Why Multi-Asset Strategies Make Sense in the Current Market

October 25, 2023

Multi-asset strategies are gaining popularity as investors look for ways to diversify their portfolios and reduce risk in the current market environment. These strategies combine different asset classes, such as equities, fixed income, alternatives, and commodities, to create a more balanced portfolio. However, it is worth noting that multi-asset strategies cannot be a “one size fits all” investment approach. Quite the contrary, exposure to each asset class must depend on individual risk appetite and financial goals under a given investment horizon.

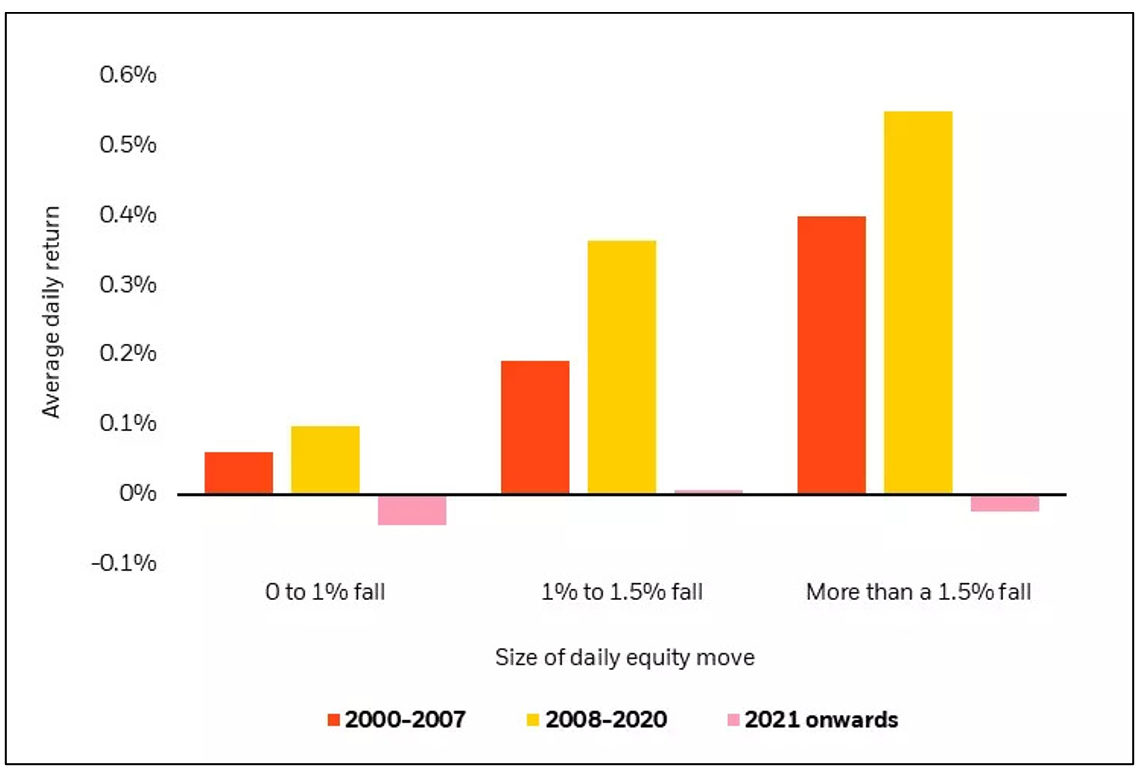

Image via BlackRock1

The above data represents 10-year US Treasury returns on equity down days from 2000-2023. The traditional 60/40 portfolio has been a popular investment strategy for many years. However, the current environment has made it more challenging for this type of portfolio to generate returns. Bonds, which have traditionally been used to diversify stock portfolios, may no longer be as effective in this role. This is because interest rates over the past 1.5+ years have been on a higher trajectory and continue to rise and bond prices have continued to fall. As a result, investors are looking for alternative investments that can provide diversification and potential for returns.

Implementing a Multi-Asset Strategy

There are a number of different ways to implement a multi-asset strategy. One way is to invest in a multi-asset fund. Multi-asset funds are a type of mutual fund or ETF that invests in a variety of asset classes. Another way to implement a multi-asset strategy is to create one’s own portfolio of individual investments. This approach gives investors more control over their asset allocation, but it also requires more research and time management.

When choosing a multi-asset strategy, investors should consider the following factors:

- Investment goals: What are their investment goals? Are they saving for retirement, a down payment on a house, or something else? Having investment goals will help determine the appropriate asset allocation for one’s portfolio.

- Risk tolerance: How much risk are they comfortable with? Multi-asset strategies can be customized to meet a variety of risk tolerances.

- Time horizon: How long are they planning to invest? Multi-asset strategies can be tailored to different time horizons, such as short-term, medium-term, and long-term.

Investors should also consider the fees associated with multi-asset strategies. Some multi-asset strategies can have higher fees than traditional investment products. It is important to compare the fees of different strategies before investing.

Risks and Rewards of Multi-Asset Strategies

Investing always carries inherent risks, including the potential loss of the initial investment. One common pitfall involves making an investment objective that doesn’t align with one’s true financial goals. For instance, one might opt for an aggressive investment strategy when a more cautious approach would be a better fit. Conversely, adopting an overly conservative strategy can hinder the ability to reach one’s long-term financial objectives. Investors should conduct a thorough analysis of various funds and investment strategies to pinpoint the one that best matches their specific financial needs and aspirations.

However, one of the main attractions of multi-asset strategies is that they can help to reduce risk. When different asset classes are combined, the overall risk of the portfolio is reduced. This is because different asset classes perform differently in different market conditions. For example, when stocks are falling, bonds may rise in value. This can help to offset some of the losses in the stock portion of the portfolio.

Another benefit of multi-asset strategies is that they can provide investors with the opportunity to generate higher returns. By investing in a variety of asset classes, investors can potentially take advantage of different investment opportunities. For example, if investors believe that inflation is likely to continue to rise, they may allocate more of their portfolio to commodities.

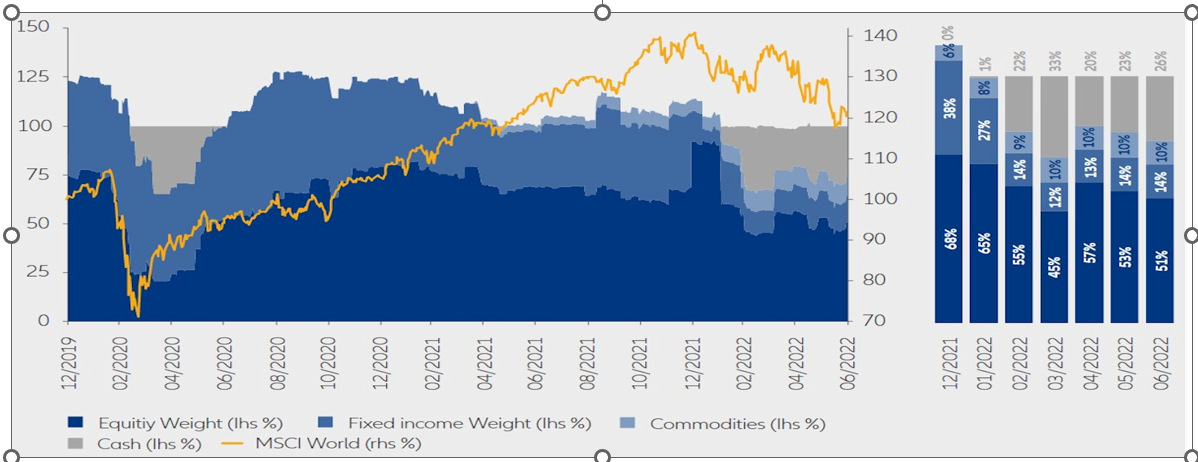

Asset allocation for an actively managed Multi Asset sample portfolio

Image via Allianz Global Investors2

In addition to the benefits of diversification and risk reduction, multi-asset strategies can also offer investors flexibility, transparency, and tax efficiency.

- Flexibility: Multi-asset strategies can be customized to meet the specific needs and goals of each investor. For example, investors can choose a multi-asset strategy that is more conservative or more aggressive, depending on their risk tolerance and time horizon.

- Transparency: Multi-asset strategies are typically more transparent than traditional investment products, such as mutual funds and ETFs. This is because multi-asset strategies typically disclose their underlying asset allocation, which allows investors to see exactly how their money is being invested.

- Tax efficiency: Multi-asset strategies can be more tax-efficient than traditional investment products. This is because multi-asset strategies can typically harvest losses and distribute them to investors, which can offset their capital gains taxes.

Conclusion

Multi-asset strategies can be a good way to diversify one’s portfolio, reduce risk, and potentially generate higher returns in the market, especially when the investment horizon presents a rather bleak picture. These strategies can also be customized to meet the specific needs and goals of an individual investor and can be adjusted based on the investment climate. One can identify a strategy that is appropriate for one’s individual investment goals, risk tolerance, and time horizon. One should also consider the fees associated with different strategies before investing. If one is considering implementing a multi-asset strategy, it is important to consult with a financial advisor to discuss one’s specific needs and situation.