Turning the corner? Is global macro set for a grand comeback?

March 31, 2022

George Soros. Julian Robertson. Stan Druckenmiller. Bruce Kovner. And a few more. This illustrious list of hedge fund managers, starting in the 1970s through the early 2000s, blazed the trail for today’s $4 trillion1 hedge fund industry, and in particular the $462bn2 global macro category.

By successfully – and, over a long term – anticipating key economic and political events and trends, and wagering on asset classes across financial markets worldwide, this class of traders consistently delivered True Alpha for their clients on a risk-adjusted, absolute-return basis, and established global macro as a leading hedge fund strategy.

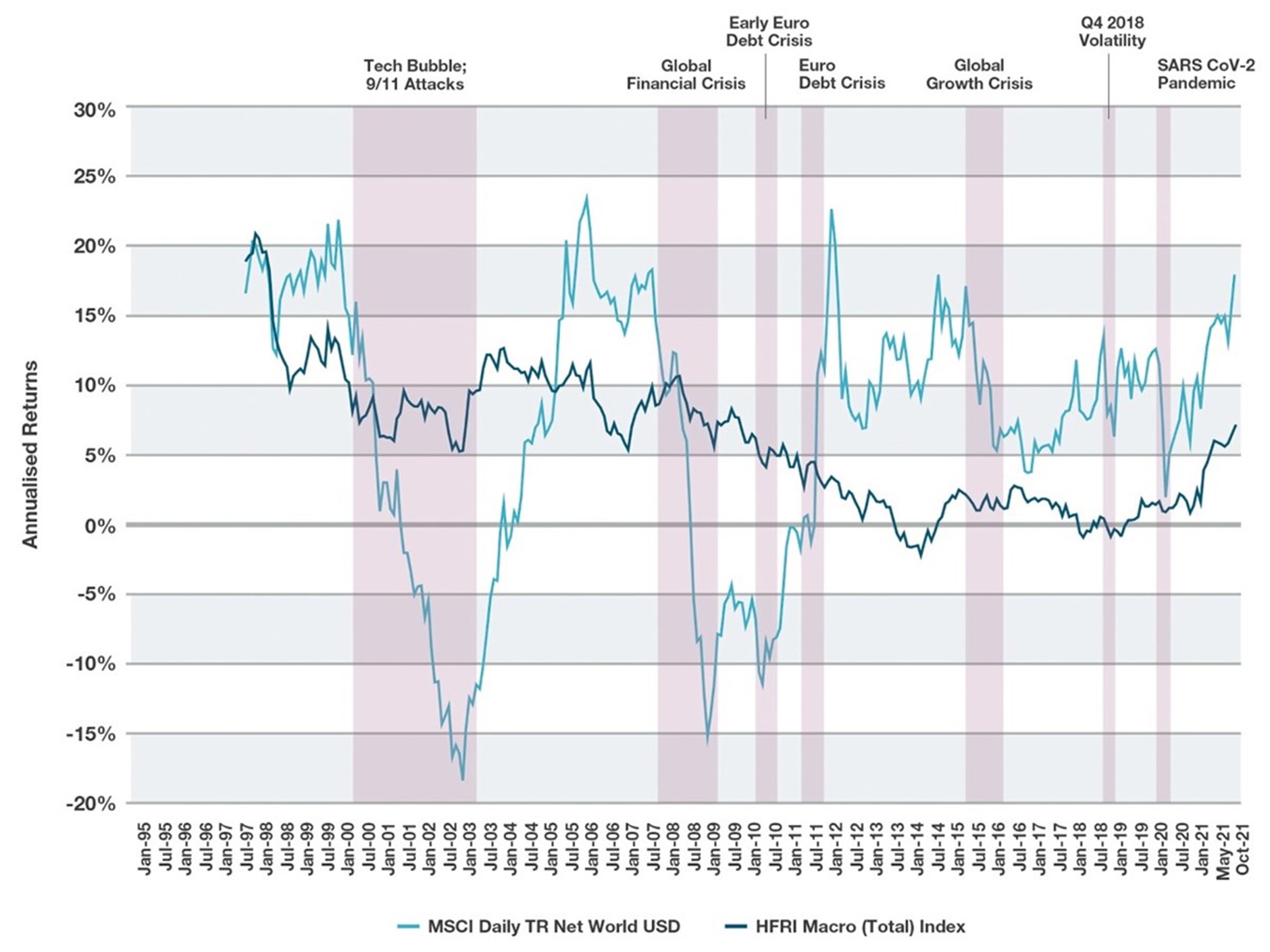

Spanning different time periods, global macro burnished its credentials as an investing strategy that is resilient to market upheavals, including major bear markets, as highlighted by the following figure tracking the performance of the HFRI Macro (Total) Index.

2010s, The dreary decade

However, somewhere the music stopped around the 2008 global financial crisis (GFC), and the story of global macro since then has been one of underwhelming performance, and several false dawns.

With central banks providing unprecedented levels of market liquidity since via a combination of ultra-low negative interest rates and quantitative easing, global macro has struggled to thrive for over a decade now, as market volatility has largely been absent.

Except for the few bright spots like the 2018 Italian bond crisis and the 2020 coronavirus outbreak that triggered sharp market movements, global macro funds have found the going tough, largely underperforming many of their hedge fund peers – not to mention mainstream equities benchmarks.

