Where Correlations Break: True Diversifiers in the Next Market Regime

February 13, 2026

Through the majority of the 20th century and for two decades in the 21st, the “60/40” was the hedge fund’s equivalent of a comfort blanket. If stocks fell, bonds fell with them, and vice versa. Sure, there were other strategies, but all of them were predicated on relationships among the Macros, financial performance, industry behavior, etc.

Even in the advent of quant funds, Alpha discovery was based on apparent and hidden relationships among the predictive factors. Technology accelerated the process of discovery, identifying relationships hitherto unexplored and all of this at dizzying speeds.

Not any more.

As we navigate the complexities of the modern world, the typical predetermining factors are being overridden by a new set of variables: fiscal dominance, nationalist economics, localized supply chains, and. Most importantly, geo-political dynamism. The 60/40 blanket is proving to be a thin blanket as traditional asset correlations are not just weakening- they are breaking.

There is an ever-increasing need to look beyond the time-tested equity-bind axis and identify the true diversifiers that thrive on volatility, structural imbalances, geopolitical posturing and burgeoning complexity. In short, the job is to find uncorrelated signals to generate Alpha.

Operational Alpha: The “Hidden” Uncorrelated Return

True diversification starts with capturing the alpha you’ve already earned but haven’t yet collected. A striking example of an uncorrelated return stream is systematic securities litigation recovery. According to a HedgeWeek survey1, a staggering 93% of hedge funds fail to systematically recover these losses. These funds are essentially leaving “Hidden Alpha” on the table- compensation for fraud-related losses that requires zero market risk and has no investment thesis. In an environment where fee structures are under pressure, missing out on these zero-beta returns is becoming an institutional red flag.

Commodities: Inflation’s Shock Absorber

When inflation is supply-driven or geopolitically induced, commodities often provide the most direct hedge. The 2025 surge in precious metals is the prime example of how Gold and Silver, particularly, became the de facto safe havens in the wake of massive turbulence driven by geopolitical dynamics and heightened Fear, Uncertainty, and Doubt (FUD). Energy prices surged following the Russia–Ukraine war, and industrial metals rallied amid supply disruptions. Gold, while volatile, retained its role as a reserve diversifier as central banks increased purchases to reduce dependence on the U.S. dollar.

The reasons are obvious. While these commodities may be inputs to inflation itself, they have little direct correlation to corporate earnings or interest rate insensitivity.

Regional and/or nationalistic tilt toward “Strategic Autonomy” has turned commodities from simple cyclical plays into essential geopolitical hedges. Rare earth elements (REEs), particularly “Heavies” like terbium and dysprosium, have become the linchpin of high-performance tech and defense.

For instance, China currently controls 91% of global refining capacity for these elements. As export curbs and “dual-use” licensing systems tighten in early 2026, supply chains are facing massive disruptions. For investors, this creates a unique opportunity in “non-Chinese” pricing benchmarks. The premium for these materials is no longer about chemical value; it is a premium for assured supply over long time frames. When equity markets reel from trade wars, these critical mineral assets often move in the opposite direction, driven by scarcity rather than sentiment.

Real Assets: The “Power” in Logistics

Real assets- such as infrastructure, real estate with pricing power, farmland, and renewable energy-provide inflation-linked cash flows. However, a caveat is in order here. While real estate is often cited as an inflation hedge, not all square footage is created equal

In an era of fiscal dominance, where governments rely on inflation and financial repression to manage debt, tangible assets with contractual or scarcity-driven pricing power become attractive.

Looking at 2026 and beyond in the medium run, real assets diversification will be critical since:

- Cash flows are often linked to inflation: As inflation remains stubbornly high, cash flows will remain protected

- Lower sensitivity to public market volatility: By their very nature, turbulence in public markets affects real assets only indirectly, and only when volatility persists for a longer-than-usual period. The events of 2025 and the forecast for 2026 indicate bouts of short-term volatility driven by different factors across regions. As a result, real estate remains a relatively stable investment vehicle.

- Structural demand from the energy transition and infrastructure spending: With the explosion in data centers, green energy, and technology-driven demand, the demand for tangible real assets to satisfy this growth is expected to continue to dominate investment themes through 2026. For example, grid congestion is making existing warehouses with high-frequency data capabilities and EV-charging infrastructure immensely valuable. These assets provide stable, index-linked income that is increasingly decoupled from broader commercial real estate trends.

Geographic Pivots: Beyond the US Core

Sixty years after Elvis Presley sang “Go East, Young Man”, the economics are beginning to fall in place. While a rumored “mega-wave” of US tech IPOs from giants like OpenAI and SpaceX threatens to overwhelm market bandwidth in 2026, true diversification requires looking East.

- Saudi Arabia: The CMA recently eliminated the Qualified Foreign Investor (QFI) framework, opening direct market access to all foreign investors and allowing them to hold listed securities. This liberalization is attracting billions in “sticky” institutional capital that is less sensitive to Western interest rate pivots.

- The APAC Surge: India and Japan are dominating the IPO landscape, with India remaining the world’s most active listing destination by deal count. Japan has seen a 33% increase in proceeds, offering a structural growth story that provides a necessary counterweight to US tech-heavy portfolios.

- The Middle East as an emerging pivot: The UAE, with Dubai at its center, is fast becoming the new destination for corporations and the wealthy. In 2025 alone, Dubai was the target destination for around 9,800 millionaires2, a number expected to rise in 2026.

Relative Value and Thematic Defense

One of the fallouts of the geo-politically fueled economics has been a return to nationalistic narratives. From Jalan to Europe, countries once under the US’s defense umbrella are committing to a self-reliant defense infrastructure. NATO and the EU, with their €800bn ReArm Europe plan, and Japan, with a record $58 billion budget3, indicate that defense has transitioned from a niche sector to a primary structural growth market. The recent €3.8bn4 IPO of CSG in Amsterdam highlights a growing pipeline of defense-led listings that offer a hedge against geopolitical instability.

At the same time, the emerging ‘yield wars’ between traditional banking and crypto, driven by the “Clarity Act” in the US, is creating a new frontier for relative value strategies. These “yield wars” provide a unique, high-frequency return stream that is fundamentally different from traditional fixed-income duration risk.

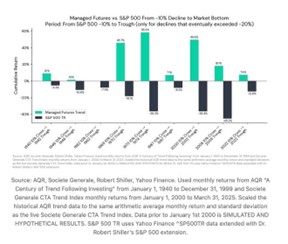

Trend-Following and Managed Futures

In unstable regimes, price persistence often increases. Trend-following strategies, commonly implemented via managed futures, capitalize on sustained moves across asset classes. Trend-followers are agnostic to direction. They can be long energy during supply shocks, short bonds during rate spikes, or long the dollar during capital flight.

Trend-following enables diversification by benefiting from macro dislocations and performing well during sustained inflationary or deflationary moves. However, trend-following can be a powerful diversifier whose benefits don’t show up immediately. Research suggests that a typical trend-following strategy has to overcome the initial “10% drop” to deliver market-beating results.

Source: LinkedIn5

The New Diversification Playbook

Diversification in 2026 is no longer about having a long list of tickers; it is about having a short list of uncorrelated drivers.

- Capture Operational Alpha through systematic recoveries.

- Hedge against Geopolitics via rare earth benchmarks and defense thematics.

- Invest in Physical Scarcity through power-resilient real estate.

- Pivot to Emerging Hubs like Saudi Arabia and emerging markets in Asia for fresh liquidity.

In a regime where the old rules have broken, the winners will be those who find the “hidden” assets that everyone else is too busy-or too manual-to see.

Sources:

1. https://www.hedgeweek.com/the-hidden-alpha-insight-report/

2. https://www.khaleejtimes.com/lifestyle/why-millionaires-are-moving-to-dubai

3. https://www.theguardian.com/world/2025/dec/26/japan-defence-budget-china

4. https://www.cnbc.com/2026/01/23/csg-stock-debut-ipo-defense-amsterdam-czech.html