The Sticky Inflation Theory and Why it May Come True

April 27, 2023

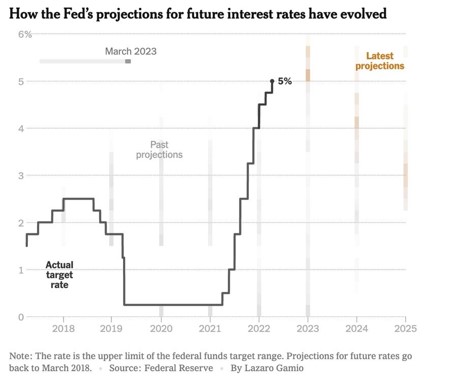

In what could be seen as a response to the failure of SVB and other banks, the Fed, on March 22nd increased the benchmark rates by 0.25% as against the new-normal of 0.5%. However, the outlook1 for the peak rate remained unchanged at 5.1%, while the benchmark rates are hovering between 4.75% to 5%. All this indicates that there could possibly be one more rate hike in 2023 by the Fed. What would be interesting for now is whether they decide to go for it at the next Fed meeting scheduled for May 3 or wait till June 14.

The markets finally can get some relief from the fact that the rate hikes which started in 2022 will possibly see some sort of a closure. What, however, will not see any closure is the volatility in the markets. If anything, the turmoil has only increased now, especially with the Ukraine situation continuing to extend and worsen and the Eurozone also settling into a recession-like situation due to high inflation amidst falling industrial output.

The Sticky Battle

The prognosis for inflation appears to be uncertain but apprehensive. While some expect the inflation to ease out, most bankers including the Fed Chairman seem to be gearing up for a sticky inflation which is likely to rise through the rest of 2023. The Fed’s easing of the rate hikes need to be seen more as a reaction to the banking crisis than an outcome of any other macro indicator easing off.

This does not augur well for fixed income/ bonds. As inflation rises, there is every risk that some of the fixed income/ bond yields could even reflect negative returns. If it turns out to be a longer and sticky inflation, there will be a direct impact on the yield expectation both in the short as well as the long term. Typically considered low risk, fixed income securities with a longer maturity are more affected by the sticky inflationary factors and could become a real casualty in 2023, and if the stickiness persists into 2024, extend into the next year too.

The Contrasting Views

There are others who disagree. A Forrester report2 published in February 2023 (and updated in April) argues that the inflationary trends in the US are likely to start easing off to 3.5% in December 2023 and further fall to 2.2% by the end of 2024. The primary reasons3 for falling inflation is the slower rate of growth in food prices and energy costs as well as the trend line for inflation which has been seeing a steady decline from its peak rate of 9.1% in June 2022 to 5% in March 2023.

The Fed in FUD

However, the bank crisis happened in March both in the US and Europe and in both the geographies, the involved banks included giants like Silicon Valley Bank and the venerable Credit Suisse. While the latter has now been taken over by UBS, the fact still remains that the banking industry is facing a period of Fear, Uncertainty and Doubt (the infamous FUD factor). The Fed Chairman Jerome Powell appears to be concurring when he remarked4 that “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation…The extent of these effects is uncertain.”

Secondly, the outlook for the UK5 continues to be grim. While the fears of recession seem to have faded slightly, the GDP growth is likely to be -0.3% for 2023 with inflation at 6.3%. The rest of Europe is not far behind with a projected6 GDP growth of 0.8% and inflation at 6.4%. Thus, in any forecast for inflation for 2023, one has to look at Powell’s statement in March when he said that additional rate moves ‘may’ be warranted – the emphasis being on ‘may’.

The Hazy Crystal

The simple hypothesis here is that there is no clarity. However, most analysts seem to agree that in a situation as fluid as this, the Fed, and the rest of the central bankers are going to be extremely wary of putting any stop to the fight against inflation. Banking industry’s woes – known as well as unknown-as-yet, will have an impact on lending and there is enough consensus on the fact that there will be a tightening of credit across the sectors. A tight credit will lead to a fall in spending which is likely to further exacerbate the fears of a recession or a recession-like scenario.

Given such a level of volatility, the year end inflation rate will be tough to predict, but current indications are that it will continue to be around the 4% levels. If one factors in one more round of rate hike this year to bring the rate on par with the terminal rate of 5.1%, it is clear that fixed income/ bonds will continue to slide. One way out could be to add inflation-linked bonds to the portfolio. In an environment where inflation is unlikely to fall and remain sticky amidst global headwinds, inflation protection might well be one structural portfolio adjustment for bonds.