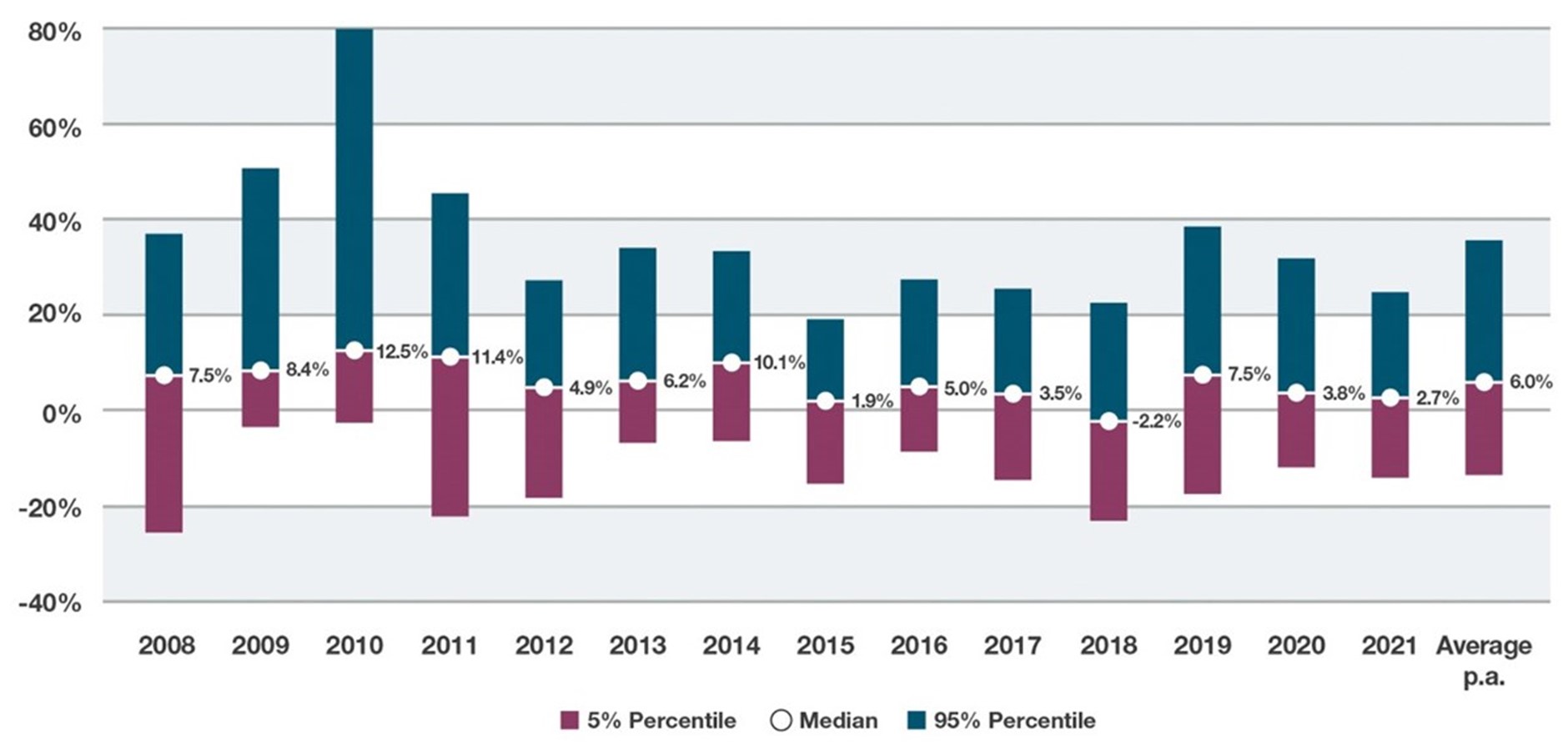

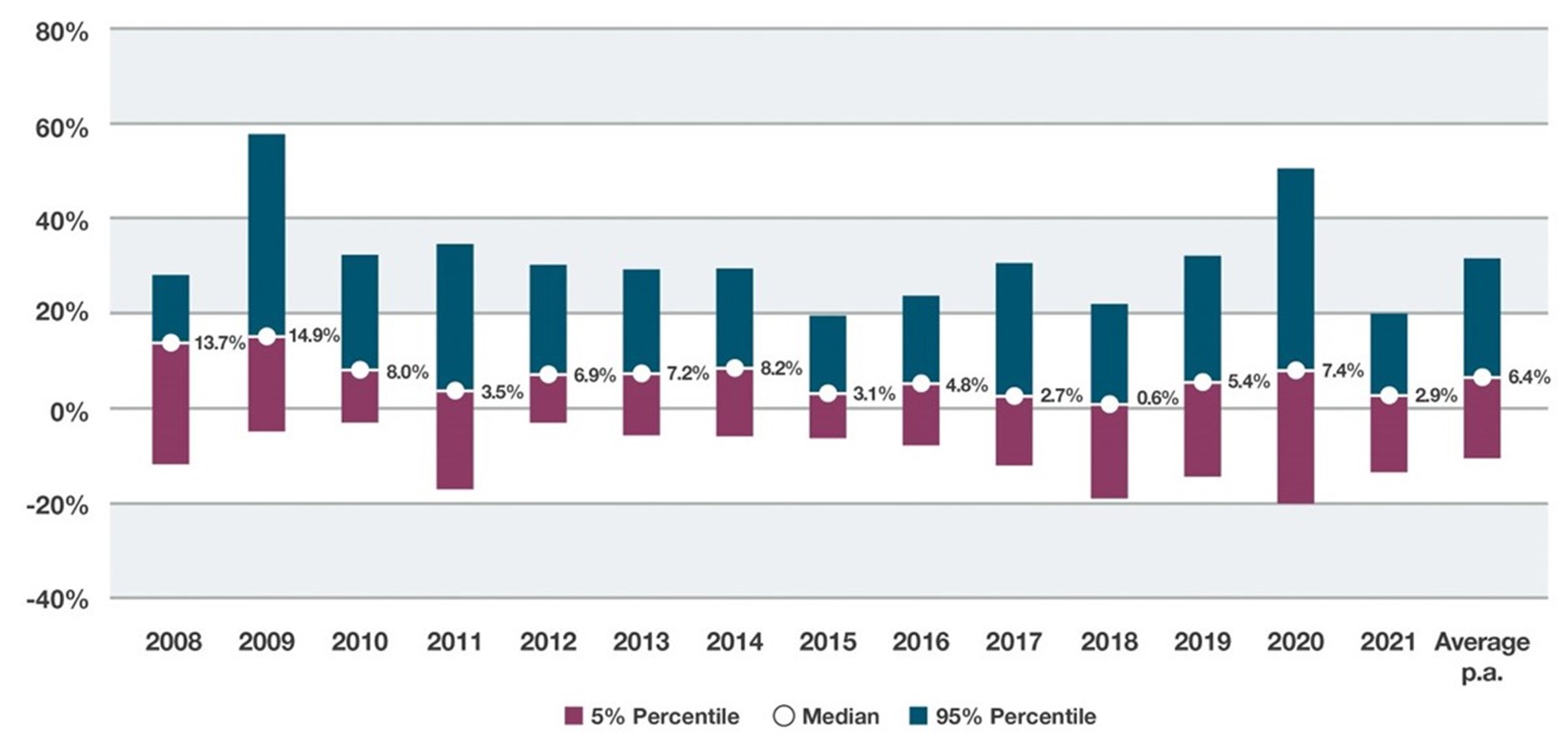

As the following couple of charts show, median annual returns2 for Systematic Macro and Discretionary Macro between 2008 and October 2021 have averaged an underwhelming 6% and 6.4%, respectively.

FIGURE 2A: CALENDAR-YEAR RETURNS OF SYSTEMATIC MACRO MANAGERS (2008–2021 YTD)

Source: HFM; data as of 21 November 2021.

FIGURE 2B: CALENDAR YEAR RETURNS OF DISCRETIONARY MACRO MANAGERS (2008–2021 YTD)

2020-2021: A story in contrast

There is always light at the end of the tunnel, they say. And so it seems like the tide has finally turned for global macro too. Since the outbreak of the coronavirus pandemic in early 2020, HFR estimates that the category boosted2 its assets under management by 43%, or $139bn, between March 2020 and October 2021, thanks to fresh inflows and a performance rebound.

Some of the leading players in this space have enjoyed bumper years since then, orchestrating a turnaround, and winning over skeptic clients once again.

So much so that a few of the marquee macro funds have since hiked both management and performance fees on the back of stellar gains in recent years, beside closing some of their exclusive vehicles to new money in order to avoid becoming “too big to manage”.

And some leading macro traders have been altering the terms of liquidity so as to restrict the amount clients can redeem every quarter.

This post-pandemic renaissance of global macro, though, has been a mixed bag. In 2020, macro traders capitalized on some spectacular opportunities around betting on declining bond yields and a central bank “put” in the first quarter amid huge market volatility. Last year, however, saw many of them get caught out on misplaced wagers that the bond yield curve would steepen significantly, and faster, amid prospects of rising inflation.

Volatility thy friend – Time for the big reflation trade?

2022 could well mark a turning point in this tale, and in a structural way. With inflation3 storming back across much of the developed world in the last 12 months and persisting at levels unseen for over a generation, and benchmark 10-year U.S. Treasury yields4 spiking to multiyear highs in tandem, global macro funds could finally be getting their prayers answered, read the return of volatility.

Not to mention the Federal Reserve’s gradual tightening of monetary policy and imminent tapering of bond buying, as well as the surge in commodities prices amid geopolitical tensions, and macro traders could well feel confident to finally place big, directional bets across bonds, currencies, etc. in these choppy waters.

Most importantly, the much talked-about reflation trade, in a manner similar to the mid 1920s post First World War and Spanish flu, could already be under way, wherein bond prices across the yield curve might rise dramatically in response to soaring inflation, a normalization of monetary policy by central banks, and rebound in global demand post COVID.

The year has begun well for global macro, which has gained 4.75%5 for the year so far, including a 2.9% gain in February, as measured by the HFRI 500 Macro Index. Several macro vehicles recorded impressive gains6 in January, following years of underperformance, thanks to a wager that short-term U.S. interest rates would spike faster than market expectations.

Conclusion

As central banks start stepping back from financial markets, and let normal price discovery mechanisms be restored, after over a decade of excessive intervention, the resulting volatility and dislocations could provide the stage for global macro to shine again.

In conjunction, the specter of high inflation persisting for the medium term, alongside the likelihood of significant downward corrections in stock prices which are hovering at all-time highs, could trigger macroeconomic fundamentals-driven market inefficiencies, manifested in the form of price anomalies, widening spreads, etc. The grand comeback of global macro could just be around the corner, finally.