The Road to Alpha: A Framework for Selecting the Right Fund Manager

November 26, 2023

In the ever-evolving world of investments, achieving “alpha” – returns exceeding the market benchmark – remains a coveted goal for many investors. But with a vast ocean of fund managers vying for attention, navigating the selection process can be daunting. The need of the hour is a framework to help investors chart their course towards alpha-generating managers.

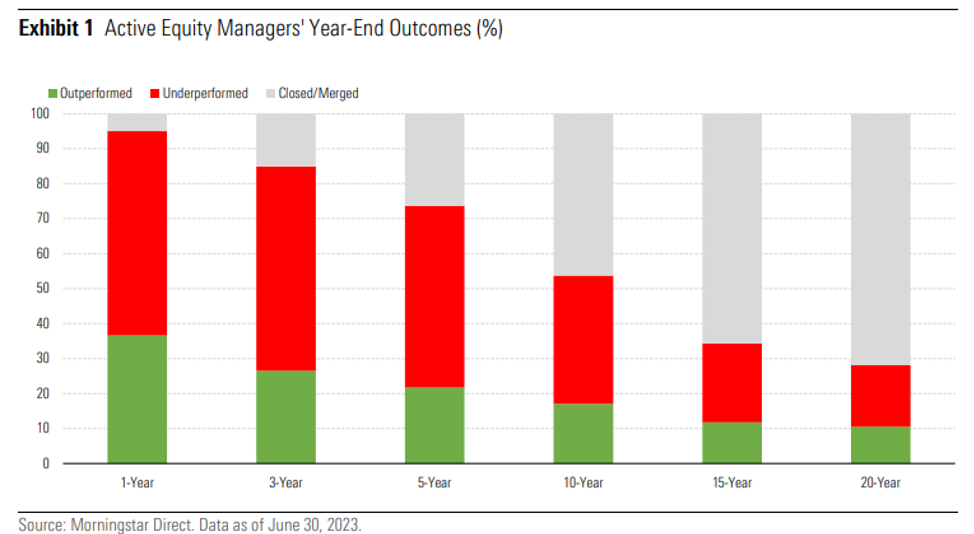

Image via Morningstar1

The Alpha Framework

This framework rests on four key pillars:

- Skill: Human expertise and judgment are still crucial, especially in the face of “passive investing” dominance. Seek out managers with unique skill sets and a proven track record of identifying “under the radar” opportunities that offer superior risk-adjusted returns.

- Inefficient Markets: Focus on areas where market inefficiencies exist, allowing skilled managers to exploit these gaps and generate alpha. This could involve niche sectors, under-researched companies, or alternative asset classes.

- Alternative Beta: Beyond traditional market beta, consider “alternative beta” sources, such as illiquidity premiums or unique risk factors not captured by standard. benchmarks. This can potentially enhance portfolio diversification and alpha generation

- Inaccessible Risk Premium: Keep in mind the importance of accessing risk premiums that are not easily available to all investors. This could involve investing in closed-end funds, private equity, or other exclusive strategies that offer differentiated risk-return profiles.

While this framework offers valuable guidance, it’s crucial to remember that selecting fund managers is a nuanced process. Investors must consider their individual risk tolerance, investment goals, and time horizon. Additionally, thorough due diligence is essential, including evaluating the manager’s investment philosophy, team expertise, performance track record, fees, and risk management practices.

Conclusion

Ultimately, the road to alpha is paved with careful research, thoughtful analysis, and a deep understanding of your own investment needs. While frameworks can provide valuable guidance, remember that there’s no one-size-fits-all approach. By combining these insights with due diligence and a clear investment strategy, you can increase your chances of navigating the fund manager landscape and potentially reaching your alpha goals.