Securitization 2.0: How Technology Is Transforming Structuring, Monitoring, and Risk Pricing

December 18, 2025

In line with the accelerating pace of technological development, the once-static pools of loans, which were essentially paper-heavy, batch-oriented processes in structured finance, are evolving into dynamic, real-time, transparent processes. This has been largely instrumental due to new capabilities in digitized collateral tracking, AI-enabled risk modeling, and tokenized loan tranches leading to democratized investor access, granular risk-pricing, and (much) faster deal execution.

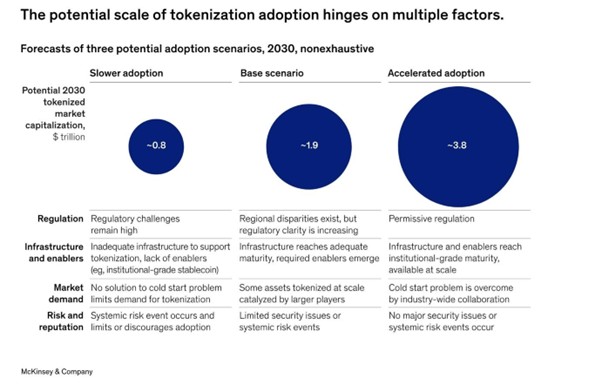

According to a McKinsey report1, the total tokenized market capitalization could range from $2 trillion to $4 trillion by 2030, primarily driven by adoption in mutual funds, bonds, exchange-traded notes (ETNs), loans, securitization, and alternative funds. In such a scenario, it becomes imperative to examine the key issues surrounding tokenization and to understand the inherent advantages and risks involved in the entire securitization process, which is the catalyst for the process.

Source: McKinsey & Company2

Structuring: Tokenization and Programmable Tranches

Tokenization, the representation of a real-world asset as a digital token on a distributed ledger, alters how securitizations are created and distributed. Deviating from the onerous paper trail, originators can issue tokenized tranches that are fractional, programmable, and instantly transferable, enabling continuous markets for fractional shares of a pool that were previously illiquid. Tokenization also enables automated cash-flow waterfalls (via smart contracts) and “atomic” settlement, reducing counterparty and settlement risk. Institutional buy-side proofs of concept and regulated tokenized funds have moved beyond pilots, proving that tokenization can work at scale for real-world assets.

At a practical level, tokenized tranches let issuers match liquidity to investor rights more granularly-for example, offering sub-tranches with built-in transfer restrictions or immediate buyback clauses programmable into the token. This ability to compose at a granular level can unlock new investors (retail or smaller institutions) and create secondary markets for illiquid slices of collateral.

Monitoring: Digitized Collateral Tracking and Real-Time Visibility

Addressing the time-lag issue between economic events and investor visibility of them, modern securitization relies on digitized collateral telemetry. Real-time transparency reduces information asymmetries and enables event-driven triggers, thereby lowering monitoring costs. Another key aspect of this is the ability to use APIs, IoT, and ledgered provenance, originators, trustees, and other players can stream events (e.g., payments, prepayments, delinquencies) into a tamper-evident record, enhancing security and transparency. Players can thus detect early warning signals and automatically execute pre-agreed remediation steps, reducing loss severity and enhancing recovery governance.

Risk Pricing: AI-Enabled Models and Dynamic Valuation

The third key attribute of Securitization 2.0 is the ability of AI-driven monitoring systems to perform continuous repricing of tranches, thereby enabling market-based risk premia that reflect evolving borrower behavior or macroeconomic shocks arising from geopolitical events. AI improves early-warning detection and tail-risk identification, and using ML models trained on rich, micro-level datasets and other alternative signals (including non-financial indicators) can produce near-real-time probability-of-default and loss-given-default estimates and generate scenarios in greater detail than traditional computational models.

When combined with tokenized tranches, an AI model can feed a pricing oracle that automatically updates token quotes or liquidity incentives, turning securitization into a living product whose risk profile and price evolve with pool performance.

Market Structure & Investor Access

By reducing minimum ticket sizes, shortening settlement times, and automating KYC/AML via programmable identity layers, financial structures lower barriers to entry and expand the potential investor base. In addition, fractional tranches allow investors to target specific risk slices, thereby improving portfolio construction and enabling micro-hedging strategies.

Operational & Regulatory Considerations

However, there are operational and legal complexities that investors and sponsors must evaluate:

- Legal recognition: Jurisdictions vary on whether tokens constitute legally enforceable ownership of the underlying cash flows. Tokenization projects require parallel legal wrappers (e.g., trusts, special-purpose vehicles) until the law converges.

- Model governance: AI models require rigorous validation, explainability, and a retraining cadence to prevent drift or embedded bias, particularly when borrower underwriting is affected.

- Operational security: Token platforms and smart contracts introduce cyber and coding risks; strong custody and upgrade/escape clauses are essential.

- Regulatory oversight: Securities regulators and standard-setting bodies are assessing market integrity risks; IOSCO and other agencies emphasize investor protection and operational resilience3.

Five Key Trends Driving the Securitization Market Forward

Despite economic volatility, the securitization market is undergoing a period of significant positive transformation, driven by regulatory modernization, technological integration, and evolving investor mandates.

- The Rise of Green and Non-Traditional AssetsThe push for sustainable finance is gaining momentum, driving increased interest in Green Securitization. This involves packaging loans that fund environmentally friendly projects, in response to growing policy initiatives and rising investor demand for ESG-compliant products. Simultaneously, the market is expanding beyond traditional mortgages and auto loans to encompass non-traditional assets, with 2024 seeing deals backed by theater receipts, Italian housing stock, and sports team cash flows.

- Focus on Effective Balance Sheet ManagementWith an expected increase in defaults driven by the overhang of corporate debt from the COVID-19 period, banks are proactively using securitization to improve balance-sheet efficiency. Specifically, the securitization of Non-Performing Loans (NPLs) has become prominent. This mechanism allows banks to manage potential risks and clean up their balance sheets ahead of anticipated credit issues.

- Regulatory Clarity with STSRegulatory advancements are bolstering investor confidence. The European Union’s implementation of a framework promoting Simple, Transparent, and Standardised (STS) Securitisations marks a significant positive step. These less risky, easier-to-understand products are designed to rebuild trust and facilitate greater liquidity in the capital markets.

- Expansion of Synthetic StructuresThere is growing use of synthetic structures, in which the credit risk of a loan portfolio is transferred to investors without physically transferring the underlying loans off the bank’s balance sheet. This method offers flexibility and is increasingly utilized for capital relief and efficient on-balance-sheet management.

- Technology and Globalization for EfficiencyTechnological applications are gradually transforming the securitization process. While the adoption of DLT and tokenization has been gradual, the use of Generative AI tools is already emerging in the review of loan documents for consistency and completeness. Paired with a rising trend toward outsourcing loan administration and leveraging global administration partners, these changes promise to enhance efficiency, reduce time-to-market, and support the broader globalization of issuance.

The Road to Dynamic Markets

To read Securitization 2.0 purely as an efficiency play is to miss the nuances of traceability, risk mitigation, and structural re-architecture of a process. Sponsors and investors are now on a higher and faster growth trajectory, with greater control over collateral performance and, most critically, significantly lower funding costs for prime collateral. At the same time, for trustees and regulators, it is a radical way to rethink disclosure, the role of intermediaries, and higher levels of transparency.

Sources:

3. https://www.iosco.org/library/pubdocs/pdf/IOSCOPD809.pdf?utm_source=chatgpt.com