Understanding Regulatory Capital Strategy: A Strategic Investment Approach

December 20, 2024

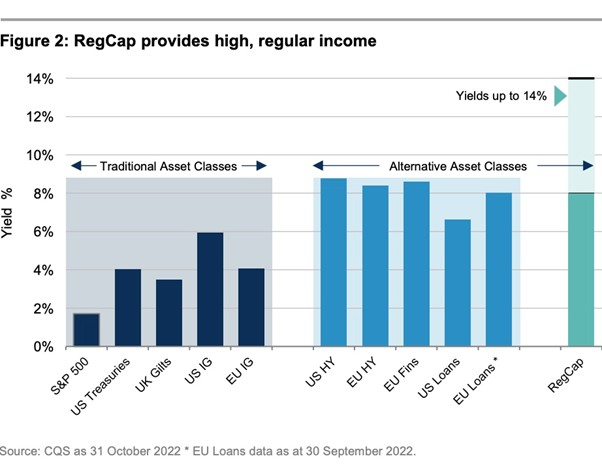

In the intricate world of financial markets, regulatory capital strategy (RCS) has emerged as a specialized and sophisticated investment domain. Focused on optimizing the capital requirements mandated by regulatory frameworks, RCS plays a pivotal role for institutions navigating stringent financial regulations. In 2025, this strategy is gaining traction among institutional investors such as endowments, pension funds, and insurance companies, who recognize its potential for consistent returns and risk mitigation.

What is Regulatory Capital Strategy?

Regulatory capital strategy refers to the management and optimization of assets to align with regulatory capital requirements, such as those set by Basel III, Solvency II, or Dodd-Frank. These regulations require financial institutions to maintain specific capital buffers to absorb risks and ensure stability during economic downturns.

RCS involves:

• Capital Optimization: Structuring portfolios to meet regulatory requirements while maximizing returns.

• Risk Transfer: Using tools like reinsurance, credit default swaps, or securitization to transfer risk and reduce capital charges.

• Efficient Allocation: Balancing assets to improve capital efficiency and meet regulatory benchmarks without compromising growth.

Why RCS Matters in 2025

In 2025, the financial landscape remains complex and heavily regulated. Central banks and governments have introduced stricter oversight to safeguard against systemic risks, making capital optimization a critical priority for financial institutions. Regulatory capital strategy offers solutions that align with these challenges, providing:

1. Capital Efficiency: By optimizing how capital is allocated and managed, institutions can free up resources for growth initiatives.

2. Risk Mitigation: RCS enables financial entities to transfer or hedge risks effectively, reducing potential losses.

3. Regulatory Compliance: Ensures adherence to complex and evolving regulatory frameworks, avoiding penalties, and enhancing institutional resilience.

The Market Size and Growth Potential

The global regulatory capital market is substantial and growing. According to a 2024 report by the Financial Times , the market for regulatory capital optimization strategies exceeds $ One trillion annually. With increased regulatory scrutiny and the rise of innovative financial instruments, this market is projected to grow by 8% annually over the next five years. RegCap has been a strong source of income and stability over recent major crisis (Global Financial Crisis 2008-2009, sovereign crisis 2012-2013, oil crisis 2016, and more recently, Covid-19). By having a low correlation to public markets, the asset class has acted like an income shelter through different market cycles.

Source: CQS Credit Matters, Nov 2022

Types of Funds Focused on Regulatory Capital Strategy

Several types of funds specialize in regulatory capital strategy, each employing distinct methodologies:

1. Systematic Funds: These funds use quantitative models to identify inefficiencies in regulatory frameworks and execute strategies to optimize returns while meeting compliance requirements. By leveraging algorithms and big data, they offer precision and scalability.

2. Quantitative Funds: Similar to systematic funds, these rely heavily on advanced analytics and machine learning to predict market movements and adjust capital allocation dynamically.

3. Fundamental Funds: These funds focus on in-depth research and analysis of market conditions, regulatory changes, and institutional needs. They design tailored solutions for clients, often incorporating long-term perspectives and macroeconomic insights.

4. Hybrid Strategies: Combining systematic and fundamental approaches, hybrid funds offer a balance of data-driven precision and human expertise.

Institutional Investors and RCS

• Large institutional investors are increasingly attracted to RCS. Pension funds, endowments, and insurance companies, with their long-term investment horizons and need for stability, find RCS particularly appealing. Pension Funds, endowments and Insurance companies see RCS as a way to diversify risk while meeting fiduciary obligations.

Advantages of Regulatory Capital Strategy

1. Consistent Returns: RCS often provides stable and predictable income streams by capitalizing on regulatory arbitrage and structured finance opportunities.

2. Risk Diversification: It offers a unique asset class that diversifies portfolio risk, particularly for institutions heavily exposed to traditional equities and fixed income.

3. Enhanced Resilience: By meeting and exceeding regulatory requirements, institutions strengthen their financial positions, ensuring stability during economic downturns.

4. Innovative Tools: The use of securitizations, collateralized loan obligations (CLOs), and other structured products enables creative solutions to complex challenges.

The Future of RCS

As regulatory frameworks evolve, the need for innovative capital strategies will only grow. Key trends driving the future of RCS include:

1. Technological Integration: Advanced analytics, blockchain, and AI are revolutionizing how funds manage and optimize capital.

2. Globalization: Emerging markets are adopting stricter regulatory standards, creating new opportunities for RCS solutions.

3. Sustainability: ESG considerations are becoming integral to RCS, with funds incorporating green bonds and sustainable investments into their portfolios.

Regulatory capital strategy is not just a compliance tool; it is a sophisticated investment approach that delivers consistent returns, mitigates risks, and enhances institutional resilience. Regulatory capital transactions provide investors with the unique opportunity to invest in a high-quality portfolio of credit exposures that are core to the banks’ business and achieve above-market returns by helping banks meet these changes in the regulations .

In 2025, as endowments, pensions, and insurance companies continue to adopt RCS, it underscores the strategy’s value as a cornerstone of modern financial management. By blending innovation with compliance, regulatory capital strategy is shaping the future of institutional investing.