The Rise of Continuation Vehicles

September 19, 2025

Private equity exits have been undergoing a significant transformation in recent years, with the rise of continuation vehicles emerging as a notable trend reshaping how sponsors and investors manage portfolio liquidity and asset ownership. Continuation vehicles (CVs) are increasingly utilised in stretched markets as an alternative exit strategy, enabling private equity fund managers to retain ownership of high-performing assets while providing options for limited partners (LPs) to exit or reinvest. The growing adoption of continuation vehicles is not only a response to fluctuating market conditions but also reflects deeper structural changes in private equity exit dynamics.

What Are Continuation Vehicles?

Initially perceived as a solution for ‘problem’ assets that went unsold in unfavourable market conditions, Continuation vehicles are now seen as useful for top-performing ‘trophy’ assets, allowing GPs to extend value creation beyond a fund’s lifecycle and at the same time providing LPs with flexible liquidity options in a volatile market environment.

Simply put, Continuation Vehicles, also known as GP-led Secondaries, are specialised investment structures that enable a private equity sponsor to transfer one or more portfolio companies from an existing fund approaching the end of its life into a new fund vehicle controlled by the same general partner (GP). This new vehicle offers existing LPs the choice to either cash out their investment, typically at a negotiated price, or reinvest and maintain exposure to the assets under continued management by the GP. Unlike traditional fund exits, which often involve sales to third parties or IPOs, continuation vehicles facilitate ongoing ownership by the GP over long-term value creation opportunities within these assets.

Drivers of the Rise in Continuation Vehicles

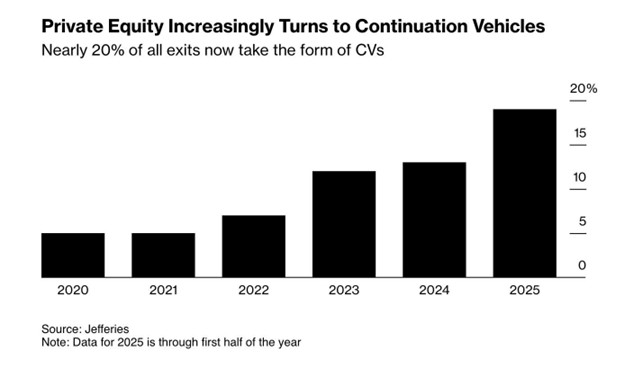

Several market forces have driven the surge in continuation activity. A weak IPO market, sluggish M&A, and longer holding periods mean GPs face more unsold assets at fund maturities. Simultaneously, ample dry powder in the secondaries market and specialist buyers have made it easier to recapitalise single assets. Industry studies report a sharp increase in GP-led transactions and CV launches in recent years, with deal counts jumping significantly from 2023 to 2024 and volumes reaching record levels in early 2025. Jeffries reported1 that around 1 in 5 private equity exits in the first half of 2025 were through continuation vehicles, amounting to $41 billion in deal value

Source: Bloomberg2

As Traditional exit pathways, such as IPOs and strategic sales, become less predictable amid volatile equity markets, geopolitical uncertainties, and tighter liquidity conditions, CVs are proving to be the routes for GPs to achieve timely and lucrative exits, providing alternative solutions. Secondly, Continuation vehicles provide a mechanism where LPs can realise liquidity in a controlled manner or opt to roll over their interests into a new vehicle and continue benefiting from future upside. Also, sectors such as technology and healthcare require longer holding periods to unlock full value. CVs permit the GPs the flexibility to extend the timeline without the pressure to exit prematurely, leaving value on the table.

Growing Secondary Market Maturity

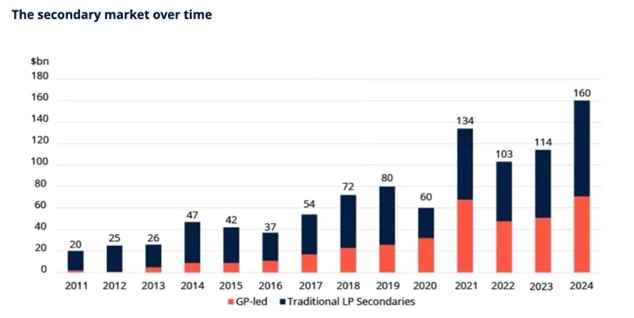

The expanding sophistication of the secondary market for private equity interests supports the structuring and funding of continuation vehicles, attracting fresh capital from new investors and rebalancing fund portfolios.

According to Schroders3, out of the total of $ 160 billion secondaries market in 2024, roughly $70 billion was in the nature of GP-led secondaries, or CVs. Looking ahead, the structural trends in private equity point to a sustained role for continuation funds. Companies are staying private for longer, and GPs are increasingly seeking mechanisms that allow them to hold onto high-performing assets while offering liquidity to investors. Against this backdrop, the continuation fund market, which has seen rapid expansion in recent years, is poised for further growth. Looking to the future, Bloomberg quotes Schroders’ research stating that Continuation investments will displace 8% of total deal flow for mid and large buyouts over the next 10 years4.

Source: Schroders5

Continuation funds are emerging as an attractive exit option for portfolio companies, particularly in the small and mid-market segments, where businesses still have substantial room for transformational growth. Their appeal has only strengthened in the current environment of uncertainty. With U.S. trade policy undergoing major shifts and markets experiencing heightened volatility, traditional exit routes such as IPOs and strategic sales remain subdued, making continuation vehicles a timely alternative.

Key Challenges in CVs

In challenging markets, continuation funds face heightened scrutiny. In an exit-drought scenario, conflicts of interest and valuation disputes heighten, making robust safeguards essential. Typical challenges include:

- Conflicts of Interest: By nature, GPs act as both buyer and seller in CV deals. In weak markets, this dual role raises concerns that assets might be transferred at artificially low prices, allowing the GP to benefit in the new fund.

- Pricing and Valuation: With IPO markets slowing down and strategic buyers cautious, independent third-party valuations and fairness opinions are critical tools to protect GPs against disputes and reassure LPs that pricing reflects market reality rather than opportunism.

- Transparency of Process: Transparent communication builds trust and mitigates risk in a fragile market. GP Sponsors must clearly justify why continuation vehicles are preferable to traditional exits. Offering documents should outline the rationale for holding assets longer, explain rejected alternatives, and detail governance and roll-over options available to LPs.

The regulatory environment is increasingly focusing on standardising fee structures and ensuring investor protections around continuation vehicles, reflecting their growing market significance and complexity.

Summation

The continued growth and institutionalisation of continuation vehicles suggest that they are becoming a standard part of the private equity exit toolkit rather than a purely cyclical response to market dislocations. Schroders and other market analysts forecast a 3x-6x growth in continuation fund investments over the next decade, as the industry adapts to longer holding periods, more complex asset transformations, and evolving investor demands.

Furthermore, continuation vehicles complement other exit strategies such as carve-outs, which are also gaining popularity for portfolio optimisation and liquidity generation. Together, these approaches represent a more nuanced, flexible, and strategic paradigm for private equity exits in current and future market environments.

The rise of CVs underscores a structural shift in private equity towards longer holding periods, enhanced liquidity options, and better alignment between GPs and LPs in managing mature portfolio companies. As the secondary market matures and regulatory scrutiny increases, continuation vehicles will likely become even more versatile and embedded within private equity exit frameworks.