Welcome volatility, welcome the quants: The grand comeback of trend-following hedge funds

June 30, 2022

“Follow the trend”. “The trend is your friend”. Many participants in financial markets swear by these adages. None more so than quantitative hedge funds, also known as computer-driven or trend-following investment funds that use complex mathematical models and advanced algorithms to try to forecast price action, and accordingly wager on the future movements in securities across various asset classes.

2010s – The ‘dead decade’

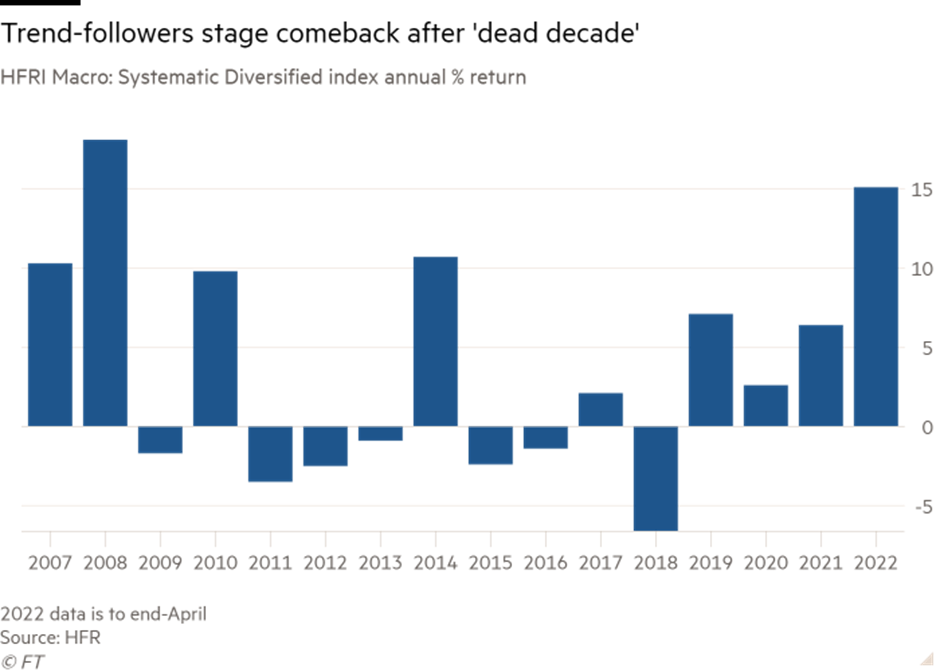

However, the going has been extremely tough for quants since 2010, in the aftermath of the 2008-09 global financial crisis (GFC), a period characterized by long spells of subpar returns, multibillion-dollar redemptions and cutbacks.

With leading central banks, led by the U.S. Federal Reserve, unleashing unprecedented levels of liquidity via ultra-accommodative monetary policies and quantitative easing (QE) in the form of bond buying programs, much of the volatility on which quants thrive got suppressed. That meant trend-followers struggled for several years, delivering underwhelming returns, and in fact posting losses in six of the eight calendar years between 2011 and 2018, according to data provider HFR.

The COVID-19 pandemic in early 2020 compounded the woes of quantitative investors as some of the underlying strategies were caught wrong-footed, prompting some observers to start questioning if managed futures funds can any longer effectively identify tradable market patterns for competitive advantage.

The quant renaissance

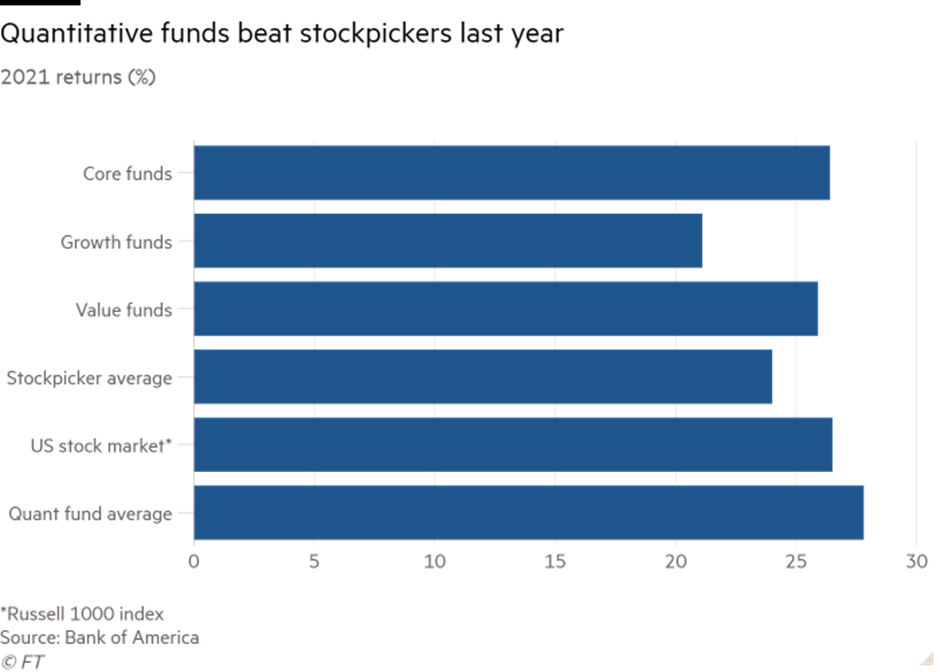

However, the tide turned in 2021 for this $337bn category of the hedge fund industry, with the average quant equity fund covered by Bank of America gaining 27.8%1 – as opposed to a 26.5% surge in the U.S. stock market and a 24% return, on average, for mainstream stock pickers.

The broad-based nature of quants’ rebound2 was underlined by the fact that nearly 70% of big trend-following funds outperformed their benchmarks last year, as compared with just 40% for stock pickers.

The rebound continues in 2022

The remarkable comeback of quants has continued into 2022, with the strategy posting its biggest gains since the GFC, figures compiled by HFR reveal. The turmoil in equities, bonds, commodities, currencies and other asset classes this year has provided the perfect playground for trend followers to spot clear trends and patterns for placing wagers and benefitting hugely from them.

The average quant fund was up 15.1% for the first four months of 2022, HFR data shows, placing the strategy among the best-performing hedge fund category during a period where the S&P 500 shed 13% and several marquee investors registered massive losses. To put this quant outperformance in context, hedge funds, on average, have lost 2.9% in the first five months of this year, HFR notes.

Change in market regime: Volatility is back

What explains this dramatic rebound? Volatility, in one word. The principal determinants of quant hedge funds’ good performance have been higher, sustained levels of market volatility, along with consistent or trending markets.

Russia’s war in Ukraine has led to a dramatic repricing of geopolitical risks across the financial landscape, including commodities, thus enabling quants to thrive in the resulting ructions. Similarly, the monetary policy tightening and quantitative tightening (QT) unleashed by the Fed to cub raging inflation in the U.S. has triggered a substantial reset in benchmark bond yields, thereby helping computer-following funds to benefit from successful directional bets against sovereign bonds, and wagers on commodities. For instance, the 10-year U.S. Treasury yield has spiked from 1.51% to a peak of 3.2% this year, while the equivalent German Bund yield, which turned negative in 2019, has soared from minus 0.18% to as high as 1.19%.

Value factor-oriented funds shining

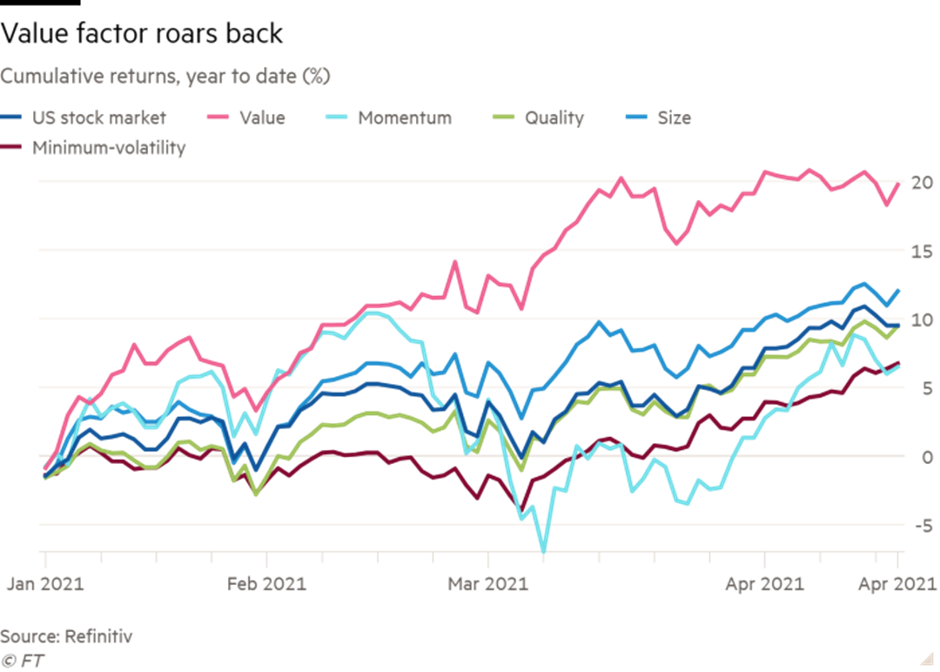

One of the biggest drivers of the quant comeback over the past 18 months has been the rebound of investment strategies centered around “value2” factors, wherein funds systematically purchase low-valued equities and shun or “short” expensive ones.

This turnaround follows a decade-long spell of underperformance for “value” strategies which seek to capitalize on relatively undervalued securities, betting that those will outshine more expansively valued, glamorous counterparts.

Looking ahead

The quant tribe today accounts for a significant proportion of the hedge fund industry. Around 22% of hedge funds worldwide now deploy purely quantitative investment strategies in their portfolios, according to SigTech’s 2021 annual Hedge Fund Research report3. And, trend-following funds expect more allocations coming their way from clients in the future, as volatility is likely to persist, if not increase, in what many anticipate to be a stagflationary world.

With inflation remaining high across leading economies, and more importantly, inflationary expectations increasing significantly, volatility is unlikely to subside anytime soon. Abetting this likely scenario could be structural trends such as decarbonization, supply chain localization and deglobalization.