prices based on global demand now incorporate political risk factors, sanctions, export bans, and shipping chokepoints into their probability distributions.

Volatility Is the New Normal

For the first time in years, volatility, the lifeblood of global macro funds, is back, not just in equities but in currencies, rates, and commodities. Increasing macro dispersion has also led to a breakdown of cross-asset correlations.

Hedge funds are embracing this environment with dynamic models ranging from Volatility targeting models, regime-switching models that identify shifts between inflationary and non-inflationary regimes, allocating capital accordingly, and machine learning-enhanced signal extraction allows funds to detect emerging macro anomalies faster — from liquidity mismatches to policy inflection points.

The key idea: macro isn’t just about taking big directional bets anymore. It’s about recognizing and adapting to changing regimes with precision and speed.

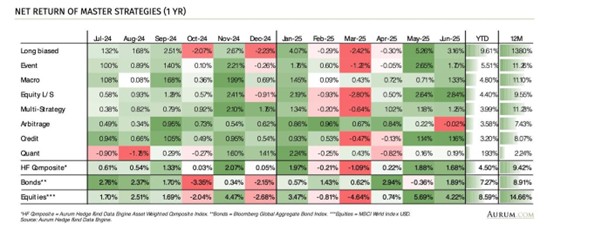

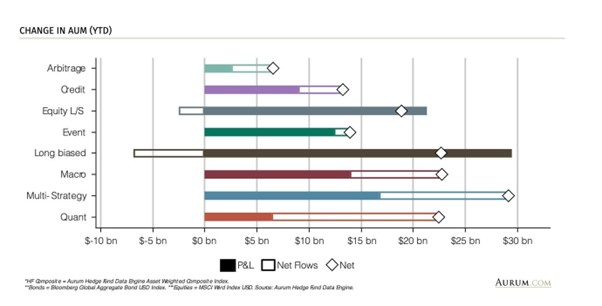

For example, by June 2025, macro hedge funds surged ahead with YTD returns of +11.2 %, capitalizing on central bank divergence and commodity spreads. Event-driven funds followed at +8.7%, boosted by an uptick in global deal-making. Equity long/short strategies lagged with +4.3%, as AI-driven equity market dispersion challenged stock pickers. Perhaps most notably, quantitative and AI-driven funds represented over 35% of new launches, reflecting the structural integration of advanced technology into hedge fund DNA.

Source: Aurum.com2

The New Generation of Macro

The macro funds leading this renaissance are not simply reviving old playbooks- they’re reinventing them. This hybridization, where human narrative meets algorithmic precision, defines the macro fund of the 2020s.

Macro managers now blend economic forecasting with nowcasting, using real-time data (shipping flows, energy inventories, even satellite imagery) to gauge activity before it appears in official statistics. With multiple data flows, they model not only the most likely policy path but the distribution of possible outcomes. In short, macro is becoming both broader and sharper.

The three decades from the fall of the Berlin Wall to the onset of COVID were marked by an unrelenting focus on global efficiencies. The post-COVID world saw a shift from efficiency to security, in which each nation-state and its economic structures are marked by self-protection and preservation. The Trump tariffs and the Russia-Ukraine attrition are but early examples of this trend. Led by these signals, the return of macro trading underlies a broader truth- that it is an asynchronous world. With diversification benefits back in focus, those funds that combine discretionary insight with quantitative tools, integrating machine learning for patterns across macroeconomic data, are best positioned for sustained success. As economic nationalism accelerates and monetary regimes fracture, the dispersion of outcomes widens – a scenario that could be uncomfortable for traditional investors, but precisely the environment macro thrives in.

After a decade of one-world-driven homogeneity, markets are once again driven by human decisions, geopolitical shocks, and probabilistic outcomes.

For macro funds, that’s not chaos. That’s an opportunity

Sources: