Turning the Corner – Is Global Macro Set for a Grand Comeback?

December 25, 2023

George Soros. Julian Robertson. Stan Druckenmiller. Bruce Kovner. This illustrious list of hedge fund managers, starting in the 1970s through the early 2000s, blazed the trail for today’s $5 trillion hedge fund industry, and in particular the global macro category.

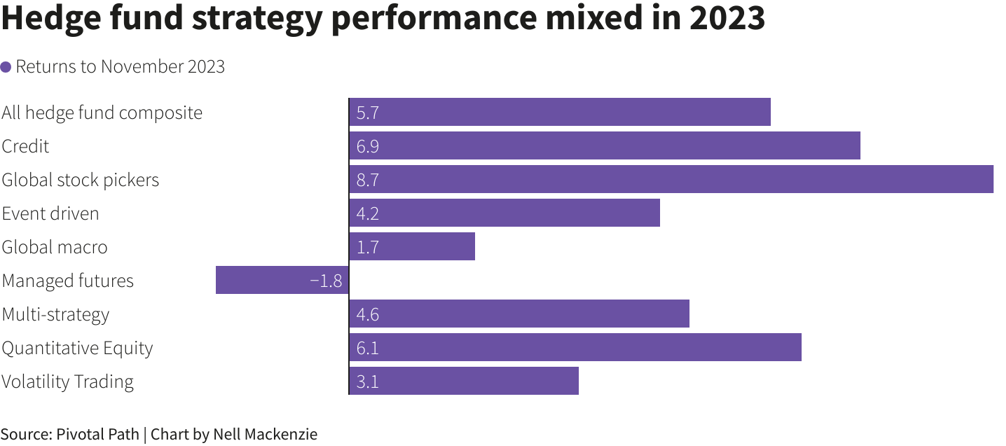

Global macro hedge funds rose 1.7% in 2023, hampered by the rollercoaster ride in markets and a banking crisis in March, in comparison to the 2022 returns of 11.5%, according to PivotalPath1 data. Recent signs suggest that global macro could be poised for a comeback in 2024.

Image via Reuters2

A Story of Contrasting Fortunes

Following the initial shock of the COVID-19 pandemic in 2020, global macro struggled to adapt to the rapidly changing economic landscape. Central bank interventions and quantitative easing programs implemented to mitigate the pandemic’s effects blurred traditional price discovery mechanisms, making it difficult for macro managers to accurately assess market signals. As a result, many investors turned away from the strategy, leading to a decline in assets under management (AUM).

However, a recent report by Hedge Fund Research (HFR) shows a potential turning point. Total Macro capital recovered from early 2023 asset declines to increase by an estimated $15.5 billion in Q3, raising total Macro strategy capital to $693 billion, according to HFR. This growth suggests a renewed interest in the strategy, potentially driven by two key factors.

The Return of Volatility and the Step Back from Central Banks

Firstly, the past year has witnessed a significant increase in market volatility. Rising inflation, tightening monetary policies, and ongoing geopolitical tensions have created a more complex and unpredictable economic environment. This volatility, while posing challenges for some investment strategies, can provide fertile ground for global macro managers who are skilled at navigating such complexities. Their ability to analyze and capitalize on these market movements could potentially lead to strong returns.

Secondly, central banks are starting to unwind their quantitative easing programs and gradually raise interest rates. This shift towards a more normalized monetary policy environment could benefit global macro strategies that are adept at identifying and profiting from these changes. As central banks relinquish their tight grip on markets, traditional price discovery mechanisms may begin to function more effectively, allowing macro managers to leverage their expertise in analyzing economic and political factors to generate alpha.

Looking Forward to 2024 and Beyond

While the potential for a comeback exists, it’s important to acknowledge the uncertainties that lie ahead. The global economic outlook remains clouded, with factors like the ongoing war in Ukraine, persistent inflation, and potential recessions in major economies posing significant risks. Additionally, the effectiveness of central bank policies in managing inflation and achieving a soft landing for the economy remains to be seen.

Despite these challenges, the recent growth in AUM and the evolving macroeconomic environment suggest that 2024 could be a crucial year for global macro. As markets navigate this period of increased volatility and policy normalization, the ability of global macro managers to identify and capitalize on these shifting dynamics will be critical in determining their success and potentially solidifying their comeback.