Thematic Investing: Will the Boom Persist in a Potentially Higher-Rates World?

December 18, 2023

Thematic funds go back a long way. In 1948, Chicago-based Television Shares Management launched the first thematic fund, The Television Fund, in a bid to capitalize on the then boom in demand for TV sets.

The thematic concept again took wings during the 1960s and 1970s when the “Nifty Fifty” – nearly 50 large-cap stocks on the New York Stock Exchange – propelled the bull market of the early 1970s, only to crash and underperform massively in the ensuing decade. Following a brief fling with Internet-focused funds in the 1990s, thematic investing took off in the 2000s, with exchange-traded funds (ETFs) gaining widespread acceptance amid a growing shift from active to passive asset management.

Today, there are almost 200 “themes” across 1,952 such funds, relating to structural or macroeconomic trends above the conventional business cycle, that investors can choose from – including artificial intelligence, robotics, clean energy, robotics, legalized cannabis, cloud computing, 3D printing, genomics and fintech.

Decade-long boom

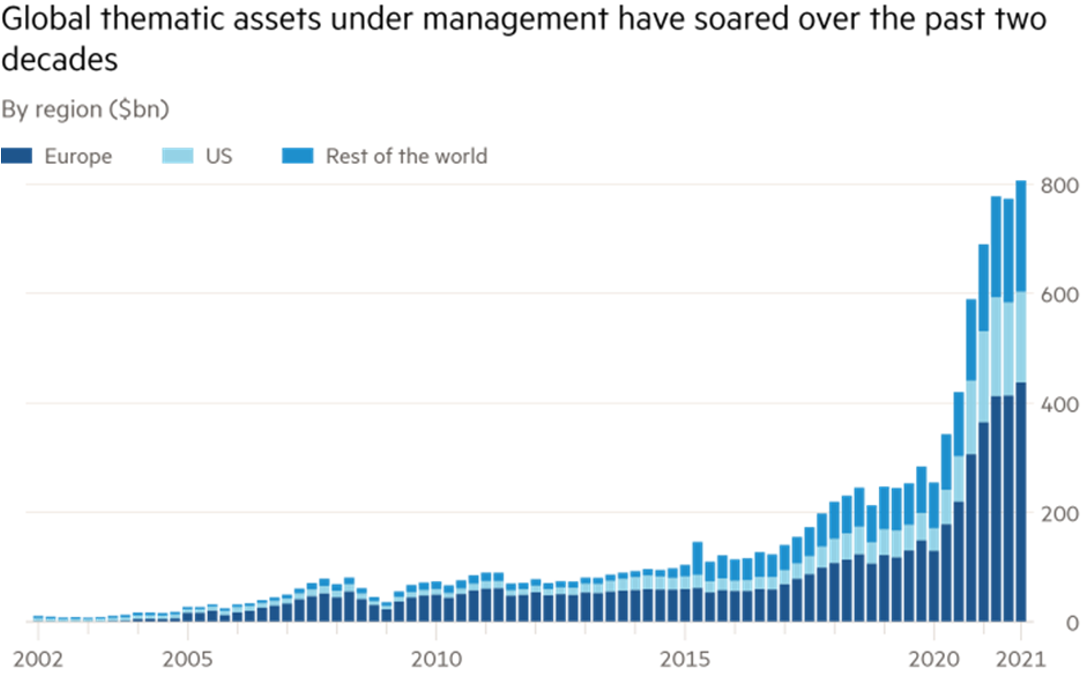

The past decade has been a home run for thematic funds, which have tripled their share of total assets under management (AuM) at all equity funds worldwide, to 2.7%, as per Morningstar. The combined asset base of equity-oriented thematic funds has soared to over $800bn during this period, as compared to a mere $71bn at the onset of 2011 – equivalent to 0.8% of equity fund AuM then.

Image via Morningstar1

The story in 2023

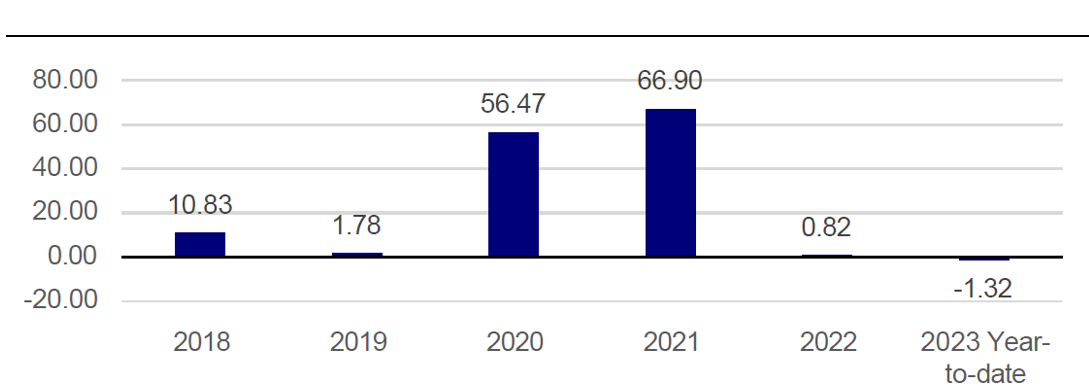

Thematic investing encountered its fair share of obstacles in 2023, as evidenced by the significant outflows of ~$1.3B by November 15th. Macro conditions, particularly concerns surrounding the Federal Reserve and recession fears, played a substantial role in driving market sentiment. The focus on smaller-cap growth equities, typical targets for many thematic themes, was particularly challenging given that the largest seven companies in the S&P 500 accounted for nearly 70% of the index return for the year. Historically, rising rates have favored value stocks over growth stocks, which are often a significant component of thematic funds. This is because value stocks tend to be more established companies with lower valuations and higher dividend yields, making them more attractive in a higher-rate environment.

Image via Invesco2

However, it’s important to note that thematic investing is not a one-size-fits-all exercise. Despite the overall struggle, 62 new thematic funds entered the market in 2023, representing a 13% growth in the number of funds. Additionally, 36% of funds experienced inflows, offsetting some of the challenges.

One way to understand thematic investing is by categorizing themes into two main groups: NextGen themes and traditional Thematic Industries. NextGen themes encompass futuristic areas like robotics, artificial intelligence (AI), and sustainability, whereas Thematic Industries include investments in sectors like defense, banking, and packaging. This distinction allows investors to target specific global or macro trends that align with their interests and preferences.

In 2023, the preference tilted towards NextGen themes, marking a reversal from the previous year’s focus on value investing. NextGen themes attracted +$1.9B in inflows, while Thematic Industries saw -$3.2B in outflows. This trend was reflected in the year-to-date returns, with NextGen funds averaging a return of 10.7% compared to 4.6% for Thematic Industries.

Themes in focus

Several individual themes stood out in 2023. Semiconductors, buoyed by the growing attention towards AI, emerged as the top flow-gathering theme, attracting $2.6B in inflows. Other NextGen themes like Digital Future, Software, and Industrial Revolution also garnered significant investor interest. Additionally, Thematic Industries such as Defense and Banking saw notable inflows.

Conversely, certain sectors faced challenges, with biotechnology, oil and gas, and other healthcare industries experiencing significant outflows.

Looking ahead to 2024, markets have shown signs of improvement amidst hopes of easing inflation and other macroeconomic figures. While recessionary risks linger, investors may start diversifying their portfolios towards more growth opportunities beyond mega-cap tech names. Overall, 2024 promises to be an intriguing year for thematic investing, and we invite you to join us as we navigate the evolving landscape.