Understanding Alternatives and the Importance of Due Diligence in Selecting the Right Alternative Fund

September 25, 2023

Alternative investments are a broad category of assets that fall outside of traditional stocks and bonds. They can include hedge funds, private equity, real estate, and infrastructure. Alternative investments can offer investors a number of potential benefits, including diversification, the potential for higher returns, and inflation protection. However, they also tend to be more complex and illiquid than traditional investments. This makes it important for investors to carefully consider their investment objectives and risk tolerance before investing in alternatives.

Liquid Alternatives/Hedge Funds

Liquid alternatives are a type of alternative investment that offers investors the potential for higher returns and lower volatility than traditional stocks and bonds. They are also more liquid than many other types of alternative investments, such as private equity and real estate. This makes them a good option for investors who want to diversify their portfolios without sacrificing liquidity.

Hedge funds are a type of liquid alternative that employs a variety of investment strategies, including long/short equity, market neutral, event-driven, multi-strategy, and relative value. Understanding hedge funds can be complex and may have higher volatility, but they also have the potential to generate high returns.

According to the Preqin Global Report 2023: Alternative Assets1, a select number of hedge funds performed well under the pressures of 2022. As of September 2022, hedge funds experienced a notable decline in growth, with a decrease of 9.3% (-12.2% on an annualized basis). However, certain strategies, such as CTAs (Commodity Trading Advisors), macro, and relative value, managed to mitigate the damage by delivering positive returns to investors during the first three quarters despite the prevailing market volatility. Meanwhile, multi-strategy and credit strategies absorbed some of the shocks, while equity and event-driven strategies, although underperforming relative to expectations, still outperformed many other segments of the market.

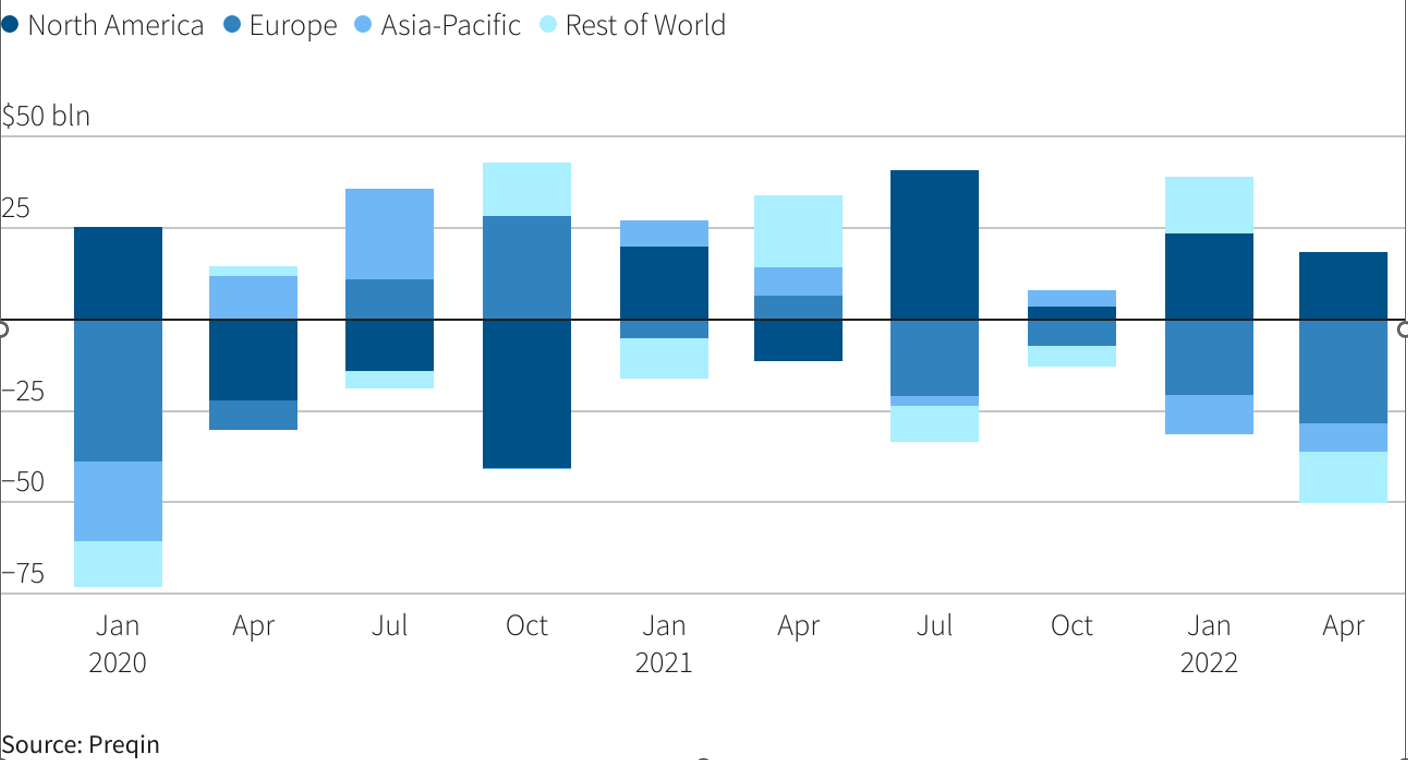

Global Hedge Fund Asset Flows

Image via Reuters2

The hedge fund market faced significant challenges in the first half of the year, marked by net capital outflows amounting to $24.3 billion. Unfortunately, this trend continued into the third quarter, with outflows totaling -$30.7 billion. The combination of lackluster performance and persistent outflows had a dampening effect on the total Assets Under Management (AUM) within the industry for 2022. According to Preqin’s most recent estimate, AUM stood at $4.1 trillion as of September 2022, reflecting a 4.8% reduction from the end of the previous year.

Investing in hedge funds, thus, requires careful consideration of multiple factors.

Private Markets Alternatives

Private markets alternatives are another type of alternative investment that are not publicly traded. This means that they can be more difficult to buy and sell than liquid alternatives. However, private markets alternatives can also offer investors the potential for higher returns than liquid alternatives. Some examples of private markets alternatives include private equity, real estate, and infrastructure funds.

The Importance of Due Diligence

Before investing in any alternative investment, it is important to conduct thorough due diligence. This includes reviewing the investment manager’s track record, investment strategy, and risk management practices. It is also important to understand the fees and expenses associated with the investment.

When selecting an alternative fund, there are a number of factors that investors should consider, including:

- Investment strategy: Investors should understand the fund’s investment strategy and how it aligns with their own investment objectives. What are the fund’s investment objectives? What assets does the fund invest in? What investment strategies does the fund use? These are questions that investors should consider before investing.

- Track record: Investors should review the fund’s track record to see how it has performed in different market conditions. A long track record is important because it can give investors a better sense of how the fund has performed in different market conditions, including bull markets, bear markets, and periods of high volatility. However, it is important to keep in mind that past performance is not always indicative of future results.

- Risk management: Investors should understand the fund’s risk management practices and how the fund manager mitigates risk. Risk management is essential for any investment, but it is especially important for liquid alternatives and hedge funds, which can use complex investment strategies and leverage. Investors should ask the fund manager about their specific risk management procedures, such as how they monitor risk, how they set position limits, and how they use hedging strategies. They should also ask about the fund’s risk appetite, which is the amount of risk that the fund manager is willing to take on.

- Fees and expenses: Investors should compare the fees and expenses of different funds to ensure that they are getting good value. For each fund, they should consider how much it charges in fees and expenses, and whether these fees are reasonable relative to the fund’s performance. This will help them get a better understanding of whether this fund will give them the returns they seek on their investment.

Due diligence is especially important when investing in alternative investments because they can be more complex and riskier than traditional investments. By conducting thorough due diligence, investors can reduce their risk and make more informed investment decisions.

Here are some tips for conducting due diligence on alternative funds:

- Review the fund prospectus: The fund prospectus is a legal document that provides detailed information about the fund, including its investment strategy, fees, and expenses.

- Talk to the fund manager: Investors should schedule a call with the fund manager to discuss the fund’s investment strategy, risk management practices, and track record.

- Review the fund’s performance: Investors should review the fund’s performance over a period of at least three years to see how it has performed in different market conditions, especially compared to other funds.

Conclusion

In conclusion, alternative investments present a compelling opportunity for investors seeking diversification, the potential for higher returns, and protection against inflation. However, they come with their own set of complexities and risks, making due diligence an essential step in selecting the right alternative fund. Whether you’re considering liquid alternatives like hedge funds or private market alternatives such as private equity and real estate, a thorough examination of several key factors is paramount.

To conduct effective due diligence, review the fund’s prospectus for comprehensive information, conduct in-depth discussions with the fund manager to gain deeper insights, and evaluate the fund’s performance over an extended period of time. By following these steps and taking the time to thoroughly analyze alternative investment opportunities, you can reduce risk and make more informed decisions that align with your financial objectives. In the world of alternative investments, diligent research is the key to unlocking their potential benefits while safeguarding your financial future.