Wealth Management 3.0: AI, Personalization, and the Future of Advisory

September 30, 2025

Wealth Management 1.0 was a world of handwritten ledgers and long client lunches. This was followed by Wealth Management 2.0, driven by the Internet, online portals, and digital tools. Today, we are at the cusp of Wealth Management 3.0, where Artificial Intelligence and data-driven personalization are rewriting the rules of the game; where the explosion of data is coupled with the foundational changes in terms of how financial advice is delivered. It is data-driven hyper-personalization coupled with customer-specific advisory, parsed from volumes of signals for that one customer, customer-by-customer where routine stuff is managed by robo-advisors with the human-in-the-loop providing deep insights, experiential knowledge and developing deep relationship.

This new paradigm is reshaping everything from portfolio management and risk profiling to client engagement, making the entire process more dynamic, predictive, and uniquely tailored to the individual.

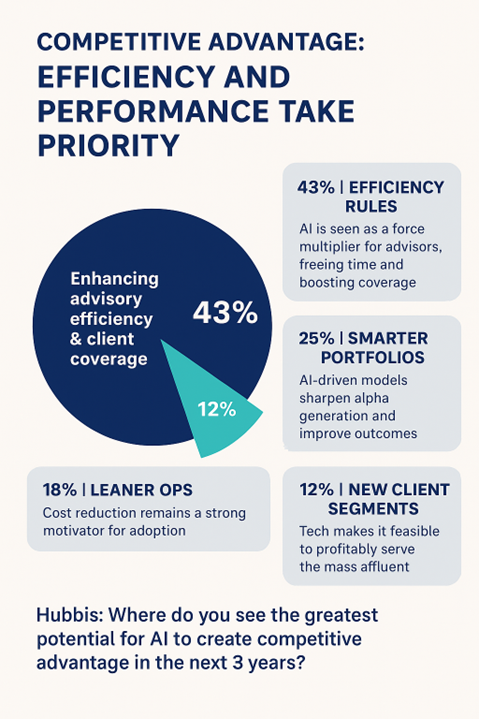

Source: Hubbis1

Key Uses for AI in Wealth Management

- Data Analysis at Scale

Going well and truly beyond the traditional financial indicators such as stock performance, earnings call transcripts, macroeconomic indicators, and even consumer spending trends, AI parses vast granular datasets including income, spending habits, savings, risk preferences, and even life events to craft highly customized portfolio solutions. Advanced machine learning algorithms analyze these client-specific inputs alongside market data to optimize asset allocation dynamically, producing portfolios that adapt to evolving client goals and market conditions in real time.

- Client Personalization

No two customers are alike. Differences in risk appetite, retirement strategies, and wealth preservation plans vary. to individual client needs and goals. By analyzing transactional behavior, life events, communication patterns, and even social media sentiment, AI can build a 360-degree profile of each client. These insights feed into dynamic asset allocation strategies that align not only with financial goals but also with personal values, such as ESG preferences or sectoral interests.

- Predictive Modeling

With this intelligence, AI is now able to deliver predictive analytics that create a more nuanced risk profile for each client instead of a generic “moderate” risk score, by dynamically adjusting a client’s risk profile based on their career stability, evolving spending habits, life goals, their current stage and market conditions. This leads to automated, proactive strategies like continuous portfolio rebalancing and tax-loss harvesting, ensuring that a client’s wealth is always aligned with their goals without the emotional biases that often derail a long-term plan. AI acts as an ever-vigilant co-pilot, optimizing the portfolio in a way that was once reserved for only the most elite institutional funds.

- Operational Automation

Instead of getting sucked into routine compliance paperwork or portfolio adjustments that can be automated, human advisors can now rely on AI to handle those tasks and focus on what matters most-guiding clients and building trust.

Where Does All This Lead?

The combination of massive operational automation, data analysis at scale presents unprecedented opportunities in the wealth management space. Instead of focussing on a few large customers with personalised advice, today’s investment managers have the ability to deliver hyper-personalised advice even to the smallest client. With all of the client’s data available (with consent, of course), the investment manager will be able to marry the individual client’s medium- and long-term goals into the marketplace dynamics seamlessly.

Trust and Ethics as the Cornerstone

Advancing AI brings regulatory and ethical challenges. Transparency, data privacy, and model bias prevention are essential to maintain client confidence and meet compliance. Leading firms adopt explainable AI frameworks and embed ESG investment principles into portfolio construction, aligning with client values. Algorithms that recommend investments must be explainable, not black boxes. Regulators will demand clarity on how AI models arrive at decisions to ensure fair treatment of investors.

Enhanced Client Engagement through AI

AI reshapes client engagement by enabling interactive and transparent communication using tools like Natural Language Processing (NLP) to power chatbots and digital assistants offering personalized financial education, portfolio queries, and predictive alerts. Besides being 24/7 they relieve human advisers of routine tasks, freeing them for strategic interactions.

The more things change, the more they remain the same. This has never been truer than today in the wealth management segment. From the days of personalised advice over long lunches, we have traversed the course of automation and are back to the days when the investment advisor’s individual credibility, her sectoral expertise and the experiential insight will be once again hallmarks of the wealth management industry. If this sounds contrarian, just imagine a situation where democratization of data ensures that pretty much most of the publicly available information, wherever it may be and whatever form, is now available to the client. The combination of AI and ML can now deliver historical data and predict where the portfolio is going to go. The key differentiator, then becomes the human-in-the-loop. The trusted advisor who uses his expertise and experience to guide the client in the maze of data to achieve what the client wants.

The Future: A Dynamic and Predictive Framework

Wealth Management 3.0 presents a paradigm shift from a reactive to a proactive and predictive framework. The shift is from being able to allocate assets and react to market events to anticipating client needs and forecasting financial outcomes in sync with the client’s needs at that point in time in their lifetime.

This new ecosystem creates a powerful synergy. The technology tools ensure that the advisor is no longer limited by their own capacity but is amplified by the power of AI allowing for a service model that is both highly efficient and deeply personal, democratizing sophisticated financial advice and making it accessible to a much broader audience. Wealth Management 3.0 goes combines technology and human desires to deliver what humanity wants and probably needs.

Sources: