Wealth Management Boom: Go East

May 27, 2025

The Asian wealth management industry is undergoing a historic transformation, driven by the explosive growth in high-net-worth individuals (HNWIs), rapid digitalization, and a deepening shift in global wealth flows toward the East. Nowhere is this shift more evident than in Singapore and Hong Kong, two financial hubs that have positioned themselves as the gateways to Asia’s wealth.

In the past decade, the Asia-Pacific region has seen the fastest growth in millionaires and billionaires globally, led by China, India, Indonesia, and other emerging economies. According to a report by Hubbis1, while the US was the most favored destination for private wealth, Asia-Pacific beat Europe, becoming the second most important geography for Wealth advisors. According to Capgemini’s World Wealth Report 20242, Asia-Pacific is home to over 7.5 million HNWIs, growing the wealth by around 4.2%, well ahead of Europe and Rest of the World, except North America.

Hong Kong: Resilient Despite Geopolitical Headwinds

Hong Kong remains a critical node in Asia’s wealth ecosystem. The launch of the Wealth Management Connect Scheme in the Greater Bay Area (GBA), which allows cross-border wealth management services between mainland China, Hong Kong, and Macau, has opened the floodgates for regional financial flows.

Hong Kong continues to benefit from its deep capital markets, access to Chinese HNWIs, and role as a capital raising hub. Many mainland Chinese families and businesses still prefer to book assets in Hong Kong due to its familiarity, proximity, and favorable tax regime. While regulatory pressures and international scrutiny have increased, Hong Kong’s infrastructure, talent pool, and long-standing wealth management culture remain compelling.

Singapore: The New Safe Haven for Global Wealth

Singapore has emerged as the preferred destination for wealth migration and management. Its political stability, robust legal infrastructure, tax transparency, and strong regulatory framework have made it especially attractive to global investors seeking certainty in an uncertain world. Many family offices and UHNWIs (ultra-high-net-worth individuals) from Asia are also increasingly pivoting toward Singapore as a base for their regional and even global wealth structures.

In 2023, Singapore saw over 1,100 family offices operating in the country – more than triple the number from 2020. Government schemes like the Variable Capital Company (VCC) structure have further bolstered its attractiveness by allowing investment funds greater operational flexibility and confidentiality.

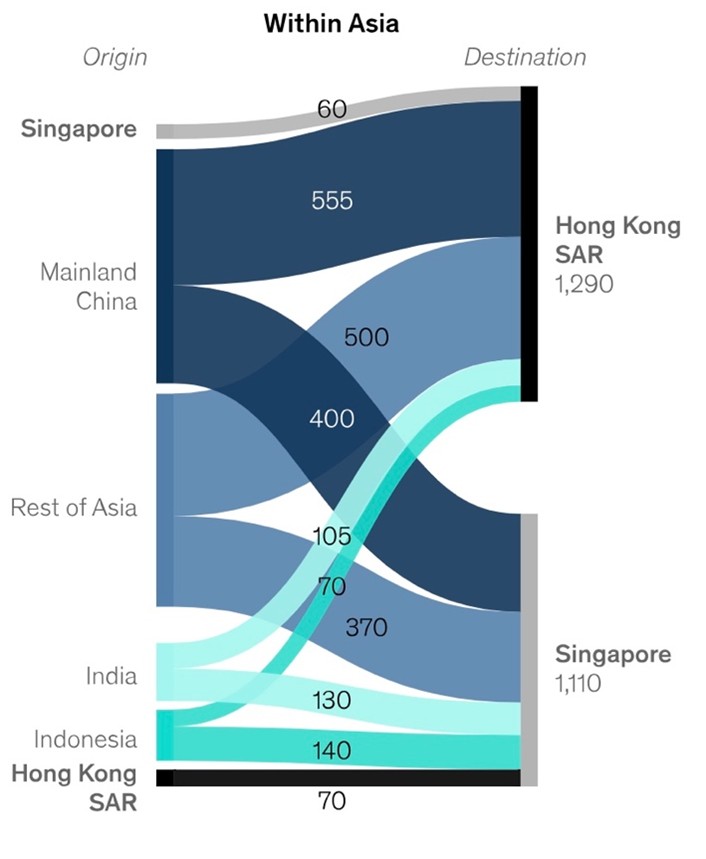

Personal Financial Assets (PFA) Holdings movement between jurisdictions as of 2023, $ billion

Source: McKinsey & Co3

The Family Office Surge

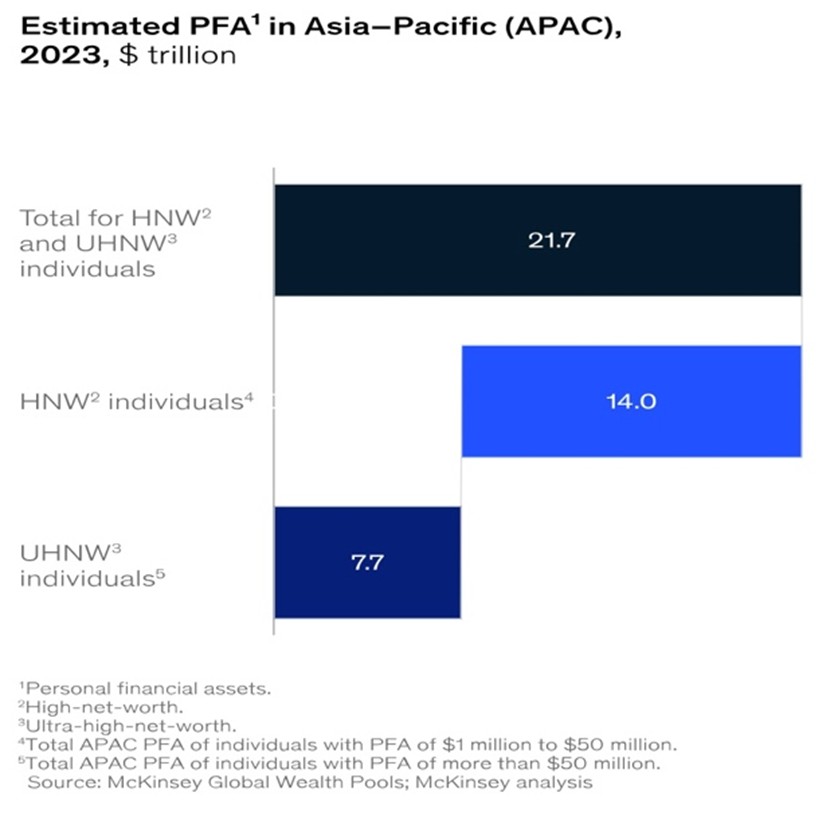

In 2023, Hong Kong and Singapore each managed roughly $1.3 trillion in offshore assets – trailing only Switzerland’s $2.5 trillion total – affirming their importance in the global financial ecosystem. Many UHNW individuals and business owners in Asia-Pacific have diverse needs and challenges that service providers to family offices could meet in more comprehensive and effective ways.

The growth of family offices in Asia-Pacific presents new opportunities for providers such as banks, insurers, MFOs, WealthTechs, and asset managers to provide differentiated services and fulfill unmet needs. Family offices are looking for trusted partners that can complement their capabilities, and their requirements vary significantly, reflecting the complexity and individuality of the families they serve.

Source: McKinsey & Co4

Key Trends Shaping Wealth Management in APAC

- Digital-First Expectations from a New Generation

A rising cohort of next-gen HNWIs is redefining engagement models. They seek hyper-personalized, transparent, and tech-driven wealth solutions. Both Singapore and Hong Kong are responding with hybrid platforms that blend robo-advisory efficiency with human expertise. Players who can seamlessly deliver this dual value proposition are poised to gain mindshare and wallet share. - The Rise of Alternatives & Sustainable Investing

Asian portfolios are evolving, moving beyond public markets into private equity, venture capital, and sustainable assets. Both cities are deepening access to alternative investments, while ESG-aligned products are gaining traction. Regulatory support and ecosystem development around green finance are turning these cities into hubs for next-gen investing. - The Battle for Talent Intensifies

Explosive growth is straining the talent pipeline. Relationship managers, investment advisors, and cross-border tax specialists are in high demand. Singapore has emerged as a magnet for global wealth talent, aided by favorable immigration and quality-of-life factors. Yet, Hong Kong continues to hold strategic influence, especially for those focused on China’s onshore opportunity. - Smarter, Stronger Regulation

Regulators are tightening the screws – Singapore’s MAS is leading on ESG reporting, tech governance, and cross-border flow frameworks. In parallel, Hong Kong is stepping up on crypto-asset oversight and client suitability rules. The shift signals a maturing market, one where innovation is welcomed, but not at the cost of investor trust.

The Road Ahead

As wealth flows deepen across ASEAN, China, and India, wealth managers will play pivotal roles in helping clients navigate complex cross-border wealth issues, from estate planning and taxation to succession and global asset allocation. Accounting for almost 15% of the global Family wealth, Hong Kong and Singapore will continue to be the preeminent destinations which will drive the APAC wealth management.

Private banks, asset managers, and fintech innovators that can offer multi-jurisdictional expertise, digital-first engagement, and holistic wealth solutions will win in this new era. Ultimately, Asia’s wealth management boom is just beginning, and Singapore and Hong Kong are shaping the future of how that wealth is advised, preserved, and passed on.