U.S. Real Estate Funds: Performance Review and Forecast for 2025

November 29, 2024

After a volatile 2022 due to rising interest rates, many real estate funds, particularly those focusing on commercial real estate (CRE), continued to face challenges in 2023. Interest rate hikes by the Federal Reserve raised the cost of borrowing, which put pressure on property values, especially in sectors like office space and retail. The following key points summarize the 2023-2024 performance:

● REITs: Listed REITs generated nearly 17% total returns in Q3 of 2024. All 18 REIT sectors saw gains in the third quarter, though performance varied widely, with office, self-storage, and cell towers standing out due to their sensitivity to interest rates. Listed REITs delivered significantly stronger returns compared to the cap-weighted S&P 500 and the NASDAQ index. As economic growth decelerates and interest rates continue to drop, there is potential for REITs to maintain their relative outperformance.

● Residential Real Estate Funds: Funds focused on multifamily and single-family rentals generally performed better as demand for rental properties stayed robust. Rising home prices and mortgage rates kept homeownership out of reach for many, pushing them into the rental market, which supported rental income growth.

● Real Estate Hedge Funds: Real estate-focused hedge funds also experienced mixed results. While some funds focusing on distressed assets or residential sectors outperformed, others in commercial office space faced headwinds.

Key Factors Influencing Real Estate in 2025

To project real estate fund performance in 2025, several macroeconomic and sector-specific factors must be considered:

● Interest Rates: The Federal Reserve’s policy on interest rates is critical. If inflation moderates and the Fed begins lowering rates, this could reduce borrowing costs and support property values. However, if rates remain elevated to combat persistent inflation, real estate funds may face headwinds due to high financing costs and downward pressure on property valuations.

● Economic Growth: The trajectory of the U.S. economy will impact real estate demand across sectors. A stable or growing economy will support demand for office, industrial, and residential spaces. Conversely, if the economy weakens, demand for office space and retail real estate could suffer, while multifamily and logistics properties might remain resilient.

● Inflation: Inflation impacts operational costs and rental income. Property sectors with the ability to adjust rents quickly (e.g., multifamily and self-storage) tend to perform better in inflationary environments. Fixed-rent assets, such as long-term office leases, are more vulnerable.

● Changing Demand for Property Types: The COVID-19 pandemic accelerated trends such as remote work, e-commerce, and a shift to suburban living. As a result, the demand for office space has declined while industrial and residential properties have grown in popularity. This divergence in demand across property types will likely persist into 2025, shaping fund performance.

Outlook for Different Real Estate Sectors in 2025

1. Residential Real Estate Funds

● Forecast: Positive outlook, especially for funds focusing on rental properties.

● Rationale: The high cost of homeownership, coupled with a shortage of affordable housing, is expected to sustain demand for rental properties. Multifamily real estate funds are likely to benefit from this demand, especially in high-growth areas in the Sunbelt region.

● Risks: Any significant economic slowdown leading to job losses could pressure rental growth. Also, if mortgage rates fall, demand for homeownership may increase, slightly dampening rental demand.

2. Industrial Real Estate Funds

● Forecast: Very positive outlook for industrial funds, especially those investing in logistics and warehousing.

● Rationale: E-commerce growth and the demand for efficient supply chains continue to drive demand for industrial properties. Additionally, “nearshoring” trends (moving production closer to the U.S.) should support industrial real estate demand over the next few years.

● Risks: High valuations and potential economic slowdown could limit rent growth. Also, if interest rates remain high, new industrial development might slow, affecting fund performance in the long run.

3. Office Real Estate Funds

● Forecast: Cautious to negative outlook for office funds, especially those focused on urban centers.

● Rationale: The remote work trend shows little sign of reversal, with many companies opting for hybrid models that reduce office space needs. Demand for office real estate may decline further, particularly in central business districts.

● Risks: If vacancy rates continue to rise, rental income will be pressured. Additionally, properties in need of refinancing may face challenges due to high interest rates, potentially leading to defaults or asset write-downs.

4. Retail Real Estate Funds

● Forecast: Mixed outlook, with positive prospects for funds focused on necessity-based retail.

● Rationale: Grocery-anchored and essential retail centers have proven more resilient, as they serve daily consumer needs. However, malls and non-essential retail centers may continue to struggle due to competition from e-commerce.

● Risks: Any economic downturn could reduce consumer spending, impacting retail tenants’ ability to pay rent and threatening fund performance in discretionary retail.

Forecast for Real Estate Investment Trusts (REITs) in 2025

REITs are often considered a barometer of real estate market conditions, given their exposure to a broad range of property types. Here’s what to expect for REITs in 2025:

● Residential REITs: Likely to perform well, particularly those focused on rental apartments and single-family rentals, driven by demand for affordable housing.

● Industrial REITs: Expected to remain strong, as the structural demand for logistics and distribution space is likely to continue.

● Office REITs: Likely to face challenges due to persistently high vacancy rates and demand shifts. Prime office REITs with high-quality tenants may fare better than those with older properties in urban areas.

● Retail REITs: Grocery-anchored and essential retail REITs are expected to be more resilient, while mall and discretionary retail REITs may face headwinds if consumer spending slows.

Source: Whitecase.com

Real Estate Hedge Funds: Strategies and Prospects

Real estate-focused hedge funds are often more flexible than traditional REITs and mutual funds. Here’s a look at common strategies and their outlook for 2025:

● Distressed Asset Investing: Hedge funds may find opportunities in distressed office or retail properties. As financing remains tight and refinancing costs increase, some owners may be forced to sell assets at a discount, creating buying opportunities for funds with capital to deploy.

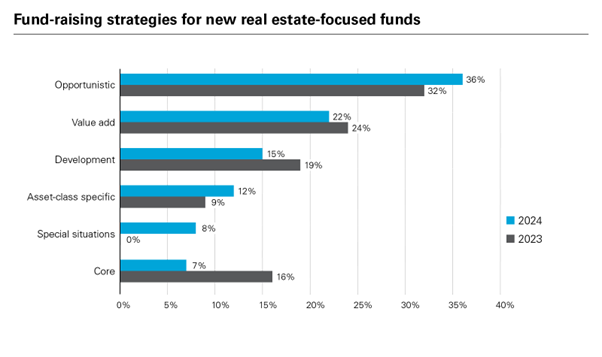

● Opportunistic and Value-Add Strategies: Funds focusing on value-add strategies—where they improve or repurpose properties to increase value—may perform well, especially in sectors like industrial or residential. Repurposing vacant retail or office space as residential or mixed-use spaces could yield returns.

● Short Strategies: Some hedge funds may short office or mall REITs, anticipating further declines in property values. This could be a lucrative strategy if the office sector continues to struggle and REITs face valuation pressure.

Investment Considerations for 2025

Source: Whitecase.com

The performance of U.S. real estate funds in 2025 will largely hinge on macroeconomic conditions and sector-specific demand trends. Here’s a summary:

● Positive Sectors: Residential and industrial real estate funds are expected to perform well, driven by strong demand for rental properties and logistics space.

● Cautionary Sectors: Office and discretionary retail are likely to face ongoing challenges, particularly if remote work remains widespread and consumer spending weakens.

● REITs: Look for resilience in industrial and residential REITs, while office and mall REITs may face valuation pressure.

● Hedge Fund Strategies: Distressed and opportunistic strategies could be attractive, particularly if there is significant distress in the office and retail sectors.

For investors, 2025 could present selective opportunities in real estate funds, especially in sectors benefiting from structural trends like e-commerce and rental demand. However, the economic backdrop will remain a critical factor, with interest rates, inflation, and growth shaping the outlook. Diversifying across property types or focusing on well-capitalized funds that can weather economic shifts may help mitigate risks while capturing the potential upside.